Vaso Corporation Announces Financial Results for First Quarter 2022

Revenue and Profitability Continued to Improve Year-over-year

PLAINVIEW, NY / May 16, 2022 / Vaso Corporation (“Vaso”) (OTC PINK:VASO) today reported its operating results for the three months ended March 31, 2022.

“For first quarter of 2022, the Company recorded a total revenue of $17.0 million, up by 3.0% from $16.5 million for the same quarter in the prior year. Quarterly gross profit reached $9.8 million, up by 14.1% year-over-year, as gross profit margin also increased significantly. Operating loss for the quarter decreased by 34.3% year-over-year to $0.4 million, making it the best first quarter in the Company’s recent history,” commented Dr. Jun Ma, President and Chief Executive Officer of Vaso Corporation. “Again, due to the cyclic nature of our businesses, we often incur losses in the beginning quarters of the year and record high revenue and profit in the later quarters, especially the fourth quarter. Therefore, we are excited to see a strong head start for the fiscal year of 2022.”

“The Company continues to maintain a strong balance sheet as well. Specifically, total deferred revenue as of March 31, 2022 reached a historical high of $27.0 million, representing an $8.5 million increase from March 31, 2021; as of May 6, 2022, cash and cash equivalents were $13.1 million. All these together provide a robust stage for continued profitability for the Company in 2022,” concluded Dr. Ma.

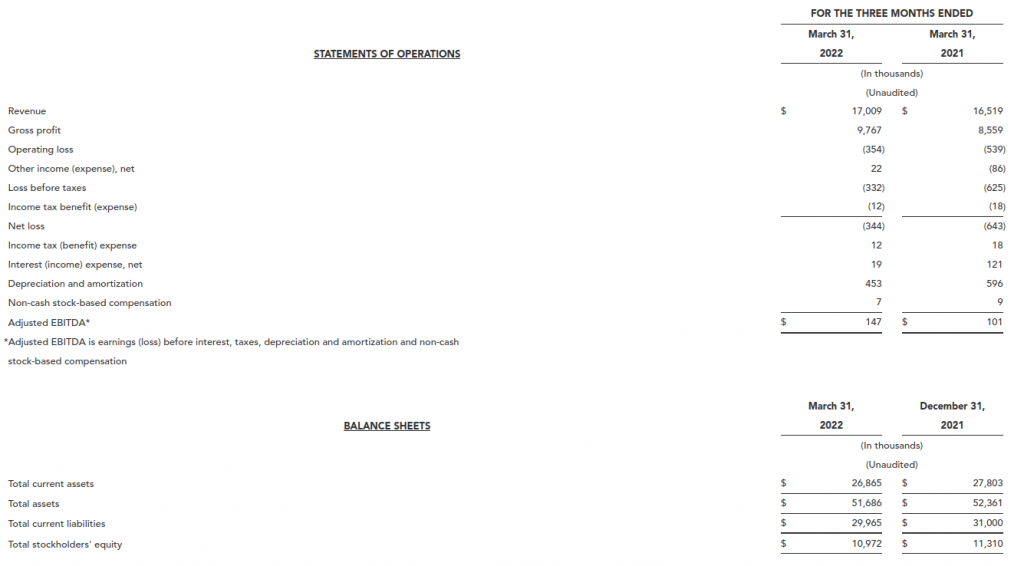

Financial Results for Three Months Ended March 31, 2022

For the three months ended March 31, 2022, revenue increased by 3.0% to $17.0 million from $16.5 million for the same period of 2021, due primarily to the increase of $2.0 million, or 41.9%, in revenue in our professional sales service segment as the result of higher equipment deliveries and a higher average commission rate during the quarter. Revenue in our IT segment decreased by $1.3 million, or 11.1%, in the first quarter 2022 when compared to the same quarter of 2021, due to lower revenue in the NetWolves business; and our equipment segment revenue decreased by $212 thousand, or 34.7%, when compared to the first quarter of 2021, principally due to lower equipment deliveries in our China operations as affected by COVID-19 lockdowns in the country.

Gross profit for the first quarter of 2022 increased by $1.2 million, or 14.1%, to $9.8 million, compared with a gross profit of $8.6 million for the same quarter of 2021. This increase was primarily the result of the increase in revenue in the professional sales service segment.

Selling, general and administrative (SG&A) expenses for the first quarter of 2022 increased by $1.0 million, or 11.7%, to $10.0 million, compared to the first quarter of 2021. The increase is primarily attributable to an increase in the costs of annual national sales meeting, which was held virtually last year, as well as travel and personnel costs. These meeting and travel costs were significantly lower in 2021 as a result of the COVID-19 pandemic.

Operating loss for the three months ended March 31, 2022 was $354 thousand, compared to an operating loss of $539 thousand in the first quarter 2021, representing an improvement of $185 thousand, or 34.3%, resulting from the increase in gross profit, partially offset by the increase in SG&A costs.

Net loss for the three months ended March 31, 2022 was $344 thousand, a significant improvement over the loss of $643 thousand for the first quarter of 2021.

Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization, and stock-based compensation) improved to $147 thousand for the quarter, compared to $101 thousand in the first quarter of 2021.

Net cash used in operating activities were $625 thousand for the first quarter 2022. compared to net cash provided from operations of $5.5 million during the first quarter of 2021. The change was mainly due to the late arrival of a large payment the Company has now received in April 2022. As of May 6, 2022, the Company’s net cash was approximately $13.1 million.

Summarized Financial Information

*Adjusted EBITDA is earnings before interest, taxes, depreciation and amortization and non-cash stock-based compensation

About Vaso

Vaso Corporation is a diversified medical technology company with several distinctive but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for diagnostic imaging products; and design, manufacture and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

- VasoTechnology, Inc. provides network and IT services through two business units: VasoHealthcare IT Corp., a national value added reseller of Radiology Information System (“RIS”), Picture Archiving and Communication System (“PACS”), and other software solutions from various vendors as well as related services, including implementation, management and support; and NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers.

- Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE Healthcare diagnostic imaging products in certain market segments in the USA.

- VasoMedical, Inc. manages and coordinates the design, manufacture and sales of proprietary medical equipment and software, as well as operates the Company’s overseas assets including China-based subsidiaries.

Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “optimistic”, “plans”, “potential” and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions, including the impact of the current COVID-19 pandemic; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreement; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; unexpected manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.

Investor Contact:

Michael J. Beecher

Investor Relations

Phone: 516-508-5840

Email: mbeecher@vasocorporation.com