Vaso Corporation Announces Financial Results for Second Quarter 2024

High deferred revenue and backlog setting stage for 2024 revenue and income growth

PLAINVIEW, N.Y., Aug. 14, 2024 (GLOBE NEWSWIRE) — Vaso Corporation (“Vaso”) (OTCQX: VASO) today reported its operating results for the three months ended June 30, 2024.

“The Company recorded a total revenue of $20.2 million for the second quarter of 2024, in line with revenue of $20.3 million for the second quarter of 2023,” commented Dr. Jun Ma, President and Chief Executive Officer of Vaso Corporation. “Deferred revenue in our professional sales service segment remains substantial, at $31.7 million as of June 30, 2024, and backlog in our IT segment reached a multi-year high of $39.4 million at the end of the second quarter, setting a good foundation for revenue and income growth in future quarters.”

“As stated before, we are a seasonal business in that a substantial amount of our revenue and income is usually generated in the last six months of any year. We are optimistic about the Company’s performance for the remainder of the year, as both top- and bottom-line numbers are tracking ahead of our 2024 goals year-to-date. We also continue to generate positive cashflow from operating activities, in the amount of $2.8 million during the second quarter of 2024. The Company had $25.7 million in cash and cash equivalents as of June 30, 2024, despite significantly increased expenses in the last several months for investment banking activities related to our efforts to list our common stock on NASDAQ through our previously announced proposed business combination with Achari Ventures Holdings Corp. I,” Dr. Ma continued.

“With regard to listing on NASDAQ, we anticipate it will afford the Company the opportunity of broadening its stockholder base as institutional investors have a very limited interest in OTC stocks. We also believe that, based on the historical performance and financial fundamentals of the Company, our common stock is undervalued as it is subject to trading restrictions under the penny stock rules which impose certain sales practice requirements on broker-dealers in transactions involving our stock. In addition, listing on NASDAQ should assist the Company in its goal of expanding operations through internal growth, new partnerships, and strategic investments with a concentration on medical and IT service companies,” concluded Dr. Ma. “A special stockholders meeting has been scheduled for August 26, 2024 in New York City to seek stockholders’ approval of the business combination, and I look forward to seeing you then.”

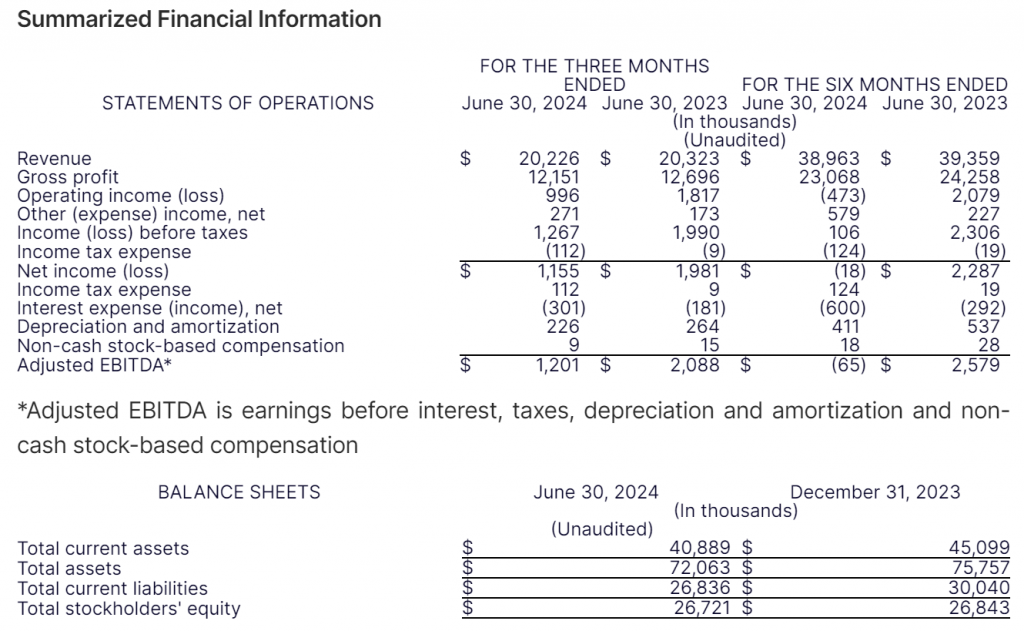

Financial Results for Three Months Ended June 30, 2024

For the three months ended June 30, 2024, total revenue decreased slightly to $20.2 million from $20.3 million for the same period of 2023. Revenue in our IT segment increased by $156 thousand or 1% when compared to the second quarter of 2023, mostly because of growth in the network services business. Revenue in the professional sales service segment decreased by $30 thousand, relatively flat compared to the second quarter of 2023, due primarily to lower deliveries of diagnostic imaging equipment, mostly offset by an increase in sales of ultrasound systems. Revenue in the equipment segment decreased by $223 thousand or 30% when compared to the same quarter of last year, due to lower sales of ARCS® cloud software subscription in the US and lower equipment deliveries in our China operations.

Gross profit for the second quarter of 2024 was $12.2 million, compared to $12.7 million for the same quarter of 2023, representing a decrease of 4% year over year. This decrease was the combined result of the decrease in revenue and lower gross margin.

Selling, general and administrative (SG&A) expenses for the second quarter of 2024 increased 2% to $10.8 million, when compared to the second quarter of 2023. The increase is primarily attributable to additional headcount for the new ultrasound sales program in the professional sales segment and an increase in personnel costs in the IT segment, partially offset by lower board fees. Total operating expenses increased 3% to $11.2 million due mainly to higher SG&A and business combination transaction costs.

Net income for the three months ended June 30, 2024 was $1.2 million, compared to net income of $2.0 million in the second quarter 2023. The lower income is due to the lower gross profit and higher expenses.

Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization and non-cash stock-based compensation) was $1.2 million for the three months ended June 30, 2024, compared to $2.1 million for the same period a year ago.

Net cash provided by operating activities in the first six months of 2024 was $1.7 million, compared to cash provided by operations of $6.0 million for the same period in 2023. As of June 30, 2024 and December 31, 2023, the Company had cash, cash equivalents and short-term investments of approximately $25.7 million and $25.3 million, respectively.

About Vaso

Vaso Corporation is a diversified medical technology company operating in three business segments:

- IT Segment provides network and IT services through two operating units: NetWolves Network Services, a managed network services provider with an extensive, proprietary service platform to a broad base of customers; and VHC-IT, a service provider for healthcare application solutions from various vendors as well as related services, including implementation, management and support.

- Professional Sales Service Segment provides sales service of capital medical equipment through a wholly owned subsidiary VasoHealthcare, currently serving as the exclusive sales representative of GE HealthCare diagnostic imaging and ultrasound products and services in certain market segments in the USA.

- Equipment Segment manages and coordinates the design, manufacture and sales of proprietary medical equipment and software, as well as operates the Company’s overseas assets including China-based subsidiaries.

Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “optimistic”, “plans”, “potential”, “looking forward”, and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions, including the possibility of a downturn in the US economy and the continued impact of the COVID-19 pandemic; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreement; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.

Investor Contacts

For Vaso:

Michael J. Beecher

Investor Relations

Phone: 516-997-4600

Email: mbeecher@vasocorporation.com

Vaso Corporation Announces the Effectiveness of the Achari Ventures Holdings Corp. I Registration Statement on Form S-4

A significant milestone for Vaso’s Listing on NASDAQ

Vaso Stockholders Meeting Scheduled for August 26, 2024 to Approve Business Combination with Achari

PLAINVIEW, N.Y., Aug. 07, 2024 (GLOBE NEWSWIRE) — Vaso Corporation (“Vaso” or the “Company”) (OTCQX: VASO) announced that on August 5, 2024, the U.S. Securities and Exchange Commission (“SEC”) declared effective the Achari Ventures Holdings Corp. I (“Achari”) (NASDAQ: AVHI) Registration Statement on Form S-4, as amended (the “Registration Statement”), filed with the SEC in connection with the previously announced proposed business combination (the “Business Combination”) of Vaso and Achari. In connection with the Business Combination, Achari will change its name to Vaso Holdings Corp. (“New Vaso”), which will be the surviving corporation after the Business Combination, and Vaso will be its wholly owned subsidiary and only operating entity. Current Vaso stockholders will own approximately 96% of New Vaso if all of the remaining public shares of Achari are redeemed in connection with Achari stockholder approval of the Business Combination, or 94% of New Vaso if none of Achari’s current public stockholders elect to redeem their shares and instead choose to remain stockholders of the combined company following the closing of the Business Combination. The parties have agreed that the valuation of Vaso stockholders in New Vaso will be approximately $176 million at closing.

“We are pleased to achieve this important step forward to becoming a publicly traded company listed on the NASDAQ stock exchange,” commented Dr. Jun Ma, President and CEO of Vaso, who will serve as President and CEO of Vaso Holdings Corp. upon closing of the Business Combination. “Our Company has achieved significant growth and profitability over the last few years, attaining in 2021, 2022 and 2023, respectively, an annual revenue of approximately $75.2 million, $79.3 million and $81.0 million, as well as operating income of approximately $2.5 million, $6.5 million and $4.2 million, respectively, over the same time periods, which has further resulted in cash reserves of about $25 million as of the latest regulatory filing.”

“Our success is primarily attributable to a diversified strategy and a strong commitment to business discipline. Based on the historical performance and financial fundamentals of the Company, we believe that our common stock is undervalued which could, in part, be that as an over-the-counter stock we are subject to the penny stock rules which impose certain sales practice requirements on broker dealers in transactions involving our stock. Additionally, we believe that institutional investors have a limited interest in a penny stock and listing on NASDAQ could afford the Company the opportunity of broadening its stockholder base. Listing on NASDAQ also should assist the Company in its goal of expanding operations through both internal growth and strategic partnerships with a concentration on medical and IT companies,” concluded Dr. Ma.

Following the Business Combination, there will be nine directors of New Vaso, consisting of Vaso’s seven current directors and two new independent directors selected by Vaso.

Vaso will be mailing its proxy statement (the “Proxy Statement”) on or about August 12, 2024 to stockholders of record as of the close of business on July 15, 2024 . The Proxy Statement contains notice of a special stockholders meeting (the “Special Meeting”) and voting instruction form or a proxy card relating to the Special Meeting.

The Special Meeting to approve the proposed business combination is scheduled to be held on August 26, 2024 at 10:00 a.m. Eastern Time at Lever House, 390 Park Avenue, New York, NY, subject to adjournment. If the proposals at the Special Meeting are approved, Vaso anticipates that the Business Combination will close promptly thereafter following similar approval of the Business Combination by Achari’s stockholders at a separate special meeting convened by Achari, and that New Vaso will commence trading on NASDAQ under the new ticker symbol “VASO” shortly following the receipt of such approval, subject to the satisfaction or waiver, as applicable, of all other closing conditions.

Every stockholder’s vote is important, and Vaso requests that each stockholder complete, sign, date and return a proxy card (online or by mail) as soon as possible to ensure that the stockholder’s shares will be represented at the Special Meeting. Stockholders who hold shares in “street name” (i.e., those stockholders whose shares are held of record by a broker, bank or other nominee) should contact their broker, bank or nominee to ensure that their shares are voted.

About Vaso

Vaso Corporation is a diversified medical technology company operating in three business segments:

- VasoTechnology provides network and IT services through two operating units: NetWolves Network Services, a managed network services provider with an extensive, proprietary service platform to a broad base of customers; and VHC-IT, a service provider for healthcare application solutions from various vendors as well as related services, including implementation, management and support.

- VasoHealthcare provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE HealthCare diagnostic imaging and ultrasound products and services in certain market segments in the USA.

- VasoMedical manages and coordinates the design, manufacture and sales of proprietary medical equipment and software, as well as operates the Company’s overseas assets including China-based subsidiaries.

About Achari

Achari is a special purpose acquisition company formed for the purpose of effecting a merger, capital stock exchange asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses.

Cautionary Statement Regarding Forward-Looking Statements

This communication includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. Generally, statements that are not historical facts in this communication are forward-looking statements. Forward-looking statements herein generally relate to future events or the future financial or operating performances of Vaso, Achari or the combined Business Combination (the “Combined Company”). For example, projections of future financial or operational performance of Vaso or Achari or the Combined Company are forward-looking statements. In some cases, you can identify forward-looking statements in terminology such as “may,” “should,” “expect,” “will,” “estimate,” “anticipate,” “believe,” “predict,” “project,” “target,” “budget,” “forecast,” “could,” “continue,” “plan,” or “potentially” or the negatives of these terms or variations of them or similar technology. Such forward-looking statements are based on beliefs and assumptions and on information available to management of Vasoand are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward-looking statements.

These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Vasoand its management, as the case may be, are inherently uncertain and subject to material change. There can be no assurance that future developments affecting Vaso or Achari, or the Combined Company, will be those that it has anticipated. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Factors that may cause actual results to differ materially from current expectations include, but are not limited to, the effect of business and economic conditions, including the possibility of a downturn in the U.S. economy and continued effects of the COVID-19 pandemic; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreement; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; unexpected manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in Vaso and Achari’s SEC reports.

Nothing in this communication should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements in this communication, which speak only as of the date they are made and are qualified in their entirety by reference to the cautionary statements herein and the risk factors described above. Neither Vaso nor Achari undertakes any duty to update these forward-looking statements. In addition, no responsibility, liability or duty of care is or will be accepted by Vaso, Achari or any other person for updating or revising the communication or providing any additional information to any recipient and any such liability is expressly disclaimed.

Investor Contacts

For Vaso:

Michael J. Beecher

Investor Relations

Phone: 516-997-4600

Email: mbeecher@vasocorporation.com

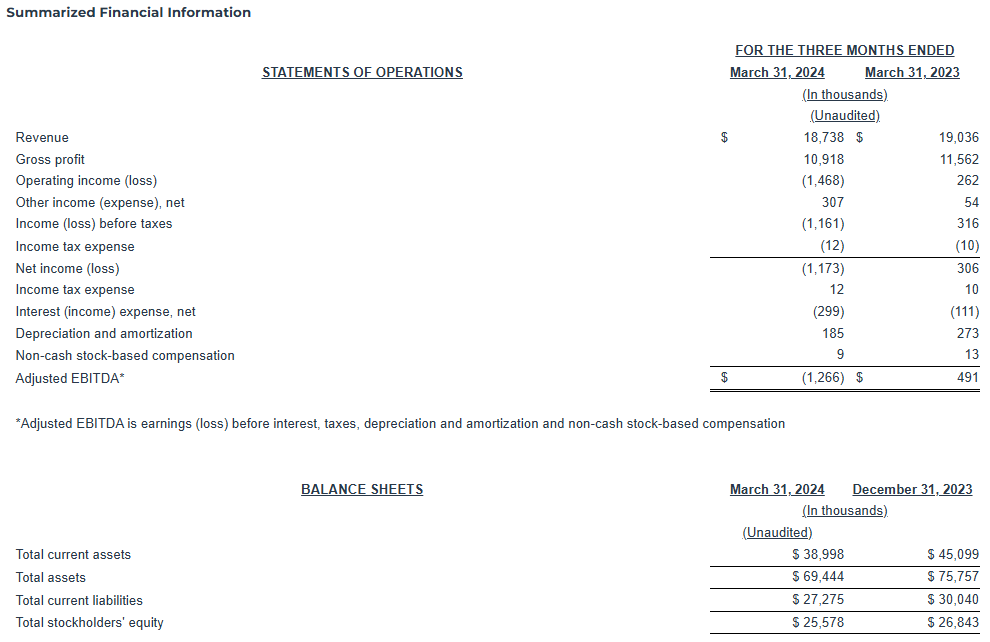

Vaso Corporation Announces Financial Results for First Quarter 2024

PLAINVIEW, N.Y., May 15, 2024 (GLOBE NEWSWIRE) — Vaso Corporation (“Vaso”) (OTCQX: VASO) today reported its operating results for the three months ended March 31, 2024.

“Total revenue for the first quarter of 2024 was $18.7 million, a decrease of $0.3 million or 1.6% when compared to the same quarter last year, mainly due to lower sales in the equipment segment. Quarterly gross profit was $10.9 million, a decrease of $0.6 million or 5.6% year-over-year, as a result of lower revenue and lower gross margin,” stated Dr. Jun Ma, President and Chief Executive Officer of Vaso Corporation. “We have also recorded a net loss of approximately $1.2 million for the quarter, as we usually incur losses historically in the early quarters of the year due to the cyclic nature of our businesses.”

“Our operating cashflow in the first quarter improved by $0.8 million year-over-year despite higher operating expenses resulting from the effect of inflation, added headcount for a new program initiated in 2023, and spending for investment banking activities related to the previously announced proposed business combination. Our cash, cash equivalents and short-term investments totaled approximately $26.0 million as of May 3, 2024. As the Company’s financial position remains very strong with good cash balance, high deferred revenue in the professional sales service segment and high backlog in the IT services business, management is looking forward to another great year in 2024,” concluded Dr. Ma.

Financial Results for Three Months Ended March 31, 2024

For the three months ended March 31, 2024, revenue decreased by 1.6% to $18.7 million from $19.0 million for the same period of 2023, due primarily to decreases in the IT and equipment segments. Revenue in the professional sales services service segment was flat year-over-year. Revenue in our IT segment decreased by $121 thousand, or 1.2%, in the first quarter 2024 when compared to the same quarter of 2023, due to slightly lower revenue from managed services sales. Revenue in our equipment segment decreased by $179 thousand, or 28.1%, when compared to the first quarter of 2023, principally due to lower equipment deliveries in our China operations.

Gross profit for the first quarter of 2024 decreased by $0.6 million, or 5.6%, to $10.9 million, compared with a gross profit of $11.6 million for the same quarter of 2023, as a result of lower revenues and lower gross profit margin in our professional sales service and IT segments.

Selling, general and administrative (SG&A) expenses for the first quarter of 2024 increased by $1.1 million, or 9.4%, to $12.2 million, compared to the first quarter of 2023. The increase is primarily attributable to higher personnel costs in the professional sales service segment due to costs in the new ultrasound business and higher costs for the national sales meeting, and higher corporate costs due to higher investment banking services.

Operating loss for the three months ended March 31, 2024 was $1.5 million, compared to operating income of $262 thousand in the first quarter of 2023. The loss is due to the lower gross profit and the higher SG&A costs as discussed above.

Net loss for the three months ended March 31, 2024 was $1.2 million, compared to net income of $306 thousand in the first quarter of 2023.

Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization, and stock-based compensation) was negative $1.3 million in the first quarter of 2024 compared to a positive $491 thousand for the first quarter of 2023. The change is the result of the net loss.

Net cash used in operating activities was $1.1 million for the first quarter of 2024, an improvement compared to net cash used in operating activities of $1.9 million for the first quarter of 2023. As of May 3, 2024, the Company’s net cash, cash equivalents and short-term investments totaled approximately $26.0 million.

About Vaso

Vaso Corporation is a diversified medical technology company with several distinctive but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for medical equipment; and design, manufacture and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

- VasoTechnology, Inc. provides network and IT services through two business units: NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers; and VasoHealthcare IT Corp., a national value added reseller of Radiology Information System (“RIS”), Picture Archiving and Communication System (“PACS”), and other software solutions from various vendors as well as related services, including implementation, management and support.

- Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE HealthCare diagnostic imaging and ultrasound products in certain market segments in the USA.

- VasoMedical, Inc. manages and coordinates the design, manufacture and sales of proprietary medical equipment and software, as well as operates the Company’s overseas assets including China-based subsidiaries.

Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “optimistic”, “plans”, “potential”, “looking forward”, and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions, including the possibility of a downturn in the US economy and the continued impact of the COVID-19 pandemic; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreement; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.

Investor Contacts

For Vaso:

Michael J. Beecher

Investor Relations

Phone: 516-997-4600

Email: mbeecher@vasocorporation.com

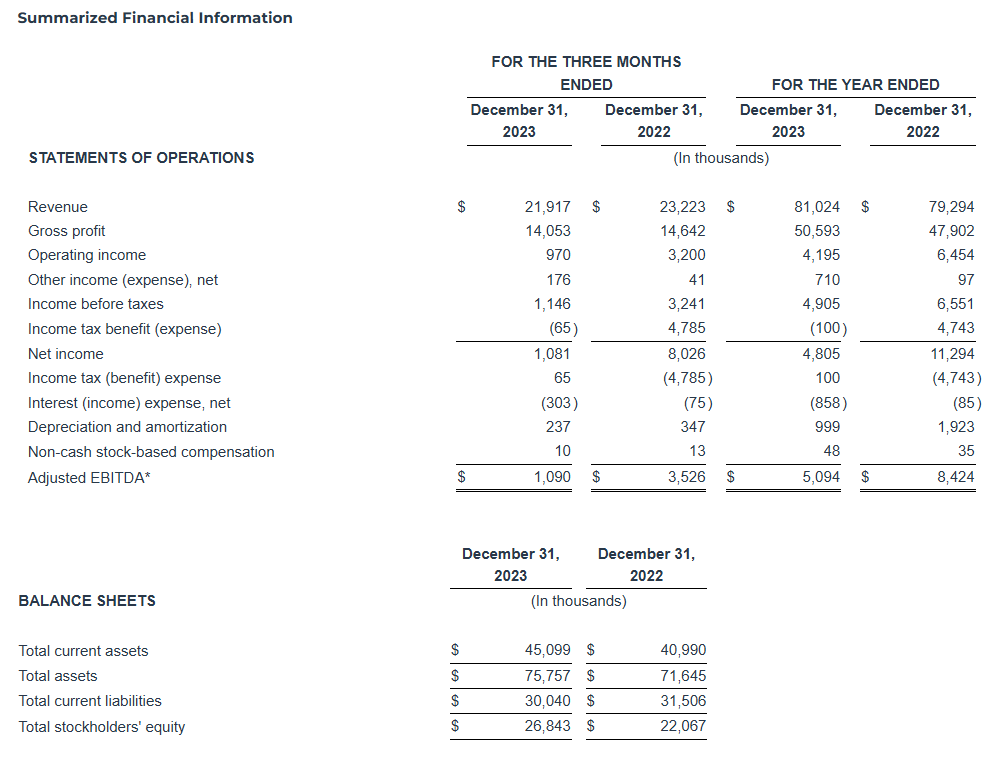

Vaso Corporation Announces Financial Results for Fourth Quarter and Full Year of 2023

The Company Reports Another Record in Annual Revenue

“The Company continued the growth trend in fiscal year 2023 and reached another record annual revenue of $81.0 million, an increase of 2.2% year-over-year. We are particularly pleased to see all three of our businesses attaining higher revenue over the prior year,” commented Dr. Jun Ma, President and Chief Executive Officer of Vaso Corporation. “Net income for the year was $4.8 million, despite additional significant investments during the year on a new program in the professional sales service segment, on product development efforts in the equipment segment, and on corporate undertakings such as investment banking activities, etc. We believe these investments and initiatives will lead to further growth of our businesses and increase the shareholder value of the Company.”

“The Company continued to generate positive cashflow from operating activities, at a rate of $5.3 million during fiscal year 2023, resulting in a strong balance sheet with $25.3 million in cash, cash equivalents and short-term investments at the end of 2023,” Dr. Ma continued. “Deferred revenue at the end of 2023 was $32.2 million, an increase of $1.4 million when compared to the end of 2022, which will turn into recognized revenue in future periods upon completion of delivery of the underlying products or services.”

“Based on the resources presently available and potentially in the future, the management is working on growth strategies for all areas of our diversified business portfolio, including seeking opportunities for new partnerships and accretive acquisitions. We look forward to delivering more exciting developments in the Company with continued growth and profitability in 2024,” concluded Dr. Ma.

Achari Business Combination Agreement

As previously announced, the Company entered into a business combination agreement (the “Business Combination Agreement”), dated as of December 6, 2023, with Achari Ventures Holdings Corp. I, a Delaware corporation (“Achari”) (NASDAQ: AVHI), and Achari Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Achari (“Merger Sub”). The Business Combination Agreement provides, among other things, that on the terms and subject to the conditions set forth therein, Merger Sub will merge with and into the Company (the “Merger”), with the Company surviving as a wholly owned subsidiary of Achari. Upon the closing of the Business Combination Agreement (the “Closing”), we anticipate that Achari will change its name to “Vaso Holdings Corp.” or an alternative name chosen by the Company and reasonably acceptable to Achari (“New Vaso”). The Merger and the other transactions contemplated by the Business Combination Agreement are hereinafter referred to collectively as the “Business Combination”.

Upon the Closing, New Vaso would have authorized shares of Class A common stock and Class B common stock. The Business Combination Agreement establishes a pro forma equity value of the Company at approximately $176 million, at $10.00 per share of Class A common stock. As such, we believe that the current Vaso stockholders would receive approximately 17.6 million shares of Class A common stock and the current Achari shareholders would maintain between 500 thousand and 750 thousand shares of Class A common stock depending on Achari’s unpaid expenses at the Closing and presuming the redemption of all outstanding public shares of Achari on or prior to the Closing. In addition, current Achari warrant holders would have outstanding warrants to purchase a minimum of 8.25 million shares of Class A common stock at an exercise price of $11.50 per share. No shares of Class B common stock are expected to be outstanding immediately after the Business Combination.

The Boards of Directors of Vaso and Achari have each approved the Business Combination, the consummation of which is subject to various customary closing conditions, including the filing and effectiveness of a Registration Statement on Form S-4 (as amended or supplemented, the “Registration Statement”) by Achari with the United States Securities and Exchange Commission (“SEC”), the filing of a proxy statement by Vaso with the SEC and clearance by the SEC, and the approval of a majority of shareholders of both Achari and Vaso of the proposed business combination (Vaso shareholders representing approximately 44% of Vaso’s outstanding shares have entered into support agreements committing them to vote in favor of the Business Combination). The Business Combination is expected to close in the second quarter of 2024.

Financial Results for Three Months Ended December 31, 2023

For the three months ended December 31, 2023, revenue decreased by 5.6% to $21.9 million from $23.2 million for the same period of 2022 due to lower revenues in all our segments. Revenue in our IT segment decreased by $0.4 million, or 4.4%, to $9.8 million as the result of lower recurring services during the quarter; revenue in our equipment segment decreased by $82 thousand, or 10.4%, to $0.7 million due to lower equipment sales in China in the quarter; and revenue in our professional sales service segment decreased by $0.8 million, or 6.4%, to $11.4 million due to lower incentive commission revenue when compared to the prior year, partially offset by higher delivery of underlying equipment. We anticipate that revenue will improve in all three business segments, as we expect growth from new business in the IT segment, higher delivery of underlying equipment in our professional sales service segment resulting from strong order bookings in 2023, and continued recovery of our China operations from COVID lockdowns.

Gross profit for the fourth quarter of 2023 decreased by 4.0% to $14.1 million, compared with a gross profit of $14.6 million for the same quarter of 2022. This decrease was primarily the result of a decrease in revenue.

Selling, general and administrative (SG&A) and R&D expenses for the fourth quarter of 2023 increased by 14.7% to $12.9 million, compared to $11.3 million for the fourth quarter of 2022. The increase was primarily attributable to an increase in personnel and travel costs in the professional sales service segment mainly as a result of the new program launched in 2023 which we anticipate will lead to increased revenue in 2024. SG&A expenses were 58.9% and 48.5% of revenue in the fourth quarter of 2023 and 2022, respectively.

Net income for the three months ended December 31, 2023 was $1.1 million, compared with a net income of $8.0 million for the three months ended December 31, 2022. The decrease was primarily due to the decrease in revenue and an increase in SG&A costs in 2023 as well as to the recognition of a $4.8 million tax benefit resulting from a reduction in the reserve for deferred tax assets in 2022.

Financial Results for Year Ended December 31, 2023

For the year ended December 31, 2023, revenue increased by $1.7 million, or 2.2%, to $81.0 million when compared with $79.3 million of revenue for the year 2022. Revenue in our IT segment increased by 0.7% to $40.4 million for the year 2023, from 2022 revenue of $40.1 million, primarily due to an increase in revenue in the healthcare IT business. Commission revenues in our professional sales service segment increased by $1.2 million, or 3.3%, to $37.8 million in the year 2023, compared to $36.6 million in 2022, primarily as the result of higher equipment deliveries by our partner and higher blended commission rates for the equipment delivered during the year. Equipment segment revenue for the year 2023 increased by 10.1% to $2.8 million, from $2.6 million in 2022, due to higher ARCS®-cloud software-as-a-service revenues partially offset by lower reported product sales in our China operations due to the effect of foreign exchange rate fluctuations in 2023.

Gross profit for the year ended December 31, 2023 increased by 5.6% to $50.6 million, from $47.9 million in 2022, as a result of the higher revenue in our professional sales service segment and improved margin in our IT segment.

SG&A expenses for the year ended December 31, 2023 increased by $4.8 million, or 11.8%, to $45.6 million, or 56.3% of revenue, compared with $40.8 million, or 51.5% of revenue, for the same period in 2022. The increase resulted primarily from an increase of $3.4 million in personnel and travel costs in the professional sales service segment, including for the launch of a new program in 2023 which we anticipate will lead to increased revenue in 2024, and a $0.8 million increase in corporate expenses resulting from an increase in investment banking costs.

For the year ended December 31, 2023, the Company had net income of $4.8 million compared to net income of $11.3 million in 2022, a decrease of $6.5 million due to higher operating expenses in 2023 as referenced above, and the income tax benefit of $4.8 million recognized in 2022.

Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization, and share-based compensation) was $5.1 million for the year ended December 31, 2023, compared to Adjusted EBITDA of $8.4 million for the year ended December 31, 2022. The decrease was primarily due to the lower reported net income.

Net cash provided from operating activities in 2023 was $5.3 million, compared to net cash provided from operating activities of $14.4 million in 2022. The decrease is principally due to the decrease in profitability. Net cash and short-term investments increased to $25.3 million at December 31, 2023, compared to $20.3 million at December 31, 2022.

Deferred revenue increased to $32.2 million at December 31, 2023, compared to $30.8 million at December 31, 2022. The increase is primarily the result of order bookings exceeding equipment deliveries in the professional sales service segment. Deferred revenue will be recognized in the future when the underlying equipment or services are delivered and accepted at the customer site.

About Vaso

Vaso Corporation is a diversified medical technology company with several distinctive but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for medical equipment; and design, manufacture and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

- VasoTechnology, Inc. provides network and IT services through two business units: NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers; and VasoHealthcare IT Corp., a national value added reseller of Radiology Information System (“RIS”), Picture Archiving and Communication System (“PACS”), and other software solutions from various vendors as well as related services, including implementation, management and support.

- Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE HealthCare diagnostic imaging and ultrasound products in certain market segments in the USA.

- VasoMedical, Inc. manages and coordinates the design, manufacture and sales of proprietary medical equipment and software, as well as operates the Company’s overseas assets including China-based subsidiaries.

Additional information is available on the Company’s website at www.vasocorporation.com.

Summarized Financial Information

*Adjusted EBITDA is earnings before interest, taxes, depreciation and amortization and non-cash stock-based compensation

Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “optimistic”, “plans”, “potential”, “looking forward”, and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions, including the possibility of a downturn in the US economy and the continued impact of the COVID-19 pandemic; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreement; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.

Investor Contacts

For Vaso:

Michael J. Beecher

Investor Relations

Phone: 516-997-4600

Email: mbeecher@vasocorporation.com

Vaso Corporation, a Diversified Medical Technology Company Currently Trading on the OTCQX Market, to List on Nasdaq via SPAC Merger

Business Combination with Achari Ventures Holdings Corp. I is Expected to Be Completed in First Quarter of 2024

- Merger with Achari Ventures Holdings Corp. I (NASDAQ:AVHI) expected to improve capital market access for existing and prospective investors of Vaso Corporation (OTCQX:VASO).

- The transaction values Vaso at a pro forma equity value of approximately $176 million at $10 per share.

- Upon closing of the transaction, existing Vaso shareholders will receive consideration consisting entirely of shares of the surviving public combined company.

PLAINVIEW, NY / ACCESSWIRE / December 7, 2023 / Vaso Corporation (“Vaso,” or “the Company”), a diversified medical technology company currently trading on the OTCQX market, today announced its plan to uplist from the OTCQX market to the Nasdaq Stock Market via a business combination (the “Transaction”) with Achari Ventures Holdings Corp. I (“Achari”, NASDAQ:AVHI). Upon the closing of the Transaction, Vaso common stock and warrants are expected to be listed on Nasdaq Capital Market (“Nasdaq”) under the ticker symbols “VASO” and “VASOW”, respectively. Vaso’s common stock will continue to trade on the OTCQX market under the symbol “VASO” until trading on Nasdaq commences following the consummation of the proposed business combination.

Vaso is led by Chief Executive Officer Jun Ma, who will continue to lead the combined company following the proposed business combination. Achari is led by Chief Executive Officer Vikas Desai, who is also Chairman of Achari’s Board of Directors.

Company Overview

Vaso Corporation is a diversified medical technology company with several distinctive but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for diagnostic imaging products; and design, manufacture and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

- VasoTechnology, Inc. provides network and IT services through two business units: VasoHealthcare IT Corp., a national value added reseller of Radiology Information System (“RIS”), Picture Archiving and Communication System (“PACS”), and other software solutions from various vendors as well as related services, including implementation, management and support; and NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers.

- Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of a large healthcare diagnostic imaging equipment manufacturer in certain market segments in the United States.

- VasoMedical, Inc. manages and coordinates the design, manufacture and sales of proprietary medical equipment and software, as well as operates the Company’s overseas assets including China-based subsidiaries.

Transaction Overview

The Transaction values Vaso at a pro forma equity value of approximately $176 million, at $10.00 per share. The Boards of Directors of Vaso and Achari have each approved the Transaction, the consummation of which is subject to various customary closing conditions, including the filing and effectiveness of a Registration Statement on Form S-4 (as amended or supplemented, the “Registration Statement”) by Achari with the United States Securities and Exchange Commission (“SEC”), the filing and clearance by the SEC of a proxy statement by Vaso and the approval of the stockholders of both Achari and Vaso of the proposed business combination (although Vaso shareholders representing 44% of Vaso’s outstanding shares have entered into support agreements committing them to vote in favor of the Transaction). The Transaction is expected to close in the first quarter of 2024.

Additional information, including a copy of the business combination agreement, will be provided in Current Reports on Form 8-K to be filed by each of Achari and Vaso with the SEC.

Advisors

Ladenburg Thalmann & Co. Inc. is serving as financial and capital markets advisor to Vaso. Katten Muchin Rosenman LLP is acting as legal advisor to Achari and Ortoli Rosenstadt LLP is acting as legal advisor to Vaso.

About Achari Ventures Holdings Corp. I

Achari Ventures Holdings Corp. I (NASDAQ:AVHI) is a blank check company formed for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses.

Additional Information and Where to Find It

Achari intends to file with the SEC the Registration Statement, which will include a preliminary proxy statement/prospectus of Achari, which will be both the proxy statement to be distributed to holders of shares of Achari’s common stock in connection with the solicitation of proxies for the vote by Achari’s stockholders with respect to the proposed business combination and related matters as may be described in the Registration Statement, as well as the prospectus relating to the offer and sale of the securities to be issued in the business combination. Vaso intends to file with the SEC (the “Company Proxy Statement”) a preliminary proxy statement of Vaso, which will be the proxy statement to be distributed to holders of shares of Vaso’s common stock in connection with the solicitation of proxies for the vote by Vaso’s stockholders with respect to the proposed business combination and related matters as may be described in the proxy statement.

After the Registration Statement is declared effective, Achari will mail a definitive proxy statement/prospectus and other relevant documents to its stockholders. After clearance from the SEC with respect to the Company Proxy Statement, Vaso will mail a definitive proxy statement and other relevant documents to its stockholders. Achari’s and Vaso’s stockholders and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus to be filed by Achari, and any amendments thereto, the preliminary proxy statement to be filed by Vaso, and any amendments thereto, the definitive proxy statement/prospectus to be filed by Achari and the definitive proxy statement to be filed by Vaso, because such documentation will contain important information about Achari, Vaso and the proposed business combination. This press release is not a substitute for the Registration Statement, the Company Proxy Statement, the definitive proxy statement/prospectus to be filed by Achari, the definitive proxy statement to be filed by Vaso or any other document that Achari or Vaso will send to their respective stockholders in connection with the business combination.

INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ, WHEN AVAILABLE, THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS, COMPANY PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE BUSINESS COMBINATION AND THE PARTIES TO THE BUSINESS COMBINATION.

The definitive proxy statement/prospectus to be filed by Achari and the definitive proxy statement to be filed by Vaso will each be mailed to Achari and Vaso’s respective stockholders as of record dates to be established for voting on the proposed business combination and related matters. Stockholders of Achari and Vaso may obtain copies of the proxy statement/prospectus to be filed by Achari and the proxy statement to be filed by Vaso, when available, without charge, at the SEC’s website at www.sec.gov or by directing requests to each of: Vaso Corporation, 137 Commercial Street, Suite 200, Plainview, New York 11803 or Achari Ventures Holdings Corp. I, 60 Walnut Avenue, Suite 400, Clark, NJ 07066, as applicable.

INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE BUSINESS COMBINATION OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE

Participants in Solicitation

This press release is not a solicitation of a proxy from any investor or security holder. However, Achari and Vaso and their respective directors, officers and other members of their management and employees may be deemed to be participants in the solicitation of proxies from Achari’s and Vaso’s stockholders with respect to the proposed business combination and related matters. Investors and security holders may obtain more detailed information regarding the names, affiliations and interests of the directors and officers of Achari and Vaso in the proxy statement/prospectus to be filed by Achari relating to the proposed business combination when it is filed with the SEC and the proxy statement to be filed by Vaso relating to the proposed business combination when it is filed with the SEC. These documents may be obtained free of charge from the sources indicated above.

No Offer or Solicitation

This press release is for informational purposes only, and is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy or subscribe for any securities or a solicitation of any vote of approval, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Forward-Looking Statements

Certain statements in this press release are “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Such forward-looking statements are often identified by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “forecasted,” “projected,” “potential,” “seem,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or otherwise indicate statements that are not of historical matters, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements and factors that may cause actual results to differ materially from current expectations include, but are not limited to: (i) the effect of changes taking place across the intersection of the information technology and healthcare industries, (ii) continuation of the Company’s agreement with a major healthcare diagnostic imaging equipment manufacturer, (iii) the impact of competitive technology and products and their pricing on the Company’s technology and products, (iv) medical insurance reimbursement policies, (v) unexpected manufacturing or supplier problems, (vi) unforeseen difficulties and delays in product development programs, (vii) the actions of regulatory authorities and third-party payors in the United States and overseas, and (viii) the risk factors reported from time to time in the Company’s and Achari’s SEC reports. The forgoing factors are not exhaustive and additional factors that may cause actual results to differ materially from current expectations include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of negotiations and any subsequent definitive agreements with respect to the business combination; (2) the outcome of any legal proceedings that may be instituted against Achari or Vaso, the combined company or others following the announcement of the business combination and any definitive agreements with respect thereto; (3) the inability to complete the business combination due to the failure to obtain approval of the stockholders of Achari or Vaso or to satisfy other conditions to closing; (4) changes to the proposed structure of the business combination that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the business combination; (5) the ability to meet stock exchange listing standards following the consummation of the business combination; (6) the risk that the business combination disrupts current plans and operations of Vaso as a result of the announcement and consummation of the business combination; (7) the ability to recognize the anticipated benefits of the business combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain key relationships and retain its management and key employees; (8) costs related to the business combination; (9) changes in applicable laws or regulations; (10) the possibility that Vaso or the combined company may be adversely affected by other economic, business, and/or competitive factors and (11) Vaso’s estimates of expenses and profitability. The foregoing list of factors is not exhaustive.

The reader should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of Achari’s final prospectus dated October 14, 2021 (Registration No. 333-258476), related to its initial public offering, Achari’s and Vaso’s Annual Reports on Form 10-K filed with the SEC and other documents filed by Achari and Vaso from time to time with the SEC.

The reader is cautioned not to place undue reliance on these forward-looking statements, which only speak as of the date made, are not a guarantee of future performance and are subject to a number of uncertainties, risks, assumptions and other factors, many of which are outside the control of Achari and Vaso. Achari and Vaso expressly disclaim any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the expectations of Achari or Vaso with respect thereto or any change in events, conditions or circumstances on which any statement is based.

Investor Contacts

For Vaso:

Michael J. Beecher

Investor Relations

Phone: 516-997-4600

Email: mbeecher@vasocorporation.com

For Achari:

Rob Kelly

MATTIO Communications

416-992-4539

AchariSpac@mattio.com