Vaso Corporation Announces Financial Results for Third Quarter 2020

Net Profit for the Quarter Increased by 104% Year-over-Year

PLAINVIEW, N.Y. November 13, 2020 – Vaso Corporation (“Vaso”) (OTCMKTS: VASO) today reported its operating results for the three months ended September 30, 2020.

“Despite continued impediment to business by the COVID pandemic, which led to a 6% drop in quarterly revenue from a year ago, the Company recorded an operating income of $1.3 million for the third quarter of 2020, an increase of 56% when compared to the $0.8 million operating income for the same quarter last year. This is mainly a result of much lower selling, general and administrative (“SG&A”) costs, which during the quarter decreased by 14% year-over-year,” commented Dr. Jun Ma, President and CEO of the Company. “Net profit for the quarter was $1.1 million, representing an increase of 104% year-over-year. Year-to-date, we saw a $2.2 million improvement to the bottom line from the prior year even when the top line was slightly down. The Company has also generated $4.7 million cash from operating activities for the nine months ended September 30, 2020, and maintains a healthy cash position as of today.”

“We remain cautiously optimistic about the current state of our businesses and are confident about the future of the Company. We are particularly encouraged by the performance of our professional sales service and equipment segments, which have shown significant improvements in the quarterly and year-to-date operating results even during this difficult year. We continue to be vigilant and stay ready for the recovery of the economy from the pandemic,” concluded Dr. Ma.

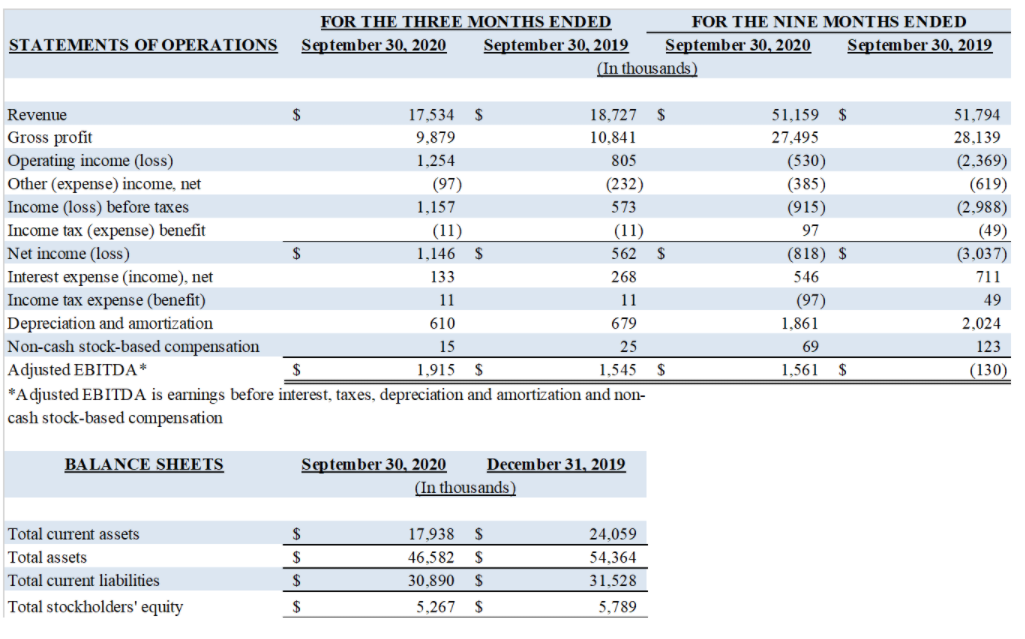

Financial Results for Three Months Ended September 30, 2020

For the three months ended September 30, 2020, revenue decreased $1.2 million, or 6%, to $17.5 million from $18.7 million for the same period of 2019, primarily due to the impact of the COVID-19 pandemic. Quarterly revenue in our IT segment decreased by $652 thousand or 6% year-over-year as both the healthcare IT business and network services business were affected by the pandemic. Revenue in the professional sales service segment decreased by $535 thousand, or 8% year-over-year, mainly due to lower equipment deliveries by our partner. Revenue in the equipment segment decreased by $6 thousand, or 0.7% year-over-year, mainly due to exclusion of EECP sales in the reporting, offset by an increase in the Biox equipment sales

Gross profit for the third quarter of 2020 decreased by 9% to $9.9 million, compared with a gross profit of $10.8 million for the third quarter of 2019. This decrease is primarily the result of a decrease in revenue in the IT and professional sales service segments due to the impact of the COVID-19 pandemic. In the IT segment gross profit decreased by $588 thousand or 12% year-over-year. Gross profit in the professional sales service segment decreased by $487 thousand or 9% year-over-year. Gross profit in the equipment segment increased $113 thousand, or 20% in the third quarter 2020 compared to the same period in 2019.

SG&A expenses for the third quarter of 2020 decreased by 14% to $8.5 million compared to $9.8 million for the same quarter of 2019. The decrease is primarily attributable to decreases in personnel and other costs in the IT segment and decreases in travel and related costs in the professional sales service and equipment segments.

Research and development costs decreased by 11% to $174 thousand in the third quarter of 2020 compared to the same period in 2019, primarily due to lower software development costs in the equipment segment

Net income for the three months ended September 30, 2020 was $1.1 million, compared to net income of $562 thousand for the third quarter of 2019. The increase of $584 thousand, or 104%, is primarily the result of the decrease in SG&A costs offset by the lower gross profit.

Net cash provided by operating activities was $4.7 million in the nine months ended September 30, 2020, compared to net cash used in operating activities of $2.1 million for the same period in 2019. Cash and cash equivalents at September 30, 2020 was $6.9 million, compared to $2.1 million at December 31, 201

Total deferred revenue remains substantial, at approximately $16.7 million as of September 30, 2020, which will be recognized in the future when the underlying equipment or services are delivered and accepted at the customer site. Our shareholders’ equity decreased to $5.3 million as of September 30, 2020 from $5.8 million as of December 31, 2019.

About Vaso

Vaso Corporation is a diversified medical technology company with several distinctive but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for diagnostic imaging products; and design, manufacture and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

- VasoTechnology, Inc. provides network and IT services through two business units: VasoHealthcare IT Corp., a national value added reseller of Radiology Information System (“RIS”), Picture Archiving and Communication System (“PACS”), and other software solutions from various vendors as well as related services, including implementation, management and support; and NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers.

- Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE Healthcare diagnostic imaging products in certain market segments in the USA

- VasoMedical, Inc. manages and coordinates the design, manufacture and sales of proprietary medical equipment and software, as well as operates the Company’s overseas assets including China-based subsidiaries.

Summarized Financial Information

Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “optimistic”, “plans”, “potential” and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions, including the impact of the current COVID-19 pandemic; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreement; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; unexpected manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments