Vaso Corporation Announces Financial Results for Third Quarter 2019

PLAINVIEW, NY / November 14, 2019 / Vaso Corporation (“Vaso”) (OTCPINK:VASO) today reported its operating results for the three months ended September 30, 2019.

“The Company recorded an operating profit of $0.8 million for the third quarter of 2019 on revenue of $18.7 million, which remained virtually flat year-over-year. This operating result represented an improvement of over $1.0 million when compared to the operating loss of $0.2 million in the same quarter last year, and was the result of a higher gross profit margin as well as a significant reduction in selling, general and administrative (“SG&A”) costs. Year to date, we have reduced SG&A expenses by $2.6 million or 8% year-over-year as a direct effect of the cost cutting measures we implemented in the last several quarters. We anticipate continued improvement in the operating results for the reminder of the year and in the coming quarters,” stated Dr. Jun Ma, President and CEO of the Company.

“Our IT segment continues to be a main contributor of the Company’s revenue, growing to $11.5 million during the quarter ended September 30, 2019, or 4% over the same quarter in the prior year. We look forward to continued growth in this segment, especially in the healthcare IT business where our expertise in managed network services combined with comprehensive healthcare IT solutions present unique value proposition to a broad base of healthcare provision clients to address their needs for bandwidth, applications, cloud storage and security,” Dr. Ma commented.

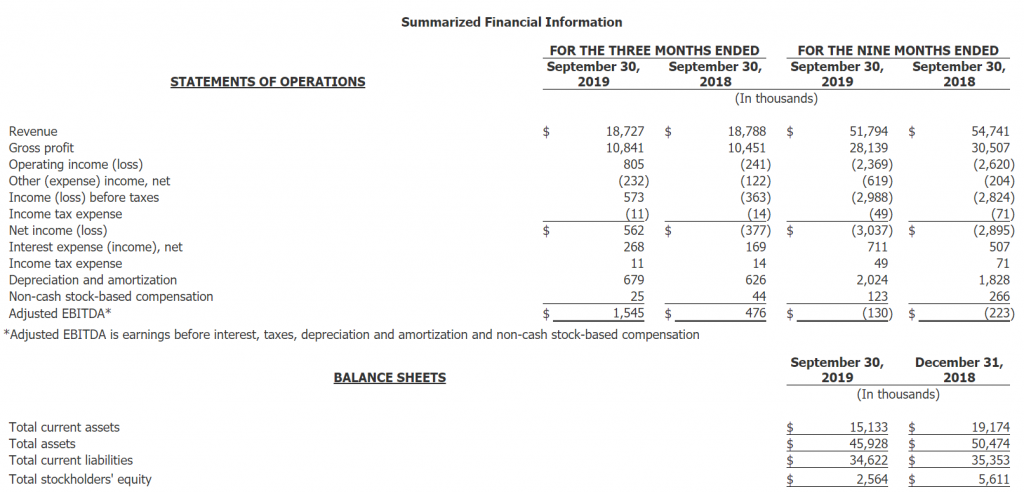

Financial Results for Three Months Ended September 30, 2019

For the three months ended September 30, 2019, revenue decreased $61 thousand, or 0.3%, to $18.7 million from $18.8 million for the same period of 2018. Quarterly revenue in our IT segment increased $483 thousand or 4% year-over-year. Revenue in the professional sales service segment decreased $518 thousand, mainly due to lower equipment deliveries by our partner. We expect that deliveries of equipment will improve over the remainder of 2019. Revenue in the equipment segment decreased $26 thousand, or 3%, to $906 thousand year-over-year, due to lower sales of EECP® equipment.

Gross profit for the third quarter of 2019 increased 4% to $10.8 million, compared with a gross profit of $10.5 million for the third quarter of 2018. This increase is primarily the result of an increase in revenue in the IT segment where gross profit increased $632 thousand or 14% year-over-year. The IT segment had increased sales and higher gross margins in the network services as well as the healthcare IT VAR business. As the healthcare ITVAR business continues to improve, we anticipate further growth in this segment. Gross profit decreased in the professional sales service and equipment segments in the third quarter 2019 compared to the same period in 2018, by $193 thousand and $49 thousand, respectively, due to lower sales.

SG&A expenses for the third quarter of 2019 decreased 6% to $9.8 million compared to $10.5 million for the same quarter of 2018. The decrease is primarily attributable to decreases in personnel and other costs in the professional sales service and IT segments, resulting from the cost reduction program the Company initiated in the fourth quarter 2018. We anticipate these costs reduction initiatives will result in significant cost savings for the full year 2019.

Research and development costs decreased 15% to $196 thousand in the third quarter of 2019 compared to the same period in 2018, due to lower software development costs in the equipment segment.

Net income for the three months ended September 30, 2019 was $562 thousand, compared to a net loss of $377 thousand for the third quarter of 2018. The improvement of $939 thousand is primarily the result of the increase in revenue and gross profit in the IT segment and the decrease in SG&A costs for the quarter. We expect continued improvement in performance for the remainder of 2019, as we anticipate an increase in equipment deliveries in the professional sales service segment, continued growth in the IT segment, and improved operating results as an effect of our cost reduction initiatives.

Net cash used in operating activities was $2.1 million in the nine months ended September 30, 2019, compared to net cash used in operating activities of $1.5 million for the same period in 2018. Cash and cash equivalents at September 30, 2019 was $1.3 million, compared to $2.7 million at December 31, 2018.

Total deferred revenue remains substantial, at approximately $17.9 million as of September 30, 2019, which will be recognized in the future when the underlying equipment or services are delivered and accepted at the customer site. Our shareholders’ equity decreased to $2.6 million as of September 30, 2019 from $5.6 million as of December 31, 2018. Shareholders’ equity at September 30, 2019 increased as compared to shareholders’ equity at June 30, 2019, as a result of the positive net income in the third quarter.

We have incurred net losses from operations for the years ended December 31, 2018 and 2017 and for the nine months ended September 30, 2019. We maintain lines of credit from a lending institution which will require further extensions after their current December 18, 2019 maturity date, as well as other notes payable that mature within twelve months from September 30, 2019. Our ability to continue operating as a going concern is dependent upon achieving profitability, extending the maturity date of our existing lines of credit and notes payable, or through additional debt or equity financing.

About Vaso

Vaso Corporation is a diversified medical technology company with several distinctive but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for diagnostic imaging products; and design, manufacture and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

- VasoTechnology, Inc. provides network and IT services through two business units: VasoHealthcare IT Corp., a national value added reseller of Radiology Information System (“RIS”), Picture Archiving and Communication System (“PACS”), and other software solutions from GEHC Digital and other vendors as well as related services, including implementation, management and support; and NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers.

- Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE Healthcare diagnostic imaging products in certain market segments in the USA.

- VasoMedical, Inc. manages and coordinates the design, manufacture and sales of EECP® Therapy Systems and other medical equipment operations, as well as operates the Company’s overseas assets including China-based subsidiaries.

Additional information is available on the Company’s website at www.vasocorporation.com.

Summarized Financial Information

Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “optimistic”, “plans”, “potential” and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreements; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; unexpected manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.

Vaso Corporation Announces Financial Results for Second Quarter 2019

Plainview, NY, August 14, 2019 – Vaso Corporation (“Vaso”) (OTCMKTS: VASO) today reported its operating results for the three months ended June 30, 2019.

“The Company’s total revenue for the second quarter of 2019 was $17.5 million, a 5% decrease when compared to revenue for the same quarter of 2018, resulting from a lower volume of equipment delivery during the quarter by our partner in our professional sales service segment. Our IT and equipment segments, on the other hand, enjoyed year-over-year quarterly revenue growths of 7% and 11%, respectively. We remain optimistic about continued growth in the IT and equipment segments and improved deliveries of underlying equipment in the professional sales service segment in the third and fourth quarters of 2019,” commented Dr. Jun Ma, President and CEO of the Company.

“The cost cutting effort we initiated at the end of 2018 has yielded a substantial decrease in selling, general and administrative (“SG&A”) costs, by 9%, in the first half of 2019 when compared to the first half of 2018. We also are implementing additional measures to further integrate and streamline operations to improve performance and efficiency. While it takes time for these measures to fully reveal the intended outcomes, we believe the Company will demonstrate substantially improved financial results by year end,” concluded Dr. Ma.

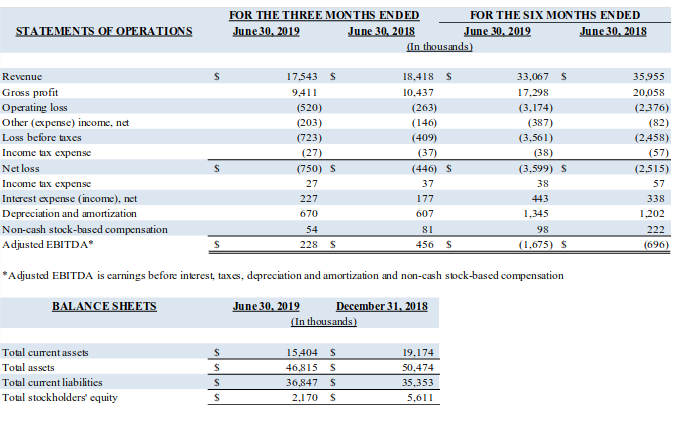

Financial Results for Three Months Ended June 30, 2019

For the three months ended June 30, 2019, revenue decreased by 5% to $17.5 million from $18.4 million for the same period of 2018, resulting from a decrease of $1.7 million in our professional sales service segment revenue, mainly due to lower equipment deliveries by our partner. We expect that deliveries of equipment will improve over the remainder of 2019. Quarterly revenue in our IT and equipment segments increased year-over-year, by $701,000 or 7% and $96,000 or 11%, respectively.

Gross profit for the second quarter of 2019 decreased 10% to $9.4 million, compared with a gross profit of $10.4 million for the second quarter of 2018. This decrease is primarily the result of the decrease in revenue as

discussed above, compounded by a lower gross profit margin in the quarter compared to a year ago.

SG&A expenses for the second quarter of 2019 decreased 7% to $9.7 million compared to $10.4 million for the same quarter of 2018. The decrease is primarily attributable to decreases in personnel and other costs in the

professional sales service and IT segments, resulting from the cost reduction program the Company initiated in the fourth quarter 2018. We anticipate these costs reduction initiatives will result in significant cost savings for the full year 2019.

Research and development costs decreased 10% to $228 thousand in the second quarter of 2019 compared to the same period in 2018, due to lower software development costs in the equipment segment.

Net loss for the three months ended June 30, 2019 was $750 thousand, compared to a net loss of $446 thousand for the second quarter of 2018. The increase in the loss is principally due to the decrease in revenue in the

professional sales service segment. We expect an improvement in performance for the remainder of 2019, as we anticipate an increase in equipment deliveries in the professional sales service segment and improved operating results as an effect of our cost reduction initiatives.

Net cash used in operating activities was $2.4 million in the six months ended June 30, 2019, compared to net cash used in operations of $2.2 million for the same period in 2018. Cash and cash equivalents at June 30, 2019 was $1.0 million, compared to $2.7 million at December 31, 2018.

Total deferred revenue remains substantial, at approximately $17.6 million as of June 30, 2019, which will be recognized in the future when the underlying equipment or services are delivered and accepted at the customer site. Our shareholders’ equity decreased to $2.2 million as of June 30, 2019 from $5.6 million as of December 31, 2018.

We have incurred net losses from operations for the years ended December 31, 2018 and 2017 and for the six months ended June 30, 2019. We maintain lines of credit from a lending institution which will require further extensions after their current December 18, 2019 maturity date; as well as other notes payable that mature within twelve months from June 30, 2019. Our ability to continue operating as a going concern is dependent upon

achieving profitability, extending the maturity date of our existing lines of credit and notes payable, or through additional debt or equity financing.

About Vaso

Vaso Corporation is a diversified medical technology company with several distinctive but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for diagnostic imaging products; and design, manufacture and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

• VasoTechnology, Inc. provides network and IT services through two business units: VasoHealthcare IT Corp., a national value added reseller of Radiology Information System (“RIS”), Picture Archiving and Communication System (“PACS”), and other software solutions from GEHC Digital and other vendors as well as related services, including implementation, management and support; and NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers.

• Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE Healthcare diagnostic imaging products in certain market segments in the USA.

• VasoMedical, Inc. manages and coordinates the design, manufacture and sales of EECP® Therapy Systems and other medical equipment operations, as well as operates the Company’s overseas assets including China-based subsidiaries Biox Instruments Co. Ltd. and Life Enhancement Technology Limited.

Additional information is available on the Company’s website at www.vasocorporation.com.

Summarized Financial Information

Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “optimistic”, “plans”, “potential” and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreements; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; unexpected manufacturing or supplier problems; unforeseen difficulties and delays in the conduct of clinical trials and other product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.

Vaso Corporation Announces Financial Results for Second Quarter 2018

PLAINVIEW, N.Y. August 14, 2018 – Vaso Corporation (“Vaso”) (OTCMKTS: VASO) today reported its operating results for the three months ended June 30, 2018.

“The Company recorded a total revenue of $18.4 million and $36.0 million for the second quarter and first half of 2018, respectively, representing a growth rate of 3% and 5% from the same periods of the previous year. All three business segments of the Company contributed to the year-to-date revenue growth, led by IT segment’s 7% increase year-over-year,” commented Dr. Jun Ma, President and Chief Executive Officer of Vaso Corporation. “We also saw significant improvement in the bottom-line numbers for both three- and six-month periods of the year as well, and we expect the trend to continue for the balance of the year as deferred revenue in our professional sales service segment and order backlog in the healthcare IT VAR operations are turning into revenues upon delivery of underlying goods and services.”

“Therefore, we anticipate revenues to continue to grow as well as significantly improved financial results for fiscal 2018,” concluded Dr. Ma.

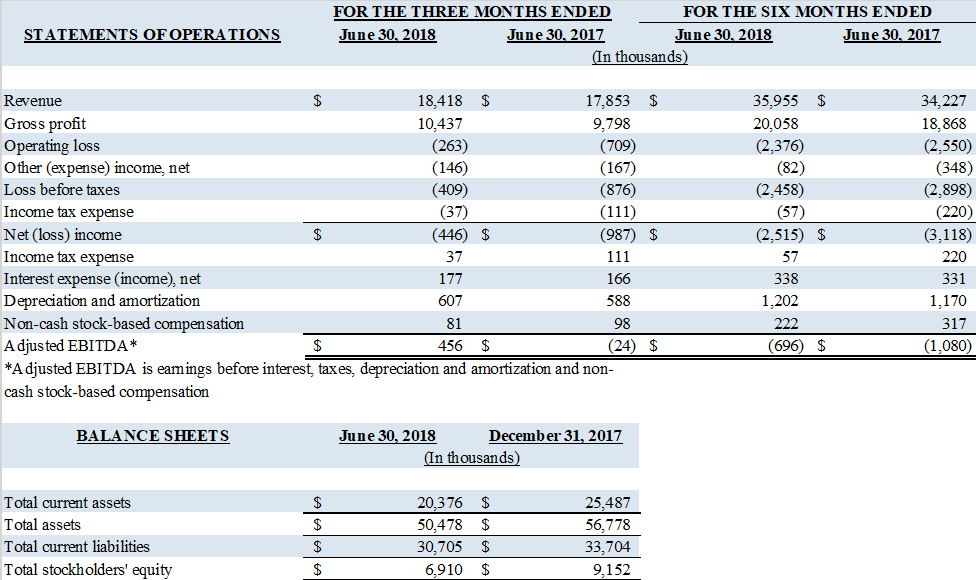

Financial Results for Three Months Ended June 30, 2018

For the three months ended June 30, 2018, revenue increased 3% to $18.4 million from $17.9 million for the same period of 2017, due to the increase of $0.8 million, or 13%, in commission revenue in our professional sales service segment as a result of higher volume of equipment deliveries by our partner, offset slightly by the lower volume of equipment sales in our equipment segment and a 1% decrease in revenue in our IT segment.

Gross profit for the second quarter of 2018 increased 7% to $10.4 million, compared with a gross profit of $9.8 million for the second quarter of 2017. This increase is primarily the result of the 15% increase in gross profit in the professional sales service segment resulting from the increase in revenue, and an increase of 2% in the IT segment as margins improved in this segment, partially offset by lower gross profit in the equipment segment.

Selling, general and administrative (SG&A) expenses for the second quarter of 2018 increased 2% to $10.4 million compared to $10.2 million for the second quarter of 2017. The increase is primarily attributable to an increase in personnel costs in the IT segment, partially offset by decreases in the professional sales service and equipment segments.

Research and development costs decreased 3% to $252 thousand in the second quarter of 2018 compared to the same quarter of 2017, principally due to lower software development costs in the IT segment.

Net loss for the three months ended June 30, 2018 was $446 thousand, an improvement of $541 thousand when compared with a net loss of $987 thousand for the three months ended June 30, 2017.

Net cash used in operating activities was $2.2 million for the six months ended June 30, 2018, compared to cash provided from operations of $1.4 million for the same period in 2017. The decrease was principally due to the decrease in deferred revenue in the professional sales service segment. Net cash at June 30, 2018 was $3.2 million, compared to $5.2 million at December 31, 2017.

Deferred revenue remains substantial, at approximately $20.2 million as of June 30, 2018, compared to $23.1 million at December 31, 2017, which will be recognized in the future when the underlying equipment or services are delivered and accepted at the customer site. Our shareholders’ equity decreased to $6.9 million as of June 30, 2018 from $9.2 million as of December 31, 2017.

About Vaso

Vaso Corporation is a diversified medical technology company with several distinctive but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for diagnostic imaging products; and design, manufacture and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

• VasoTechnology, Inc. provides network and IT services through two business units: VasoHealthcare IT Corp., a national value added reseller of Radiology Information System (“RIS”), Picture Archiving and Communication System (“PACS”), and other software solutions from GEHC Digital and other vendors as well as related services, including implementation, management and support; and NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers.

• Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE Healthcare diagnostic imaging products in certain market segments in the USA.

• VasoMedical, Inc. manages and coordinates the design, manufacture and sales of EECP® Therapy Systems and other medical equipment operations, as well as operates the Company’s overseas assets including China-based subsidiaries Biox Instruments Co. Ltd. and Life Enhancement Technology Limited.

Additional information is available on the Company’s website at www.vasocorporation.com.

Summarized Financial Information

Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “optimistic”, “plans”, “potential” and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreements; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; unexpected manufacturing or supplier problems; unforeseen difficulties and delays in the conduct of clinical trials and other product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.

Vaso Corporation Announces Financial Results for First Quarter 2018

PLAINVIEW, N.Y. May 15, 2018 – Vaso Corporation (“Vaso”) (OTCMKTS: VASO) today reported its operating results for the three months ended March 31, 2018.

“The Company’s revenue increased by $1.2 million, or 7%, in the first quarter of 2018 when compared to the same quarter of the prior year, led by a 16% year-over-year quarterly revenue growth in the information technology, or IT, segment, continuing the upward trend in this segment,” stated Dr. Jun Ma, President and Chief Executive Officer of Vaso Corporation. “Our equipment segment also contributed to the improvement in total revenue and gross profit, but we continued to experience slow equipment delivery by our partner in the professional sales services segment. This has resulted in a decrease in commission revenue for the quarter in the segment since we only recognize revenue upon delivery and acceptance of the underlying equipment. Therefore, at the end of the first quarter, deferred revenue in the segment increased 8% from a year ago to $20.3 million, of which $15.2 million was short-term, as compared to $9.1 million a year ago, a strong indication that equipment deliveries will be accelerated in the following quarters.”

“As we expect continued growth and improved performance in our IT and equipment segments, and anticipate higher equipment delivery volume in the professional sales service segment, we remain optimistic about the Company’s future profitability and financial position,” concluded Dr. Ma.

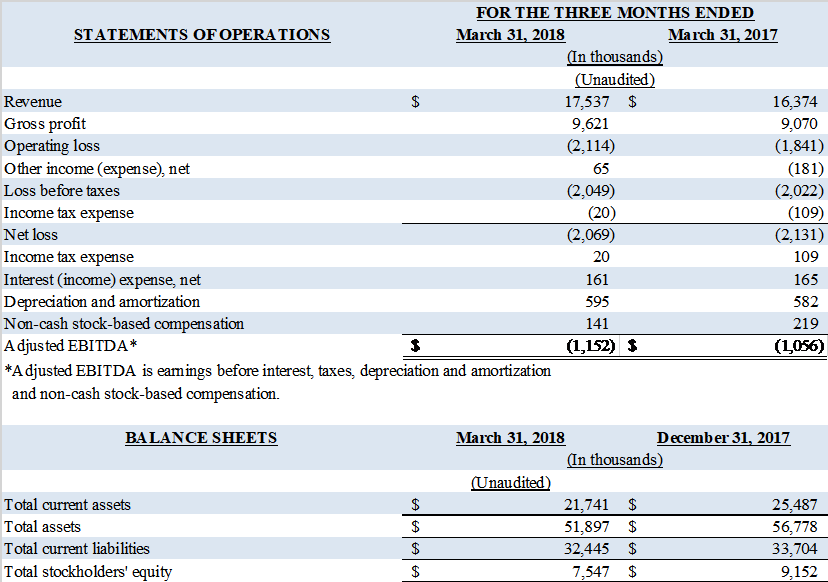

Financial Results for Three Months Ended March 31, 2018

For the three months ended March 31, 2018, revenue grew by 7% to $17.5 million from $16.4 million from the same period of 2017, resulting from an increase of $1.6 million in our IT segment revenue and an increase of $0.2 million in our equipment segment revenue, offset by a decrease of $0.7 million in our professional sales service segment due to a decrease in delivery of underlying equipment by our partner. We expect that deliveries will improve over the remainder of 2018.

Gross profit for the first quarter of 2018 increased 6% to $9.6 million, compared with a gross profit of $9.1 million for the first quarter of 2017. This increase is primarily the result of the increase in revenue in the IT and equipment segments, partially offset by a decrease in gross profit in the professional sales services segment.

Selling, general and administrative (SG&A) expenses for the first quarter of 2018 increased 8% to $11.5 million compared to $10.7 million for the first quarter of 2017. The increase is primarily attributable to an increase in personnel costs in the professional sales service and IT segments.

Research and development costs decreased 15% to $187 thousand in the first quarter of 2018 compared to the first quarter of 2017, due to a decrease in software development costs.

Net loss for the three months ended March 31, 2018 was $2.1 million, representing a year-over-year improvement of $62 thousand.

Net cash use in operating activities was $0.5 million in the first quarter of 2018 compared to net cash provided by operations of $0.7 million for the three months ended March 31, 2017. Cash and cash equivalents at March 31, 2018 was $5.8 million, compared to $5.2 million at December 31, 2017.

Total deferred revenue remains substantial, at approximately $21.3 million as of March 31, 2018, which will be recognized in the future when the underlying equipment or services are delivered and accepted at the customer site. Our shareholders’ equity decreased to $7.5 million as of March 31, 2018 from $9.2 million as of December 31, 2017.

About Vaso

Vaso Corporation is a diversified medical technology company with several distinctive but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for diagnostic imaging products; and design, manufacture and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

- VasoTechnology, Inc. provides network and IT services through two business units: VasoHealthcare IT Corp., a national value added reseller of Radiology Information System (“RIS”), Picture Archiving and Communication System (“PACS”), and other software solutions from GEHC Digital and other vendors as well as related services, including implementation, management and support; and NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers.

- Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE Healthcare diagnostic imaging products in certain market segments in the USA.

- VasoMedical, Inc. manages and coordinates the design, manufacture and sales of EECP® Therapy Systems and other medical equipment operations, as well as operates the Company’s overseas assets including China-based subsidiaries Biox Instruments Co. Ltd. and Life Enhancement Technology Limited.

Additional information is available on the Company’s website at www.vasocorporation.com.

Summarized Financial Information

Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “optimistic”, “plans”, “potential” and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreements; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; unexpected manufacturing or supplier problems; unforeseen difficulties and delays in the conduct of clinical trials and other product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.

Vaso Corporation Names Jane Moen as President of VasoHealthcare

PLAINVIEW, N.Y. May 7, 2018 – Vaso Corporation (“Vaso”) (OTCMKTS: VASO) today announced the appointment of Jane Moen as President of Vaso Diagnostics, Inc. d/b/a/ VasoHealthcare, a wholly owned subsidiary of Vaso Corporation, effective June 1, 2018. VasoHealthcare has since July 1, 2010 been the exclusive representative for the sale of select GE Healthcare Diagnostic Imaging equipment as well as related finance and service products to specific market segments in the 48 contiguous states of the United States and the District of Columbia. GE Healthcare (“GEHC”) is the healthcare business of General Electric Company (NYSE:GE).

Ms. Moen is succeeding Shawl Lobree, who is stepping down from the position for personal reasons but will remain as an advisor to VasoHealthcare. An accomplished professional in the healthcare sales arena for 15 years including more than 10 years in diagnostic imaging equipment sales, Ms. Moen has attained great achievements in many aspects of the business such as sales generation, team management, as well as coordination with OEM partner for products, marketing and training, etc., and has proven to be not only a great talent but also a skillful executive. She has been with VasoHealthcare since its inception in 2010 and has risen through the ranks of Account Manager, Regional Manager, Director of Product Business Line, and is currently Vice President of National Sales. Prior to that, she held sales positions at various companies including Ledford Medical, Vital Signs, Pfizer, and EcoLab.

“I am extremely honored to be selected to lead this outstanding team of medical sales professionals at VasoHealthcare, and I really appreciate the trust and confidence of Vaso leadership,” stated Ms. Moen upon accepting the position. “With the best-in-class organization we have built at VasoHealthcare in the last several years, I look forward to continuing the legacy and success to further grow the business with our partner GE Healthcare.”

“We are fortunate to have had Shawl Lobree, an exceptional industry veteran, leading the VasoHealthcare team in the last two and a half years, during which time he has brought the organization to a new level of performance,” commented Dr. Jun Ma, President and CEO of Vaso Corporation. In congratulating Ms. Moen’s promotion to President of VasoHealthcare, Dr. Ma further stated, “Jane’s track record, especially her career path with VasoHealthcare, exemplifies the Company’s belief that success of a business is ultimately reflected in the success of its employees. I am confident that Jane will continue the success of her predecessors and take the organization to yet another level.”

About Vaso

Vaso Corporation is a diversified medical technology company with several distinctive but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for diagnostic imaging products; and design, manufacture and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

- VasoTechnology, Inc. provides network and IT services through two business units: VasoHealthcare IT Corp., a national value added reseller of Radiology Information System (“RIS”), Picture Archiving and Communication System (“PACS”), and other software solutions from GEHC Digital and other vendors as well as related services, including implementation, management and support; and NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers.

- Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE Healthcare diagnostic imaging products in certain market segments in the USA.

- VasoMedical, Inc. manages and coordinates the design, manufacture and sales of EECP® Therapy Systems and other medical equipment operations, as well as operates the Company’s overseas assets including China-based subsidiaries Biox Instruments Co. Ltd. and Life Enhancement Technology Limited.

Additional information is available on the Company’s website at www.vasocorporation.com.

Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “plans”, “potential” and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreements; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; unexpected manufacturing or supplier problems; unforeseen difficulties and delays in the conduct of clinical trials and other product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.