Vaso Corporation Announces Fifth Extension of Sales Representation Agreement with GE HealthCare

PLAINVIEW, N.Y., Dec. 17, 2025 (GLOBE NEWSWIRE) — Vaso Corporation (OTCQX: VASO) announced today that its wholly owned subsidiary, Vaso Diagnostics, Inc. d/b/a VasoHealthcare, has signed an amendment to the sales representation agreement with GE HealthCare (NASDAQ: GEHC) to extend the term of the agreement through December 31, 2030. This is the fifth time the parties have agreed to extend the term of the agreement and establishes a significant milestone in this longstanding collaboration, which began in May 2010. By virtue of the latest extension, the relationship will ultimately span over 20 years, reinforcing the shared commitment to advancing diagnostic imaging and ultrasound solutions across the United States.

Under the terms of this latest amendment, VasoHealthcare will continue to represent GE HealthCare’s portfolio of diagnostic imaging and ultrasound products and services, including CT, MR, molecular imaging, X-ray, mammography, and interventional guided solutions systems, as well as associated service and financial offerings. The amendment builds upon the success of the long-term relationship, ensuring continuity in sales representation and alignment with GE HealthCare’s commercial strategy. The collaboration has consistently delivered strong results, leveraging VasoHealthcare’s expertise and GE HealthCare’s technologies to help improve patient outcomes and support healthcare providers in meeting evolving clinical demands. This extension underscores both organizations’ dedication to delivering cutting-edge technology and exceptional customer support to healthcare providers nationwide.

“This extension reflects the strength and longevity of our partnership with VasoHealthcare, built on a shared commitment to advancing patient care in the U.S. and, ultimately, helping to build a healthier future,” said Catherine Estrampes, President & CEO, U.S. and Canada, GE Healthcare.

“This milestone reflects a partnership built on trust, execution, and shared purpose. Extending the agreement between GE HealthCare and VasoHealthcare gives customers continuity and confidence. Our team – serving community hospitals, outpatient imaging centers, and specialty practices, including rural and underserved markets – will continue bringing GE HealthCare innovation to the point of care with the service, expertise, and urgency that customers expect,” shared Ms. Jane Moen, President, VasoHealthcare and COO, Vaso Corporation.

“The success of the representation program for GE HealthCare’s diagnostic imaging equipment has also expanded our partnership to include ultrasound products. I would like to thank all employees of VasoHealthcare and wish you continued success. We would not be able to achieve any of these without your dedication and professionalism,” added Dr. Jun Ma, President and CEO of Vaso Corporation.

About Vaso

Vaso Corporation (OTCQX: VASO), headquartered in Plainview, New York, is a diversified organization with three core businesses operating as wholly-owned subsidiaries: VasoHealthcare, the professional sales service arm for GE HealthCare’s diagnostic imaging and ultrasound products; VasoTechnology, an information technology and managed connectivity leader serving customers in healthcare provision and other sectors; and VasoMedical, the designer and manufacturer of proprietary medical devices including Biox series devices and the developer and operator of the ARCS cloud-based SaaS platform.

Forward Looking Statements. Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “optimistic”, “plans”, “potential”, “looking forward”, and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions, including the possibility of a downturn in the US economy and the continued impact of the COVID-19 pandemic; failure to achieve any portion of the earnout; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreement; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.

Investor Contacts:

Jonathan Newton

Investor Relations

Phone: 516-997-4600

Email: jnewton@vasocorporation.com

Vaso Corporation Announces Divestiture of Subsidiary

PLAINVIEW, N.Y, Nov. 19, 2025 — Vaso Corporation (“Vaso”) (OTCQX: VASO), a leading MedTech company with a diversified business portfolio in network and healthcare IT services, professional sales services and proprietary medical products, announced today that it had reached an agreement, subject to certain conditions, with Nano-X Imaging Ltd. (“Nanox”) (Nasdaq: NNOX), an innovative medical imaging technology company, to sell one of its subsidiaries, VasoHealthcare IT Corp. The parties intend to complete the sale within a couple of weeks.

VasoHealthcare IT Corp. (“VasoHealthcare IT”), a healthcare IT application value added reseller, is a division of Vaso’s information technology business segment. “The decision to sell our VasoHealthcare IT subsidiary to Nanox resulted from a strategic review of our lines of business,” Dr. Jun Ma, President and Chief Executive Officer of Vaso, commented on the transaction. “The divestiture of VasoHealthcare IT will allow us to sharpen our focus on our core operations and competencies. We believe the sale of this line of business is a positive development for our shareholders and provides a strong future for the VasoHealthcare IT team as part of Nanox.”

VasoHealthcare IT provides imaging information technology to hospitals and healthcare providers and represented less than 5% of Vaso’s total revenue. The transaction consideration is up to $800,000, with $200,000 payable at closing and up to $600,000 as an earnout based on the post-closing performance of the business. Vaso expects to use the proceeds from the sale to invest in its other business lines and for strategic initiatives.

Advisors

Barley Snyder, LLP acted as legal counsel to Vaso Corporation.

About Vaso

Vaso Corporation (OTCQX: VASO), headquartered in Plainview, New York, is a diversified organization with three core businesses operating as wholly-owned subsidiaries: VasoHealthcare, the professional sales service arm for GEHealthCare’s diagnostic imaging and ultrasound products; VasoTechnology, an information technology and managed connectivity leader serving customers in healthcare provision and other sectors; and VasoMedical, the designer and manufacturer of proprietary medical devices including Biox series devices and the developer and operator of the ARCS cloud-based SaaS platform.

For additional information, please visit www.vasocorporation.com or contact us at info@vasocorporation.

Forward Looking Statements. Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “optimistic”, “plans”, “potential”, “looking forward”, and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions, including the possibility of a downturn in the US economy and the continued impact of the COVID-19 pandemic; failure to achieve any portion of the earnout; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreement; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.

Investor Contacts:

Jonathan Newton

Investor Relations

Phone: 516-997-4600

Email: jnewton@vasocorporation.com

Vaso Corporation Announces Financial Results for Third Quarter of 2025

PLAINVIEW, N.Y., Nov. 14, 2025 — Vaso Corporation (“Vaso”) (OTCQX: VASO), a leading MedTech company with a diversified business portfolio in network and healthcare IT services, professional sales services and proprietary medical products, today announced operating results for the three months ended September 30, 2025.

“For the third quarter of 2025, the Company’s total revenue was $22.7 million, an increase of $1.9 million, or 9.1%, from prior year’s third quarter revenue of $20.8 million. All three segments of our business contributed to this significant year-over-year growth of quarterly revenue,” commented Dr. Jun Ma, President and Chief Executive Officer of Vaso Corporation. “Net income for the quarter was $1.7 million as compared to a net loss of $1.2 million for the same period last year, representing an improvement of $2.9 million, due to higher levels of revenue and gross margin as well as lower operating expenses in the three-month period of 2025 compared to the same period of 2024.”

“Cashflow generated from operating activities during the three months ended September 30, 2025 was $2.8 million. As a result, the Company’s balance sheet continues to be strong, with cash and cash equivalents at $34.9 million as of the end of the quarter,” Dr. Ma continued. “Deferred revenue continued to trend upward, and subscription revenues remain a significant portion of the total revenue, both of which forecasting a stable topline for the foreseeable future.”

“As you might be aware, the 2025 Annual Shareholders Meeting will take place on December 17, 2025 in New York City; I look forward to seeing you then,” concluded Dr. Ma.

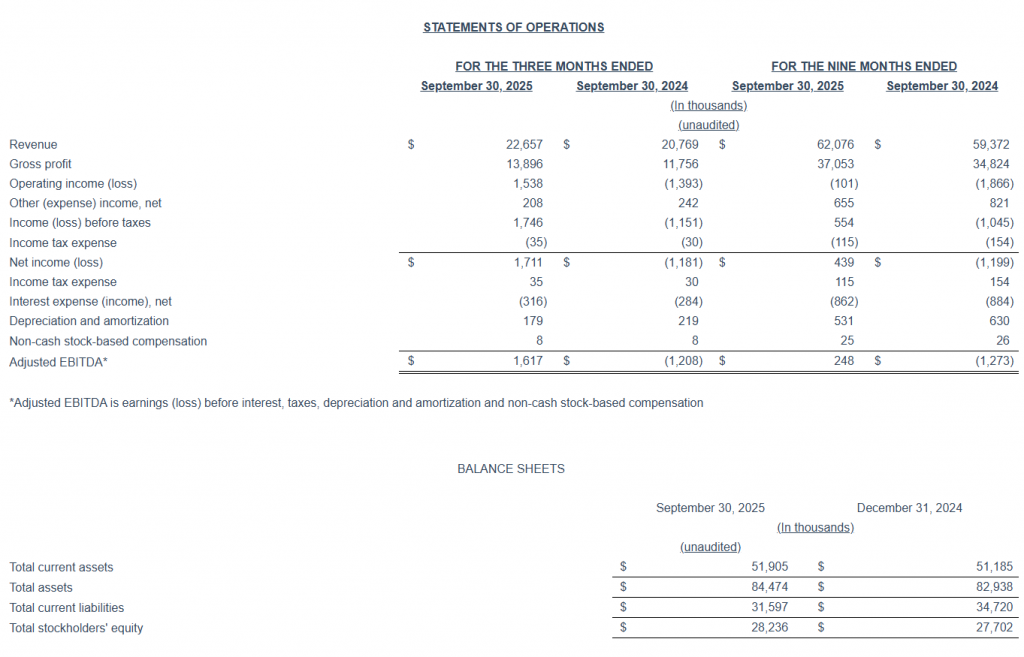

Financial Results for Three Months Ended September 30, 2025

For the three months ended September 30, 2025, total revenue increased by 9.1%, to $22.7 million, compared to $20.8 million for the same period of 2024, due to revenue increases in all three segments of our business. Revenue in the professional sales service segment was up by $1.7 million, or 18.7%, year-over-year, mainly due to a higher volume of underlying equipment delivered by our partner during the period. Revenue in our IT segment increased by $136 thousand, or 1.2%, in the third quarter 2025 when compared to the same quarter of 2024, due to higher revenue from network services sales, partially offset by lower healthcare IT sales. Quarterly revenue in our equipment segment increased by $46 thousand, or 8.0%, when compared to the third quarter of 2024, principally due to higher ARCS software subscription revenue in the US, partially offset by lower equipment deliveries in our China operations.

Gross profit for the third quarter of 2025 increased by $2.1 million, or 18.2%, to $13.9 million, compared with a gross profit of $11.8 million for the same quarter of 2024, as a result of both higher revenues and higher margins.

Selling, general and administrative (SG&A) expenses for the third quarter of 2025 increased by $803 thousand, or 7.0%, to $12.2 million, compared to the third quarter of 2024. The increase was primarily attributable to higher personnel costs in the IT and professional sales service segments, partially offset by lower expenses in the equipment segment.

Operating income for the three months ended September 30, 2025 was $1.5 million, compared to operating loss of $1.4 million in the third quarter of 2024. The improvement of $2.9 million year-over-year was due to the higher gross profit in all three business segments, partially offset by higher SG&A expenses as discussed above.

Net income for the three months ended September 30, 2025 was $1.7 million, compared to net loss of $1.2 million in the third quarter of 2024.

Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization, and stock-based compensation) was $1.6 million for the third quarter of 2025, compared to a negative $1.2 million for the third quarter of 2024. The improvement of $2.8 million was primarily the result of the increase in net income for the quarter. Adjusted EBITDA is a non-GAAP financial measure, as further discussed below.

Net cash generated in operating activities was $9.0 million for the first nine months of 2025, as compared to $3.6 million for the first nine months of 2024. As of September 30, 2025, the Company’s cash and cash equivalents totaled approximately $34.9 million.

About Vaso

Vaso Corporation is a diversified medical technology company with several distinct but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for medical equipment; and design, manufacture, and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

- VasoTechnology, Inc. provides network and IT services through two business units: NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers; and VasoHealthcare IT Corp., a national value added reseller of RIS (radiology Information system), PACS (picture archiving and communication system), and other software solutions from various vendors as well as related services, including implementation, management and support.

- Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE HealthCare diagnostic imaging and ultrasound products in certain market segments in the USA.

- VasoMedical, Inc. manages and coordinates the design, manufacture and sales of proprietary medical equipment and software, as well as operates the Company’s overseas assets including China-based subsidiaries.

Additional information is available on the Company’s website at www.vasocorporation.com.

Summarized Financial Information and Non-GAAP Financial Measures

We utilize Adjusted EBITDA to evaluate our performance internally, and this non-GAAP financial measure is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Company’s industry. Management believes that this non-GAAP financial measure, in addition to GAAP measures, is also useful to investors to evaluate the Company’s results.

Adjusted EBITDA is not a measure of financial performance under U.S. GAAP and should not be considered a substitute for operating income (loss), which we consider to be the most directly comparable U.S. GAAP measure. Adjusted EBITDA has limitations as an analytical tool, and when assessing our operating performance, you should not consider Adjusted EBITDA in isolation, or as a substitute for net income or other consolidated income statement data prepared in accordance with U.S. GAAP. Investors should recognize that the Company’s presentation of this non-GAAP financial measure might not be comparable to similarly-titled measures of other companies, limiting its usefulness as a comparative measure.

Summarized financial information including a reconciliation of operating loss to Adjusted EBITDA is set forth below:

The information contained in this report contains forward-looking statements (as such term is defined in the Securities Exchange Act of 1934 and the regulations thereunder). These forward-looking statements may include projections of, or guidance on, the Company’s future financial performance, expected levels of future revenue and expenses, anticipated growth strategies, and anticipated trends in the Company’s business or financial results. When used in this report, words such as “anticipates”, “continue”, “believes”, “could”, “estimates”, “expects”, “may”, “plans”, “potential”, “future”, “intends”, the negative of these terms and similar expressions identify forward-looking statements. Any forward-looking statement made by the Company in this document is based only on the Company’s current expectations, estimates and projections about future events and financial trends affecting the financial condition of its business based on information currently available to the Company and speaks only as of the date when made. Forward-looking statements are not historical facts or guarantees of future performance. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Company’s control, and actual results may differ materially from this forward-looking information and therefore should not be unduly relied upon. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions, including the possibility of a downturn or disruptions in the U.S. economy; the impact of US tariff policies; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreement; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; unexpected manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.

Investor Contacts:

Jonathan Newton

Investor Relations

Phone: 516-997-4600

Email: jnewton@vasocorporation.com

Vaso Corporation Announces Financial Results for Second Quarter of 2025

PLAINVIEW, N.Y., Aug. 14, 2025 — Vaso Corporation (“Vaso”) (OTCQX: VASO), a leading MedTech company with a diversified business portfolio in network and healthcare IT services, professional sales services and proprietary medical products, today announced operating results for the three months ended June 30, 2025.

“The Company’s 2025 second quarter revenue was $20.0 million, slightly down from $20.2 million for the same quarter of the prior year,” commented Dr. Jun Ma, President and Chief Executive Officer of Vaso Corporation. “The decrease in revenue was primarily in the professional sales service segment as a result of lower equipment delivery volume by our partner. The value of orders we booked in this business segment, however, continued to outpace delivery of the underlying equipment, as reflected in higher deferred revenue, which reached a record high of $38.1 million as of June 30, 2025, up from $31.7 million as of June 30, 2024.”

“Gross profit for the quarter was $11.8 million, down by $354 thousand, or 2.9%, year-over-year, and net loss for the quarter was $197 thousand, compared to net income of $1.2 million for the same quarter of 2024,” Dr. Ma continued. “Operating cash flow during the three months ended June 30, 2025 was $6.8 million. As a result, we continued to maintain a strong balance sheet with cash and cash equivalents of $32.6 million at the end of the reporting period.”

“As we are historically more profitable in the later quarters of the year, we continue to be cautiously optimistic about the full year 2025,” concluded Dr. Ma.

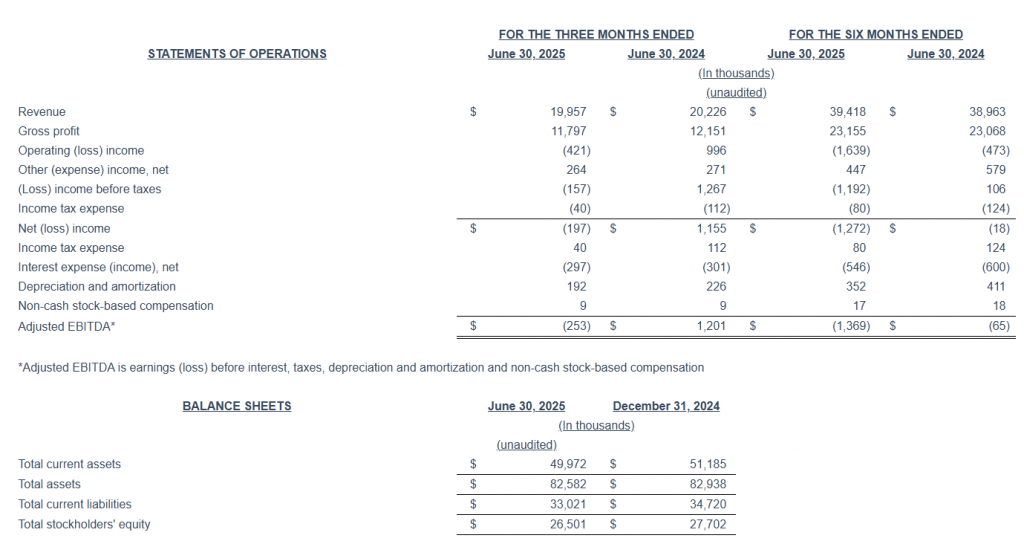

Financial Results for Three Months Ended June 30, 2025

For the three months ended June 30, 2025, revenue decreased by 1.3%, to $20.0 million, compared to $20.2 million for the same period of 2024, due primarily to a revenue decrease in the professional sales service segment. Revenue in the professional sales service segment was down by $366 thousand, or 4.0%, year-over-year, mainly due to lower product deliveries by our partner during the period. Revenue in our IT segment increased by $93 thousand, or 0.9%, in the second quarter 2025 when compared to the same quarter of 2024, due to higher revenue from network services sales, partially offset by lower healthcare IT sales. Revenue in our equipment segment increased by $4 thousand, or 0.7%, when compared to the second quarter of 2024, principally due to higher ARCS software subscription revenue in the US, partially offset by lower equipment deliveries in our China operations.

Gross profit for the second quarter of 2025 decreased by $354 thousand, or 2.9%, to $11.8 million, compared with a gross profit of $12.2 million for the same quarter of 2024, as a result of lower revenues and lower margins.

Selling, general and administrative (SG&A) expenses for the second quarter of 2025 increased by $1.2 million, or 11%, to $12.1 million, compared to the second quarter of 2024. The increase was primarily attributable to higher personnel costs in the IT and professional sales service segments, partially offset by lower expenses in the equipment segment.

Operating loss for the three months ended June 30, 2025 was $421 thousand, compared to operating income of $996 thousand in the second quarter of 2024. The loss was due to the lower gross profit and higher SG&A expenses as discussed above.

Net loss for the three months ended June 30, 2025 was $197 thousand, compared to net income of $1.2 million in the second quarter of 2024.

Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization, and stock-based compensation) was negative $253 thousand in the second quarter of 2025, compared to a positive $1.2 million for the second quarter of 2024. The change was primarily the result of the net loss for the quarter. Adjusted EBITDA is a non-GAAP financial measure, as further discussed below.

Net cash generated in operating activities was $6.2 million for the first half of 2025, as compared to $1.7 million for the first half of 2024. As of June 30, 2025, the Company’s cash and cash equivalents totaled approximately $32.6 million.

About Vaso

Vaso Corporation is a diversified medical technology company with several distinct but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for medical equipment; and design, manufacture, and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

- VasoTechnology, Inc. provides network and IT services through two business units: NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers; and VasoHealthcare IT Corp., a national value added reseller of RIS (radiology Information system), PACS (picture archiving and communication system), and other software solutions from various vendors as well as related services, including implementation, management and support.

- Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE HealthCare diagnostic imaging and ultrasound products in certain market segments in the USA.

- VasoMedical, Inc. manages and coordinates the design, manufacture and sales of proprietary medical equipment and software, as well as operates the Company’s overseas assets including China-based subsidiaries.

Additional information is available on the Company’s website at www.vasocorporation.com.

Summarized Financial Information and Non-GAAP Financial Measures

We utilize Adjusted EBITDA to evaluate our performance internally, and this non-GAAP financial measure is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Company’s industry. Management believes that this non-GAAP financial measure, in addition to GAAP measures, is also useful to investors to evaluate the Company’s results.

Adjusted EBITDA is not a measure of financial performance under U.S. GAAP and should not be considered a substitute for operating income (loss), which we consider to be the most directly comparable U.S. GAAP measure. Adjusted EBITDA has limitations as an analytical tool, and when assessing our operating performance, you should not consider Adjusted EBITDA in isolation, or as a substitute for net income or other consolidated income statement data prepared in accordance with U.S. GAAP. Investors should recognize that the Company’s presentation of this non-GAAP financial measure might not be comparable to similarly-titled measures of other companies, limiting its usefulness as a comparative measure.

Summarized financial information including a reconciliation of operating loss to Adjusted EBITDA is set forth below:

The information contained in this report contains forward-looking statements (as such term is defined in the Securities Exchange Act of 1934 and the regulations thereunder). These forward-looking statements may include projections of, or guidance on, the Company’s future financial performance, expected levels of future revenue and expenses, anticipated growth strategies, and anticipated trends in the Company’s business or financial results. When used in this report, words such as “anticipates”, “continue”, “believes”, “could”, “estimates”, “expects”, “may”, “plans”, “potential”, “future”, “intends”, the negative of these terms and similar expressions identify forward-looking statements. Any forward-looking statement made by the Company in this document is based only on the Company’s current expectations, estimates and projections about future events and financial trends affecting the financial condition of its business based on information currently available to the Company and speaks only as of the date when made. Forward-looking statements are not historical facts or guarantees of future performance. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Company’s control, and actual results may differ materially from this forward-looking information and therefore should not be unduly relied upon. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions, including the possibility of a downturn or disruptions in the U.S. economy; the impact of US tariff policies; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreement; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; unexpected manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.

Investor Contacts:

Jonathan Newton

Investor Relations

Phone: 516-997-4600

Email: jnewton@vasocorporation.com

Vaso Corporation Announces Financial Results for First Quarter of 2025

PLAINVIEW, N.Y., May 15, 2025 — Vaso Corporation (“Vaso”) (OTCQX: VASO), a leading MedTech company with a diversified business portfolio in network and healthcare IT services, professional sales services, and proprietary medical products, today announced its operating results for the three months ended March 31, 2025.

“The Company recorded record first quarter revenue, with revenue of $19.5 million, an increase of 3.9% when compared to the same quarter of the prior year,” commented Dr. Jun Ma, President and Chief Executive Officer of Vaso Corporation. “Gross profit for the quarter was $11.4 million, up by $440 thousand, or 4.0%, year-over-year, and net loss for the first three months of 2025 narrowed to $1.1 million from $1.2 million for the same period of 2024.”

“Our balance sheet remains strong, with $25.3 million in cash and cash equivalents as of March 31, 2025,” Dr. Ma continued. “Total deferred revenue grew to $35.4 million at the end of first quarter of 2025, an increase of $4.0 million, or 12.7%, from March 31, 2024, and an increase of $510 thousand, or 1.5%, from December 31, 2024.”

“The high deferred revenue in the professional sales service segment and backlogs in the IT and equipment segments provide revenue stability and financial visibility. In addition, we are historically more profitable in the later quarters of the year. Therefore, we remain cautiously optimistic about 2025 despite the recent increased uncertainties in the general business environment,” concluded Dr. Ma.

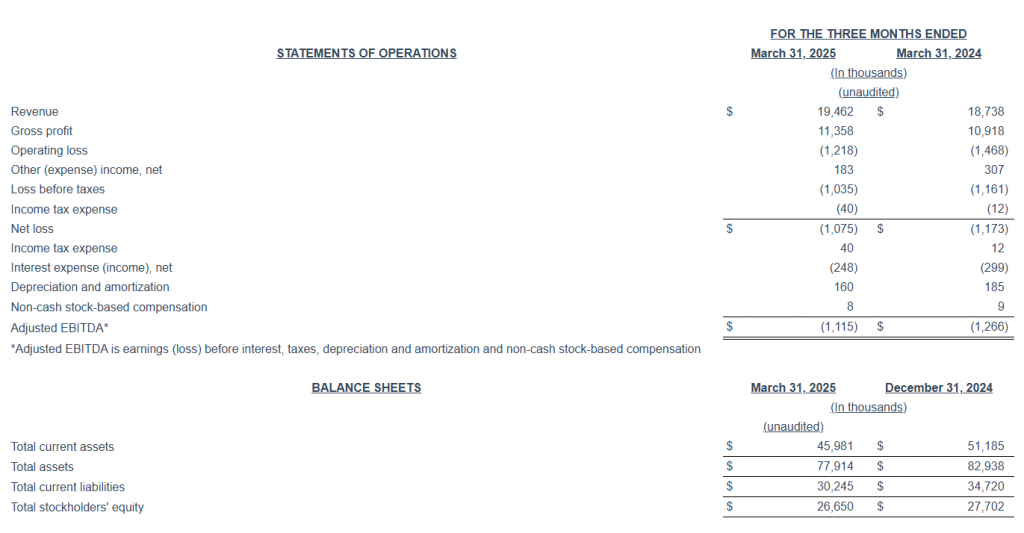

Financial Results for Three Months Ended March 31, 2025

For the three months ended March 31, 2025, revenue increased by 3.9%, to $19.5 million, compared to $18.7 million for the same period of 2024, due primarily to revenue increases in the IT and professional sales service segments. Revenue in the professional sales service segment was up by $578 thousand, or 7.1%, year-over-year, mainly due to higher product deliveries by our partner during the period. Revenue in our IT segment increased by $162 thousand, or 1.6%, in the first quarter 2025 when compared to the same quarter of 2024, due to higher revenue from network services sales, partially offset by lower healthcare IT sales. Revenue in our equipment segment decreased by $16 thousand, or 3.6%, when compared to the first quarter of 2024, principally due to lower equipment deliveries in our China operations, partially offset by higher ARCS software subscription revenue in the US.

Gross profit for the first quarter of 2025 increased by $440 thousand, or 4.0%, to $11.4 million, compared with a gross profit of $10.9 million for the same quarter of 2024, as a result of higher revenues.

Selling, general and administrative (SG&A) expenses for the first quarter of 2025 increased by $332 thousand, or 2.8%, to $12.4 million, compared to the first quarter of 2024. The increase was primarily attributable to higher personnel costs in the IT and professional sales service segments, partially offset by lower expenses in the equipment segment as well as lower corporate expenses.

Operating loss for the three months ended March 31, 2025 was $1.2 million, compared to operating loss of $1.5 million in the first quarter of 2024. The decrease in loss was due to the higher gross profit, partially offset by higher SG&A expenses as discussed above.

Net loss for the three months ended March 31, 2025 was $1.1 million, compared to net loss of $1.2 million in the first quarter of 2024.

Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization, and stock-based compensation) was negative $1.1 million in the first quarter of 2025 compared to a negative $1.3 million for the first quarter of 2024. The improvement was primarily the result of the narrower net loss. Adjusted EBITDA is a non-GAAP financial measure, as further discussed below.

Net cash used in operating activities was $566 thousand for the first quarter of 2025, an improvement compared to net cash used in operating activities of $1.1 million for the first quarter of 2024. As of May 9, 2025, the Company’s cash and cash equivalents totaled approximately $30.5 million.

About Vaso

Vaso Corporation is a diversified medical technology company with several distinct but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for medical equipment; and design, manufacture, and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

- VasoTechnology, Inc. provides network and IT services through two business units: NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers; and VasoHealthcare IT Corp., a national value added reseller of RIS (radiology Information system), PACS (picture archiving and communication system), and other software solutions from various vendors as well as related services, including implementation, management and support.

- Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE HealthCare diagnostic imaging and ultrasound products in certain market segments in the USA.

- VasoMedical, Inc. manages and coordinates the design, manufacture and sales of proprietary medical equipment and software, as well as operates the Company’s overseas assets including China-based subsidiaries.

Additional information is available on the Company’s website at www.vasocorporation.com.

Summarized Financial Information and Non-GAAP Financial Measures

We utilize Adjusted EBITDA to evaluate our performance internally, and this non-GAAP financial measure is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Company’s industry. Management believes that this non-GAAP financial measure, in addition to GAAP measures, is also useful to investors to evaluate the Company’s results.

Adjusted EBITDA is not a measure of financial performance under U.S. GAAP and should not be considered a substitute for operating income (loss), which we consider to be the most directly comparable U.S. GAAP measure. Adjusted EBITDA has limitations as an analytical tool, and when assessing our operating performance, you should not consider Adjusted EBITDA in isolation, or as a substitute for net income or other consolidated income statement data prepared in accordance with U.S. GAAP. Investors should recognize that the Company’s presentation of this non-GAAP financial measure might not be comparable to similarly-titled measures of other companies, limiting its usefulness as a comparative measure.

Summarized financial information including a reconciliation of operating loss to Adjusted EBITDA is set forth below:

The information contained in this report contains forward-looking statements (as such term is defined in the Securities Exchange Act of 1934 and the regulations thereunder). These forward-looking statements may include projections of, or guidance on, the Company’s future financial performance, expected levels of future revenue and expenses, anticipated growth strategies, and anticipated trends in the Company’s business or financial results. When used in this report, words such as “anticipates”, “continue”, “believes”, “could”, “estimates”, “expects”, “may”, “plans”, “potential”, “future”, “intends”, the negative of these terms and similar expressions identify forward-looking statements. Any forward-looking statement made by the Company in this document is based only on the Company’s current expectations, estimates and projections about future events and financial trends affecting the financial condition of its business based on information currently available to the Company and speaks only as of the date when made. Forward-looking statements are not historical facts or guarantees of future performance. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Company’s control, and actual results may differ materially from this forward-looking information and therefore should not be unduly relied upon. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions, including the possibility of a downturn or disruptions in the U.S. economy; the impact of US tariff policies; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreement; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; unexpected manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.

Investor Contacts:

Jonathan Newton

Investor Relations

Phone: 516-997-4600

Email: jnewton@vasocorporation.com