Vaso Corporation Announces Financial Results for Fourth Quarter and Full Year of 2022

The Company Announces Record Annual Revenue and Profit

PLAINVIEW, NY / ACCESSWIRE / March 29, 2023 / Vaso Corporation (“Vaso”) (OTCQB:VASO) today announced its operating results for the three months and year ended December 31, 2022.

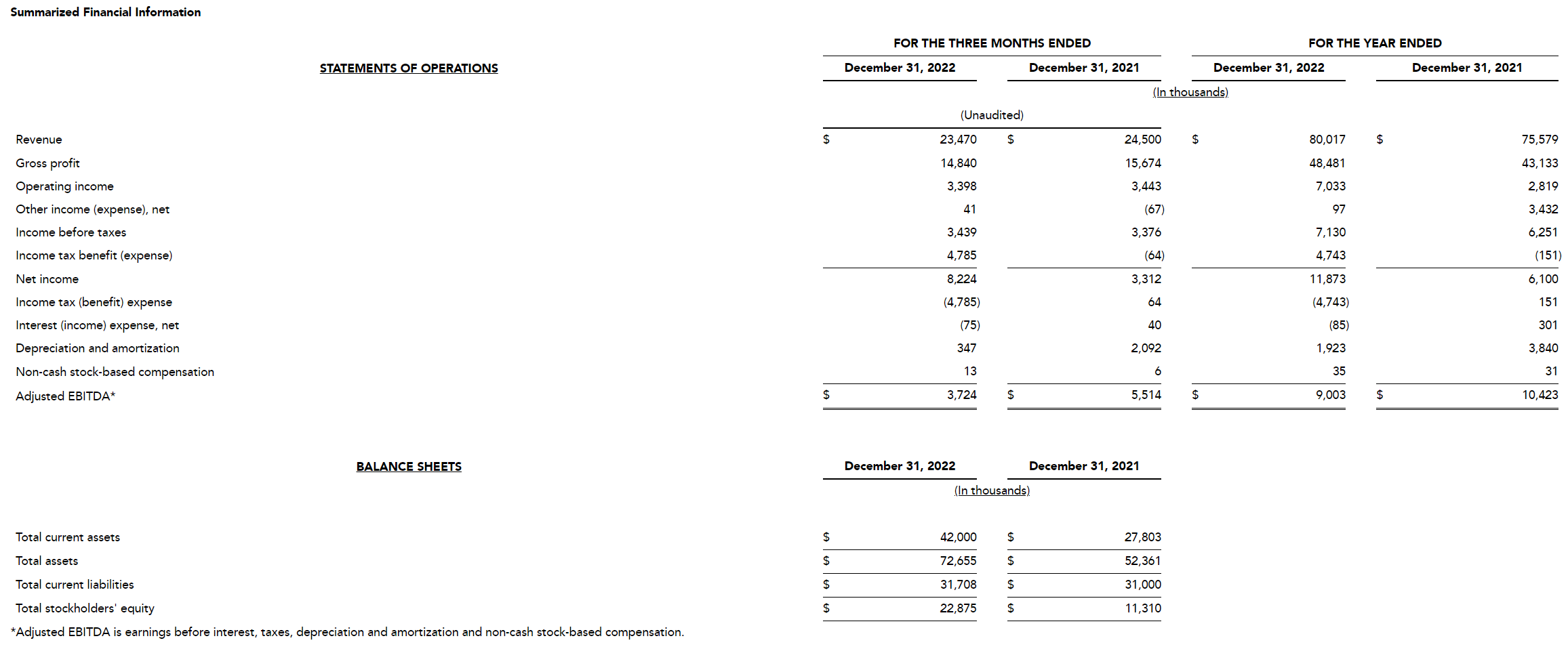

“The Company recorded annual revenue of $80.0 million in fiscal year 2022, a growth of 5.9% over the prior year, and achieved an annual operating income of $7.0 million, an increase of 149.5% year-over-year. Net income for the year also increased significantly, to $11.9 million from $6.1 million for 2021,” stated Dr. Jun Ma, President and Chief Executive Officer of Vaso Corporation. “We were able to deliver such continued improvements in the top- and bottom-line results thanks to the extraordinary performance of our professional sales service segment and improved operating results in our IT segment, despite the negative effect of last year’s COVID lockdowns in China that our equipment segment endured.”

“Our balance sheet remains strong, with $20.3 million of cash and short-term investments at the end of 2022 as a result of $14.4 million in operating cashflow generated during the year,” Dr. Ma continued. “Deferred revenue increased by $5.8 million in fiscal year 2022 to reach a historical high of $30.8 million as of December 31, 2022, which will turn into recognized revenue once the underlying products or services are delivered in future periods.”

“With a healthy financial position and a diversified business portfolio, management is optimistic about the Company’s performance going forward. Our IT segment has improved operating efficiency as it’s recovering from the impact of the COVID-19 pandemic; our professional sales service segment continues to outperform expectations and has expanded the scope of its partnership with GE HealthCare; and our equipment segment is starting to evolve from a pure product play to a more product-based service business. We would not be able to accomplish all these without our employees’ dedication and professionalism. On behalf of the board of directors, I want to thank them as well as our shareholders for their continued support,” concluded Dr. Ma.

Financial Results for Three Months Ended December 31, 2022

For the three months ended December 31, 2022, revenue decreased by 4.2% to $23.5 million from $24.5 million for the same period of 2021, due to lower revenues in all our business segments. Revenue in our IT segment decreased by $0.4 million, or 3.7%, to $10.2 million as the result of lower recurring services during the quarter; revenue in our equipment segment decreased by $0.5 million, or 39.1%, to $0.8 million due to lower equipment sales in China in the quarter; and revenue in our professional sales service segment decreased by $0.1 million, or 1.0%, to $12.4 million due to lower incentive revenue when compared to the prior year, partially offset by higher equipment deliveries. We anticipate that revenue will improve in all three business segments, as we expect growth from new business in the IT segment, growth in our professional sales service segment resulting from strong order bookings in 2022, and a recovery of our China operations from last year’s COVID lockdowns.

Gross profit for the fourth quarter of 2022 decreased by 5.3% to $14.8 million, compared with a gross profit of $15.7 million for the same quarter of 2021. This decrease was primarily the result of a decrease in revenue and the increase in commission expense in the professional sales service segment.

Selling, general and administrative (SG&A) expenses for the fourth quarter of 2022 increased by 2.9% to $11.3 million, compared to $10.9 million for the fourth quarter of 2021. The increase was primarily attributable to an increase in personnel and travel costs in the professional sales service segment, offset by a decrease in travel and other costs in the IT segment. SG&A expenses were 48.0% and 44.7% of revenue in the fourth quarter of 2022 and 2021, respectively.

Net income for the three months ended December 31, 2022 was $8.2 million, compared with a net income of $3.3 million for the three months ended December 31, 2021. The increase was primarily due to the recognition of a $4.8 million tax benefit resulting from a reduction in the reserve for deferred tax assets.

Financial Results for Year Ended December 31, 2022

For the year ended December 31, 2022, revenue increased by $4.4 million, or 5.9%, to $80.0 million when compared with $75.6 million of revenue for the year 2021. Revenue in our IT segment decreased by 6.6% to $40.1 million for the year 2022, from 2021 revenue of $42.9 million, primarily due to a decrease of revenue in the network services business. Commission revenues in our professional sales service segment increased by $7.9 million, or 26.8%, to $37.3 million in the year 2022, compared to $29.4 million in 2021, primarily as the result of higher equipment deliveries by our partner and higher blended commission rates for the equipment delivered during the year. Equipment segment revenue for the year 2022 decreased by 20.1% to $2.6 million, from $3.2 million in 2021, due to a decrease in product sales in our China operations and the effect of foreign exchange rates, partially offset by a small increase in U.S. sales.

Gross profit for the year ended December 31, 2022 increased by 12.4% to $48.5 million, from $43.1 million in 2021, as a result of the higher revenue as well as higher gross profit margin in 2022.

SG&A expenses for the year ended December 31, 2022 increased by $2.3 million, or 5.8%, to $40.8 million, or 51.0% of revenue, compared with $38.6 million, or 51.1% of revenue, for the same period in 2021. The increase resulted primarily from an increase of $2.2 million in personnel and travel costs in the professional sales service segment.

For the year ended December 31, 2022, the Company had net income of $11.9 million, $5.8 million greater than the net income of $6.1 million for the year ended December 31, 2021.

Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization, and share-based compensation) was $9.0 million for the year ended December 31, 2022, compared to Adjusted EBITDA of $10.4 million for the year ended December 31, 2021 which included $3.6 million of PPP loan and interest forgiveness the Company recognized as income in 2021.

Net cash provided from operating activities in 2022 was $14.4 million, compared to net cash provided from operating activities of $7.8 million in 2021. The increase is principally due to the increase in profitability. Net cash and short-term investments increased to $20.3 million at December 31, 2022, compared to $6.6 million at December 31, 2021. The increase is the net effect of the increase in cash from operating activities and lower debt service payments in 2022 compared to 2021.

Deferred revenue increased to $30.8 million at December 31, 2022, compared to $25.0 million at December 31, 2021. The increase is primarily the result of higher order bookings in the professional sales service segment. Deferred revenue will be recognized in the future when the underlying equipment or services are delivered and accepted at the customer site.

About Vaso

Vaso Corporation is a diversified medical technology company with several distinctive but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for diagnostic imaging products; and design, manufacture and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

- VasoTechnology, Inc. provides network and IT services through two business units: VasoHealthcare IT Corp., a national value added reseller of Radiology Information System (“RIS”), Picture Archiving and Communication System (“PACS”), and other software solutions from various vendors as well as related services, including implementation, management and support; and NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers.

- Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE Healthcare diagnostic imaging products in certain market segments in the USA.

- VasoMedical, Inc. manages and coordinates the design, manufacture and sales of proprietary medical equipment and software, as well as operates the Company’s overseas assets including China-based subsidiaries.

Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “optimistic”, “plans”, “potential” and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions, including the impact of the current COVID-19 pandemic; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreement; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; unexpected manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.

Investor Contact:

Michael J. Beecher

Investor Relations

Phone: 516-508-5840

Email: mbeecher@vasocorporation.com