Vaso Corporation Announces Financial Results for Third Quarter 2024

PLAINVIEW, N.Y., Nov. 14, 2024 (GLOBE NEWSWIRE) — Vaso Corporation (“Vaso”) (OTCQX: VASO), a leading medtech company with a diversified business portfolio in network and healthcare IT services, professional sales services, and proprietary medical products, today reported its operating results for the three months ended September 30, 2024.

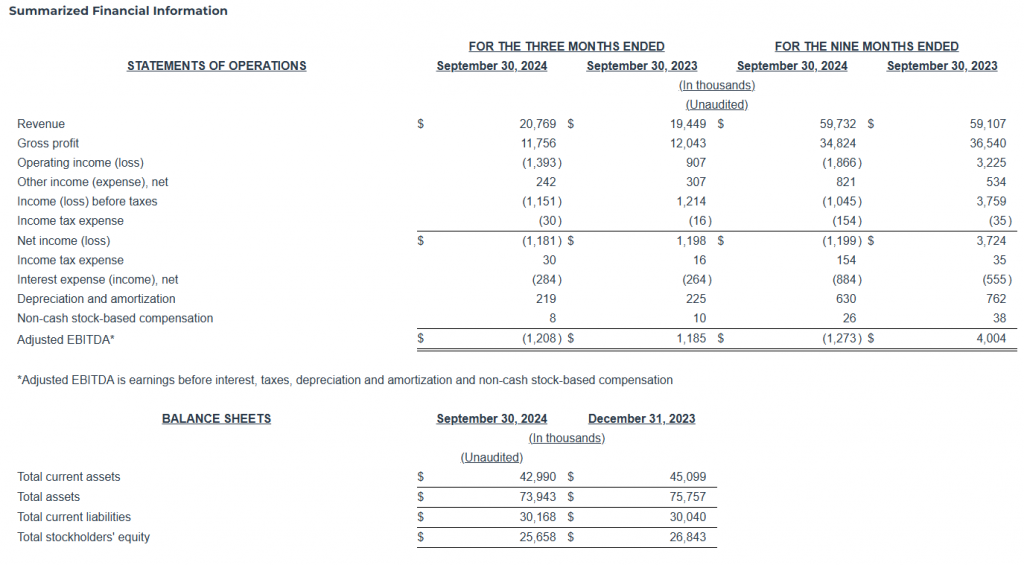

“For the third quarter of 2024, the Company’s revenue was $20.8 million, an increase of 7% when compared to the prior year’s third quarter revenue of $19.4 million, mainly due to higher revenue from the network services business in our IT segment. The Company recorded an operating loss of $1.4 million for the third quarter of 2024 compared to operating income of $907 thousand for the same quarter in 2023, as operating expenses increased including a significant amount in investment banking activities,” commented Dr. Jun Ma, President and Chief Executive Officer of Vaso Corporation.

“As the Company continues to generate positive operating cashflow, which was $3.6 million during the first nine months of the year, its balance sheet continues to be strong, with $26.8 million in cash, cash equivalents and short-term investments as of September 30, 2024. In addition, total deferred revenue increased by $1.4 million during the quarter to $33.1 million, which will be recognized as revenue in future reporting periods when the underlying products or services are delivered,” Dr. Ma continued.

“Our mission is to continue to grow our current business and revenue streams organically while working closely with our partners and customers across all our business segments. We are cautiously optimistic about the Company’s performance for the remainder of the year, as historically the fourth quarter has been the quarter with highest revenue and income of the year due to the cyclical nature of our business. As we approach yearend, we are focused on optimizing our strong business performance to seize new growth opportunities in 2025,” concluded Dr. Ma.

Financial Results for Three Months Ended September 30, 2024

Total revenue for the three months ended September 30, 2024 was $20.8 million, representing an increase of 7% from revenue of $19.4 million for the same period in the prior year. On a segment basis, revenue in the professional sales services segment increased $0.3 million, or 3%, year-over-year, mainly as a result of higher volume of underlying equipment delivered by our partner and higher commission rates on these deliveries; revenue in the IT segment increased $1.2 million, or 12%, compared to the third quarter of 2023, principally due to higher network services revenue; while revenue in the equipment segment decreased $172,000, or 23%, due mainly to lower ARCS® software sales.

Gross profit for the three months ended September 30, 2024 decreased by $287 thousand, or 2%, to $11.8 million, from $12.0 million for the third quarter of 2023. This decrease was mainly due to product mix with lower margins in the IT and equipment segments.

Selling, general and administrative (SG&A) expenses for the third quarter of 2024 increased by 5% to $11.4 million when compared to the third quarter of 2023. The increase is primarily attributable to higher personnel costs in the professional sales services segment due to an expansion of services for our partner as compared to 2023, and an increase in personnel costs in the IT segment.

Net loss for the three months ended September 30, 2024 was $1.2 million, compared to net income of $1.2 million for the three months ended September 30, 2023. The principal cause of the net loss was the costs incurred for the business combination of $1.5 million and the increase in SG&A costs.

Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization, and non-cash stock-based compensation) was negative $1.2 million for the quarter ended September 30, 2024, compared to positive $1.2 million for the third quarter of 2023. The decrease is the result of the decrease in net income.

Net cash provided by operating activities in the first nine months of 2024 was $3.6 million, compared to $6.9 million for the same period in 2023. As of September 30, 2024 and December 31, 2023, the Company had cash, cash equivalents and short term investments of approximately $26.8 million and $25.3 million, respectively, an increase of $1.5 million.

About Vaso

Vaso Corporation is a diversified medical technology company with several distinctive but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for medical equipment; and design, manufacture, and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

- VasoTechnology, Inc. provides network and IT services through two business units: NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers; and VasoHealthcare IT Corp., a national value added reseller of Radiology Information System (“RIS”), Picture Archiving and Communication System (“PACS”), and other software solutions from various vendors as well as related services, including implementation, management and support.

- Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE HealthCare diagnostic imaging and ultrasound products in certain market segments in the USA.

- VasoMedical, Inc. manages and coordinates the design, manufacture and sales of proprietary medical equipment and software, as well as operates the Company’s overseas assets including China-based subsidiaries.

Additional information is available on the Company’s website at www.vasocorporation.com.

Investor Contacts

Investor Contact:

Michael J. Beecher

Investor Relations

Phone: 516-508-5840

Email: mbeecher@vasocorporation.com