Vaso Corporation Announces Financial Results for Fourth Quarter and Full Year for 2019

Plainview, NY, April 14, 2020 – Vaso Corporation (“Vaso”) (OTCMKTS: VASO) today reported its operating results for the three months and year ended December 31, 2019.

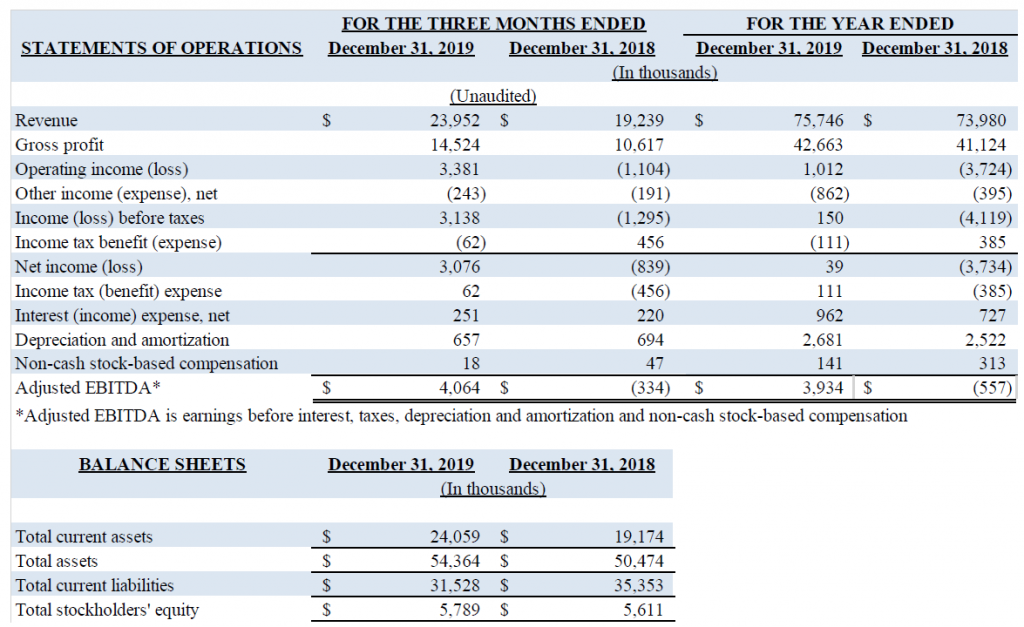

“The Company’s total revenue for fiscal 2019 reached $75.7 million, a record in its history, as sales in its IT and professional sales service segments grew 3.4% and 2.7%, respectively, from the prior year,”

commented Dr. Jun Ma, President and Chief Executive Officer of Vaso Corporation. “In addition, as a result of revenue growth and significant cost reduction, Vaso Corporation has returned to profitability

after two years of losses, with an operating income of $1.0 million for 2019, an improvement of $4.7 million when compared to an operating loss of $3.7 million in 2018.”

“Selling, general and administrative, or SG&A, costs went down by $3.1 million, or 7.1%, in 2019 when compared to 2018. We continue to watch business expenses while carefully executing our business strategy, especially in this time of uncertainty when the COVID-19 pandemic is impacting all aspects of life and business adversely,” concluded Dr. Ma.

Financial Results for Three Months Ended December 31, 2019

For the three months ended December 31, 2019, revenue increased 24.5% to $24.0 million from $19.2 million for the same period of 2018, due primarily to the increase of $4.7 million, or 70.5%, in revenue in

our professional sales service segment as the result of achieving certain performance goals and higher blended commission rates for the equipment delivered during the quarter. Revenue in our IT segment

increased 3.7%, to $11.5 million in the fourth quarter 2019, compared to the same quarter of 2018, while our equipment segment revenue decreased 25.5% to $1.1 million from $1.5 million for the fourth quarter

of 2018, due to lower sales of EECP products.

Gross profit for the fourth quarter of 2019 increased 36.8% to $14.5 million, compared with a gross profit of $10.6 million for the same quarter of 2018. This increase was primarily the result of the increase in revenue in the professional sales service and IT segments, partially offset by a decrease in gross profit in the equipment segment

Selling, general and administrative (SG&A) expenses for the fourth quarter of 2019 decreased 4.8% to $11.0 million, compared to $11.5 million for the fourth quarter of 2018. The decrease is primarily

Page 2 of 4 attributable to a decrease in personnel costs in the professional sales service and IT segments. SG&A expenses were 45.7% and 59.8% of revenue in the fourth quarter of 2019 and 2018, respectively.

Net income for the three months ended December 31, 2019 was $3.1 million, compared with a net loss of $0.8 million for the three months ended December 31, 2018.

Financial Results for Year Ended December 31, 2019

For the year ended December 31, 2019, revenue increased $1.8 million or 2.4% to $75.7 million when compared with $74.0 million for the year 2018. Revenue in our IT segment increased 3.4% to $45.7 million for the year 2019, from 2018 revenue of $44.2 million, primarily due to an increase of $1.6 million in the healthcare IT business, offset by a slight decrease in network service revenue. Commission revenues in our professional sales service segment increased by 2.7% to $26.2 million in the year 2019, compared to revenue of $25.5 million in 2018. The increase was the result of achieving certain performance goals

and higher blended commission rates for the equipment delivered during the year. Equipment segment revenue for the year 2019 decreased by 10.4% to $3.8 million, from $4.2 million in 2018, principally due to the decrease in EECP equipment sales and related service revenues.

Gross profit for the year ended December 31, 2019 increased 3.7% to $42.7 million, from $41.1 million in 2018, as a result of $1.1 million increase in the professional sales service segment gross profit and $642

thousand increase in the IT segment gross profit, both resulting from revenue growth in the segments, offset by a $225 thousand decrease in the equipment segment gross profit as a result of the lower revenues

in that segment.

SG&A expenses for the year ended December 31, 2019 decreased $3.1 million or 7.1% to $40.8 million, or 53.9% of revenue, compared with $44.0 million, or 59.4% of revenue, for the same period in 2018.

The decrease resulted primarily from a decrease in personnel and other costs in the professional sales service and IT segments, as well as a decrease in corporate expenses.

For the year ended December 31, 2019, the Company had net income of $39 thousand, compared with a net loss of $3.7 million for the year ended December 31, 2018.

Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization, and share-based compensation) was $3.9 million for the year ended December 31, 2019 compared to negative Adjusted

EBITDA of $0.6 million for the year ended December 31, 2018, an improvement of $4.5 million. The improvement was primarily the result of the net income in 2019 compared to the net loss in 2018.

Net cash used in operating activities was $1.3 million, compared to net cash used in operating activities of $1.5 million in 2018. The decrease is principally due to the increase in profitability and an increase in

deferred revenue, offset by an increase in accounts receivable. Net cash decreased to $2.1 million at December 31, 2019, compared to $2.7 million at December 31, 2018. The decrease in cash is the net effect of negative cash from operating and investing activities, offset by an increase in net borrowings. As of March 31, 2020, the Company’s net cash was approximately $7.2 million.

Deferred revenue increased to $19.3 million at December 31, 2019, compared to $18.1 million at December 31, 2018. The increase is primarily the result of higher order bookings in the professional sales

service segment. The deferred revenue will be recognized in the future when the underlying equipment or services are delivered and accepted at the customer site. Our shareholders’ equity increased to $5.8 million

as of December 31, 2019 from $5.6 million as of December 31, 2018.

About Vaso

Vaso Corporation is a diversified medical technology company with several distinctive but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for diagnostic imaging products; and design, manufacture and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

• VasoTechnology, Inc. provides network and IT services through two business units: VasoHealthcare IT Corp., a national value added reseller of Radiology Information System (“RIS”), Picture Archiving and Communication System (“PACS”), and other software solutions from GEHC Digital and other vendors as well as related services, including implementation, management and support; and NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers.

• Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE Healthcare diagnostic imaging products in certain market segments in the USA.

• VasoMedical, Inc. manages and coordinates the design, manufacture and sales of EECP® Therapy Systems and other medical equipment operations, as well as operates the Company’s overseas assets including China-based subsidiaries Biox Instruments Co. Ltd. and Life Enhancement Technology Limited.

Additional information is available on the Company’s website at www.vasocorporation.com.

Summarized Financial Information

Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “optimistic”, “plans”, “potential” and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreements; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; unexpected manufacturing or supplier problems; unforeseen difficulties and delays in the conduct of clinical trials and other product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.