Vaso Corporation Announces Financial Results for Fourth Quarter and Full Year 2024

The Company Reports Continued Growth in Annual Revenue

PLAINVIEW, N.Y., March 31, 2025 — Vaso Corporation (“Vaso”) (OTCQX: VASO), a leading MedTech company with a diversified business portfolio in network and healthcare IT services, professional sales services, and proprietary medical products, today announced its operating results for the three months and year ended December 31, 2024.

“Continuing the trend of top-line growth, the Company’s annual revenue reached another record of $86.8 million for the fiscal year 2024, an increase of $5.7 million or 7% when compared to the prior year’s revenue,” commented Dr. Jun Ma, President and Chief Executive Officer of Vaso Corporation. “Gross profit for 2024 was $52.1 million, up by $1.5 million or 3% year-over-year, and net income for 2024 decreased to $1.3 million from $4.8 million in 2023, mainly due to higher operating expenses including investment in new programs and spending in strategy related activities during the year.”

“As we continued to generate positive cashflow from operating activities, at a rate of $3.3 million during fiscal year 2024, the Company’s balance sheet remains strong, with $26.3 million in cash and cash equivalents as of December 31, 2024,” Dr. Ma continued. “Total deferred revenue increased by $2.7 million, or 8%, in 2024 to $34.9 million, which will be recognized as revenue in future reporting periods when the underlying products or services are delivered.”

“In the last several years we were able to sustain significant top-line growth and maintain bottom-line profitability, while at the same time generating a substantial amount of free cashflow. As a result, the Company’s financial wellbeing has been improving consistently, setting a good foundation for further growth organically and through partnership or other external opportunities,” concluded Dr. Ma.

Financial Results for Three Months Ended December 31, 2024

For the three months ended December 31, 2024, revenue increased by 23.4% to $27.0 million from $21.9 million for the same period of 2023, due to higher revenues in all our business segments. Revenue in our IT segment increased by $1.3 million, or 13.6%, to $11.1 million as the result of higher network service and healthcare IT revenue; commission revenues in our professional sales service segment increased by $3.6 million, or 31.2%, to $15.0 million due to higher delivery of underlying equipment by our partner as well as higher blended commission rates for the delivered equipment; revenue in our equipment segment increased by $218 thousand, or 31.0%, to $921 thousand as a result of higher equipment sales in China, slightly offset by lower US software-as-a-service subscription sales.

Gross profit for the fourth quarter of 2024 increased by 22.6% to $17.2 million, compared with a gross profit of $14.1 million for the same quarter of 2023. The increase in gross profit was primarily the result of increased revenue.

Selling, general and administrative (SG&A) expenses for the fourth quarter of 2024 increased by 18.4% to $14.3 million, compared to $12.4 million for the fourth quarter of 2023. The increase was primarily attributable to an increase in personnel and travel costs in the professional sales service segment and the IT segment. SG&A expenses were 53.0% and 56.5% of revenue in the fourth quarter of 2024 and 2023, respectively.

Net income for the three months ended December 31, 2024 was $2.5 million, compared with net income of $1.1 million for the three months ended December 31, 2023. The increase was primarily due to the increase in revenue, partially offset by an increase in SG&A costs in 2024.

Financial Results for Year Ended December 31, 2024

For the year ended December 31, 2024, total revenue increased by $5.7 million, or 7.1%, to $86.8 million when compared with $81.0 million of revenue for the year 2023. Revenue in our IT segment increased by 6.4%, to $43.0 million, for the year 2024, from 2023 revenue of $40.4 million, primarily due to an increase in revenue in the managed network service business. Commission revenues in our professional sales service segment increased by $3.5 million, or 9.3%, to $41.3 million in the year 2024, compared to $37.8 million in 2023, primarily as the result of higher equipment deliveries by our partner and higher blended commission rates for the equipment delivered during the year. Equipment segment revenue for the year 2024 decreased by 12.5% to $2.5 million, from $2.8 million in 2023, due to lower ARCS®-cloud software-as-a-service revenues and lower product sales in our China operations driven by a lower volume of deliveries and the negative effect of foreign exchange rate fluctuations in 2024.

Gross profit for the year ended December 31, 2024 increased by 2.9% to $52.1 million from $50.6 million in 2023, as a result of the higher revenue, partially offset by lower gross margin.

SG&A expenses for the year ended December 31, 2024 increased by $3.6 million, or 7.9%, to $48.6 million, or 56.1% of revenue, compared with $45.1 million, or 55.6% of revenue, for 2023. The increase resulted primarily from an increase of $2.2 million in personnel and travel costs in the professional sales service segment, as well as a $1.3 million increase in the IT segment, also due to higher personnel and travel costs. Corporate expenses increased $1.4 million, resulting from an increase in professional fees including legal, accounting and investment banking costs for the proposed business combination transaction with Achari, which we terminated in 2024.

For the year ended December 31, 2024, the Company had net income of $1.3 million compared to net income of $4.8 million in 2023, a decrease of $3.5 million, mainly due to higher operating expenses in 2024 as referenced above.

Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization, and share-based compensation) was $1.4 million for the year ended December 31, 2024, compared to Adjusted EBITDA of $5.1 million for the year ended December 31, 2023. The decrease was primarily due to the lower reported net income.

Net cash provided from operating activities in 2024 was $3.3 million, compared to net cash provided from operating activities of $5.3 million in 2023. The decrease was principally due to the decrease in net income. Net cash and short-term investments increased to $26.3 million as of December 31, 2024, compared to $25.3 million as of December 31, 2023.

Deferred revenue increased to $34.9 million as of December 31, 2024, compared to $32.2 million as of December 31, 2023. The increase was primarily the result of order bookings exceeding equipment deliveries in the professional sales service segment in 2024. Deferred revenue will be recognized in the future when the underlying equipment or services are delivered and accepted at the customer site.

About Vaso

Vaso Corporation is a diversified medical technology company with several distinct but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for medical equipment; and design, manufacture, and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

- VasoTechnology, Inc. provides network and IT services through two business units: NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers; and VasoHealthcare IT Corp., a national value added reseller of RIS (radiology Information system), PACS (picture archiving and communication system), and other software solutions from various vendors as well as related services, including implementation, management and support.

- Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE HealthCare diagnostic imaging and ultrasound products in certain market segments in the USA.

- VasoMedical, Inc. manages and coordinates the design, manufacture and sales of proprietary medical equipment and software, as well as operates the Company’s overseas assets including China-based subsidiaries.

Additional information is available on the Company website.

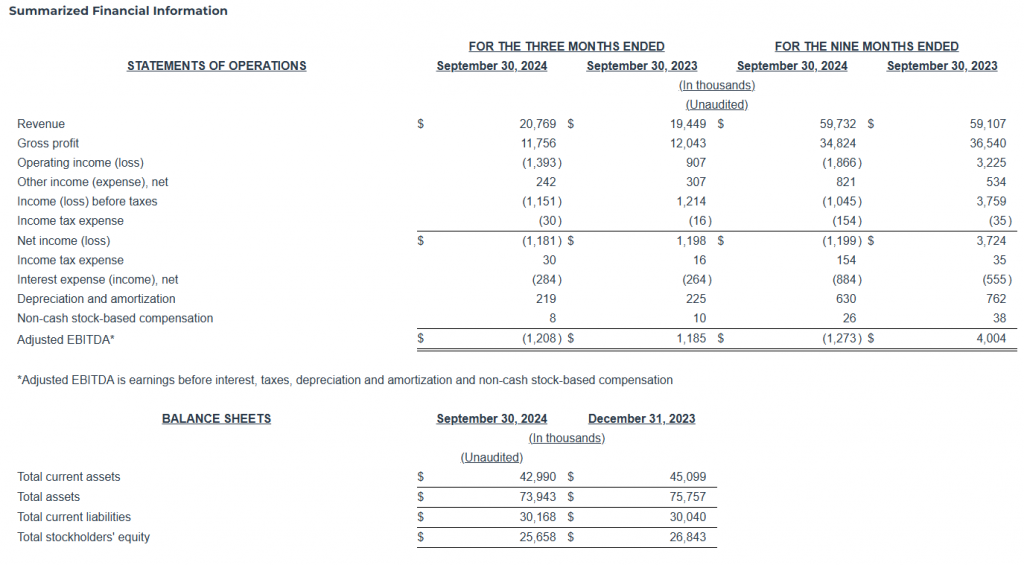

Summarized Financial Information

The information contained in this report contains forward-looking statements (as such term is defined in the Securities Exchange Act of 1934 and the regulations thereunder). These forward-looking statements may include projections of, or guidance on, the Company’s future financial performance, expected levels of future revenue and expenses, anticipated growth strategies, and anticipated trends in the Company’s business or financial results. When used in this report, words such as “anticipates”, “continue”, “believes”, “could”, “estimates”, “expects”, “may”, “plans”, “potential”, “future”, “intends”, the negative of these terms and similar expressions identify forward-looking statements. Any forward-looking statement made by the Company in this document is based only on the Company’s current expectations, estimates and projections about future events and financial trends affecting the financial condition of its business based on information currently available to the Company and speaks only as of the date when made. Forward-looking statements are not historical facts or guarantees of future performance. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Company’s control, and actual results may differ materially from this forward-looking information and therefore should not be unduly relied upon. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions, including the possibility of a downturn or disruptions in the U.S. economy; the impact of US tariff policies; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreement; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; unexpected manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.

Investor Contacts:

Jonathan Newton

Investor Relations

Phone: 516-508-5823

Email: jnewton@vasocorporation.com

Vaso Corporation Announces Executive Leadership Appointments & Names New Vice Chairman to the Board of Directors

PLAINVIEW, N.Y. January 13, 2025 – Vaso Corporation (“Vaso”) (OTCQX: VASO), a leader in human capital, information technology and MedTech, today announced new executive appointments to the Vaso management team and Board of Directors, effective January 1, 2025.

- Jane Moen was appointed Vaso Corporation’s Chief Operating Officer. She will continue in her role as President of VasoHealthcare, a Vaso Corporation subsidiary. Ms. Moen has served as a Director of Vaso Corporation’s Board since 2020.

- Jonathan Newton was promoted to Chief Financial Officer of Vaso Corporation from his previous role as Vaso’s Co-Chief Financial Officer. As part of this development, Michael Beecher, previously Co-Chief Financial Officer, will transition to a Vaso financial and investor relations advisory role.

- Edgar Rios was elected Vice Chairman of Vaso Corporation’s Board of Directors. Mr. Rios has served as an independent Director of Vaso since 2011. He will also continue in his role as Chairman of the Board’s Audit Committee.

Furthermore, Vaso Corporation named new corporate and securities outside counsel, Kimberly Decker of the law firm Barley Snyder LLP.

Dr. Jun Ma, President and Chief Executive Officer of Vaso Corporation commented, “Today’s executive changes and board appointments reflect Vaso Corporation’s commitment to its human capital mission and our focus on advancing our dedicated leaders. As we implement our 2025 strategy during this pivotal time in our corporate history, we are optimistic on our path and our competitive position as a leading human capital, MedTech, and information technology business. As we have recently articulated, our top priority in 2025 will be to continue growing organically across our diversified portfolio businesses, working closely with our customers and partners, while continuing to explore new strategic opportunities. We cannot be prouder of having leaders such as Jane and Jonathan in their expanded executive roles. Their devotion to Vaso has contributed to our success and I am looking forward to continuing to work with them and our entire leadership team.”

“We are also delighted to name Kimberly Decker from the prestigious law firm Barley Snyder LLP to work with us as legal counsel on corporate and securities matters. Lastly, the election of Edgar Rios, a respected and trusted Board Member, as Vaso’s new Vice Chairman is a natural progression and on behalf of the entire Board, I would like to thank him for his continued service to the Vaso mission,” Dr. Ma added.

About Vaso Corporation

Headquartered in Plainview New York, Vaso Corporation is a leading human capital, information technology and MedTech business with a focus on healthcare professional sales services, network and IT services across sectors, and proprietary medical products. Vaso Corporation is a diversified organization with three core businesses operating as wholly-owned subsidiaries: VasoHealthcare, the professional sales service arm for GEHealthCare’s diagnostic imaging and ultrasound products; VasoTechnology, an information technology and managed connectivity leader serving customers in healthcare provision and other sectors; and VasoMedical, the designer and manufacturer of proprietary medical devices including Biox series devices and the developer and operator of the ARCS cloud-based SaaS platform.

Investor Contacts:

Michael J. Beecher

Investor Relations

Phone: 516-508-5840

Email: mbeecher@vasocorporation.com

V&S Strategic Consulting

Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “optimistic”, “plans”, “potential”, “looking forward”, and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions, including the possibility of a downturn in the US economy and the continued impact of the COVID-19 pandemic; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreement; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.

Vaso Corporation CEO Reflects on a Year of Growth and Innovation in End-of-Year Letter Setting the Tone for a Promising 2025

Plainview, N.Y. December 16, 2024 – Vaso Corporation (“Vaso”) (OTCQX: VASO), a leader in human capital, information technology and MedTech, today released a letter to shareholders and employees summarizing the company’s achievements throughout the year and outlining key strategic developments and priorities for the upcoming year.

Highlights in the letter include operational developments, product updates, financial performance, and insights on thought-leadership initiatives. The goal is also to provide a business outlook and priorities for the year ahead.

To access the CEO Shareholder Letter, please see below:

Vaso-2024-Yearhend-Shareholder-Letter-FINAL-12-16-24-3About Vaso Corporation

Headquartered in Plainview New York, Vaso Corporation is a leading human capital, information technology and MedTech business with a focus on healthcare professional sales services, network and IT services across sectors, and proprietary medical products. Vaso Corporation is a diversified organization with three core businesses operating as wholly-owned subsidiaries: VasoHealthcare, the professional sales service arm for GEHealthCare’s diagnostic imaging and ultrasound products; VasoTechnology, an information technology and managed connectivity leader serving customers in healthcare provision and other sectors; and VasoMedical, the designer and manufacturer of proprietary medical devices including Biox series devices and the developer and operator of the ARCS cloud-based SaaS platform.

Investor Contacts:

Michael J. Beecher

+516-508-5840

mbeecher@vasocorporation.com

V&S Strategic Consulting

Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “optimistic”, “plans”, “potential”, “looking forward”, and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions, including the possibility of a downturn in the US economy and the continued impact of the COVID-19 pandemic; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreement; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.

Investor Contacts

Investor Contact:

Michael J. Beecher

Investor Relations

Phone: 516-508-5840

Email: mbeecher@vasocorporation.com

Vaso Corporation Announces Financial Results for Third Quarter 2024

PLAINVIEW, N.Y., Nov. 14, 2024 (GLOBE NEWSWIRE) — Vaso Corporation (“Vaso”) (OTCQX: VASO), a leading medtech company with a diversified business portfolio in network and healthcare IT services, professional sales services, and proprietary medical products, today reported its operating results for the three months ended September 30, 2024.

“For the third quarter of 2024, the Company’s revenue was $20.8 million, an increase of 7% when compared to the prior year’s third quarter revenue of $19.4 million, mainly due to higher revenue from the network services business in our IT segment. The Company recorded an operating loss of $1.4 million for the third quarter of 2024 compared to operating income of $907 thousand for the same quarter in 2023, as operating expenses increased including a significant amount in investment banking activities,” commented Dr. Jun Ma, President and Chief Executive Officer of Vaso Corporation.

“As the Company continues to generate positive operating cashflow, which was $3.6 million during the first nine months of the year, its balance sheet continues to be strong, with $26.8 million in cash, cash equivalents and short-term investments as of September 30, 2024. In addition, total deferred revenue increased by $1.4 million during the quarter to $33.1 million, which will be recognized as revenue in future reporting periods when the underlying products or services are delivered,” Dr. Ma continued.

“Our mission is to continue to grow our current business and revenue streams organically while working closely with our partners and customers across all our business segments. We are cautiously optimistic about the Company’s performance for the remainder of the year, as historically the fourth quarter has been the quarter with highest revenue and income of the year due to the cyclical nature of our business. As we approach yearend, we are focused on optimizing our strong business performance to seize new growth opportunities in 2025,” concluded Dr. Ma.

Financial Results for Three Months Ended September 30, 2024

Total revenue for the three months ended September 30, 2024 was $20.8 million, representing an increase of 7% from revenue of $19.4 million for the same period in the prior year. On a segment basis, revenue in the professional sales services segment increased $0.3 million, or 3%, year-over-year, mainly as a result of higher volume of underlying equipment delivered by our partner and higher commission rates on these deliveries; revenue in the IT segment increased $1.2 million, or 12%, compared to the third quarter of 2023, principally due to higher network services revenue; while revenue in the equipment segment decreased $172,000, or 23%, due mainly to lower ARCS® software sales.

Gross profit for the three months ended September 30, 2024 decreased by $287 thousand, or 2%, to $11.8 million, from $12.0 million for the third quarter of 2023. This decrease was mainly due to product mix with lower margins in the IT and equipment segments.

Selling, general and administrative (SG&A) expenses for the third quarter of 2024 increased by 5% to $11.4 million when compared to the third quarter of 2023. The increase is primarily attributable to higher personnel costs in the professional sales services segment due to an expansion of services for our partner as compared to 2023, and an increase in personnel costs in the IT segment.

Net loss for the three months ended September 30, 2024 was $1.2 million, compared to net income of $1.2 million for the three months ended September 30, 2023. The principal cause of the net loss was the costs incurred for the business combination of $1.5 million and the increase in SG&A costs.

Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization, and non-cash stock-based compensation) was negative $1.2 million for the quarter ended September 30, 2024, compared to positive $1.2 million for the third quarter of 2023. The decrease is the result of the decrease in net income.

Net cash provided by operating activities in the first nine months of 2024 was $3.6 million, compared to $6.9 million for the same period in 2023. As of September 30, 2024 and December 31, 2023, the Company had cash, cash equivalents and short term investments of approximately $26.8 million and $25.3 million, respectively, an increase of $1.5 million.

About Vaso

Vaso Corporation is a diversified medical technology company with several distinctive but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for medical equipment; and design, manufacture, and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

- VasoTechnology, Inc. provides network and IT services through two business units: NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers; and VasoHealthcare IT Corp., a national value added reseller of Radiology Information System (“RIS”), Picture Archiving and Communication System (“PACS”), and other software solutions from various vendors as well as related services, including implementation, management and support.

- Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE HealthCare diagnostic imaging and ultrasound products in certain market segments in the USA.

- VasoMedical, Inc. manages and coordinates the design, manufacture and sales of proprietary medical equipment and software, as well as operates the Company’s overseas assets including China-based subsidiaries.

Additional information is available on the Company’s website at www.vasocorporation.com.

Investor Contacts

Investor Contact:

Michael J. Beecher

Investor Relations

Phone: 516-508-5840

Email: mbeecher@vasocorporation.com

Vaso Corporation Announces Date Change for Its Stockholders Meeting

PLAINVIEW, N.Y., Aug. 26, 2024 — Vaso Corporation (“Vaso”) (OTCQX: VASO) today announced that at its special stockholders meeting on August 26, 2024, the meeting was adjourned without any consideration of the proposals to 10:00 AM Eastern on September 10, 2024 at the same location, the Lever House located at 390 Park Avenue, New York, NY 10022. With the adjourned date being well after the Labor Day holiday, it will provide more stockholders with the opportunity to attend the stockholders meeting in person.

About Vaso

Vaso Corporation is a diversified medical technology company operating in three business segments:

- IT Segment provides network and IT services through two operating units: NetWolves Network Services, a managed network services provider with an extensive, proprietary service platform to a broad base of customers; and VHC-IT, a service provider for healthcare application solutions from various vendors as well as related services, including implementation, management and support.

- Professional Sales Service Segment provides sales service of capital medical equipment through a wholly owned subsidiary VasoHealthcare, currently serving as the exclusive sales representative of GE HealthCare diagnostic imaging and ultrasound products and services in certain market segments in the USA.

- Equipment Segment manages and coordinates the design, manufacture and sales of proprietary medical equipment and software, as well as operates the Company’s overseas assets including China-based subsidiaries.

Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “optimistic”, “plans”, “potential”, “looking forward”, and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions, including the possibility of a downturn in the US economy and the continued impact of the COVID-19 pandemic; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreement; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.

Investor Contacts

For Vaso:

Michael J. Beecher

Investor Relations

Phone: 516-997-4600

Email: mbeecher@vasocorporation.com