Vaso Corporation Announces Financial Results for Third Quarter 2023

Making it the sixth consecutive quarter of profitability

PLAINVIEW, NY / ACCESSWIRE / November 14, 2023 / Vaso Corporation (“Vaso”) (OTCQX:VASO) today reported its operating results for the three months ended September 30, 2023.

“For the third quarter of 2023, the Company’s revenue was $19.4 million, compared to the prior year’s third quarter revenue of $19.8 million. The slight decrease in revenue was mainly due to lower deliveries of underlying equipment during the quarter by our partner in the professional sales services segment. Net income for the quarter was $1.2 million, down from $2.3 million for the same quarter of 2022, as operating expenses increased due to investment in new programs and the impact of inflation,” commented Dr. Jun Ma, President and Chief Executive Officer of Vaso Corporation. “While we experienced year-over-year declines in quarterly revenue and profit following significant growth in previous periods, year-to-date results for the nine-month period ended September 30, 2023 remain solid; specifically, revenue increased by $3.0 million to $59.1 million, and net income increased by $0.5 million to $3.7 million, when compared to the corresponding nine months of 2022.”

“As the Company continues to generate positive operating cashflow, which was $6.9 million during the first nine months of the year, our balance sheet continues to be strong, with $26.9 million in cash, cash equivalents and short-term investments at the end of the third quarter, an increase of $8.2 million from a year before. Total deferred revenue as of September 30, 2023 maintained at a high level of $33.2 million, which will be recognized as revenue in the future reporting periods when the underlying products or services are delivered,” Dr. Ma continued.

“We are cautiously optimistic about the Company’s performance for the remainder of the year, as historically the fourth quarter has been the quarter with highest revenue and income of the year due to the cyclical nature of our business.” concluded Dr. Ma.

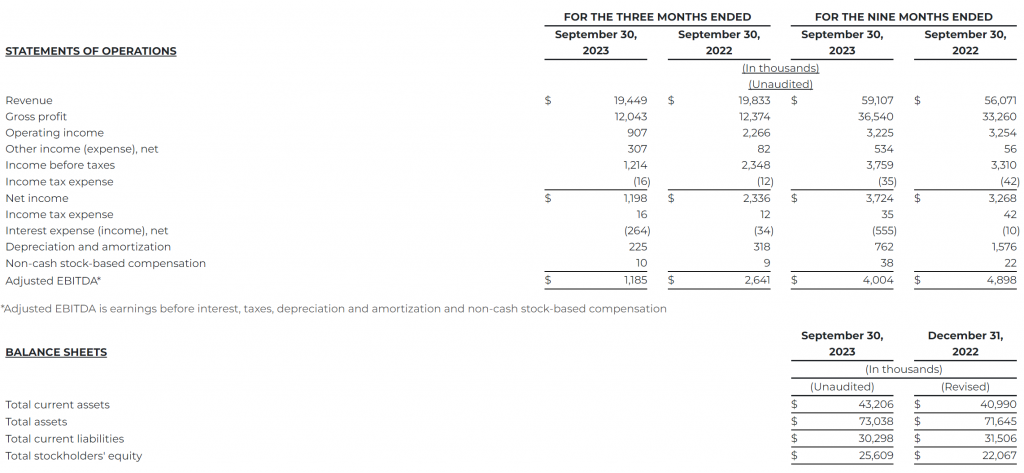

Financial Results for Three Months Ended September 30, 2023

Total revenue for the three months ended September 30, 2023 was $19.4 million, representing a slight decrease of 2% from revenue of $19.8 million for the same period in the prior year. On a segment basis, revenue in the professional sales services segment decreased $0.4 million or 4% year-over-year, mainly as a result of lower volume of underlying equipment delivered by our partner, partially offset by a higher blended commission rate during the period on those deliveries; revenue in the IT segment increased $31,000 compared to the third quarter of 2022, while revenue in the equipment segment decreased $15,000 or 2% due to lower equipment deliveries in our China operations, partially offset by a revenue increase in our US operations.

Gross profit for the three months ended September 30, 2023 decreased by $0.4 million, or 3%, to $12.0 million, from $12.4 million for the third quarter of 2022. This decrease was mainly due to the decrease in revenue in the professional sales services segment.

Selling, general and administrative (SG&A) expenses for the third quarter of 2023 increased by 10% to $10.9 million when compared to the third quarter of 2022. The increase is primarily attributable to higher personnel costs in the professional sales services segment as compared to 2022, due to an expansion of services for our partner.

Net income for the three months ended September 30, 2023 was $1.2 million, compared to net income of $2.3 million for the three months ended September 30, 2022. The principal cause of the decrease in net income is the decrease in gross profit and the increase in SG&A expenses discussed above.

Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization, adjusted for non-cash stock-based compensation) was $1.2 million for the quarter ended September 30, 2023, compared to $2.6 million for the third quarter of 2022. The decrease is the result of the decrease in net income.

Net cash provided by operating activities in the first nine months of 2023 was $6.9 million, compared to $12.7 million for the same period in 2022. As of September 30, 2023 and December 31, 2022, the Company had cash, cash equivalents and short term investments of approximately $26.9 million and $20.3 million, respectively, an increase of $6.6 million.

About Vaso

Vaso Corporation is a diversified medical technology company with several distinctive but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for diagnostic imaging products; and design, manufacture and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

- VasoTechnology, Inc. provides network and IT services through two business units: VasoHealthcare IT Corp., a national value added reseller of Radiology Information System (“RIS”), Picture Archiving and Communication System (“PACS”), and other software solutions from various vendors as well as related services, including implementation, management and support; and NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers.

- Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE Healthcare diagnostic imaging products in certain market segments in the USA.

- VasoMedical, Inc. manages and coordinates the design, manufacture and sales of proprietary medical equipment and software, as well as operates the Company’s overseas assets including China-based subsidiaries.

Summarized Financial Information

Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “optimistic”, “plans”, “potential” and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions, including the impact of the current COVID-19 pandemic; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreement; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; unexpected manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.

Investor Contact:

Michael J. Beecher

Investor Relations

Phone: 516-997-4600

Email: mbeecher@vasocorporation.com

Vaso Corporation Announces Upgrade to OTCQX Best Market from OTCQB Venture Market

PLAINVIEW, NY / September 25, 2023 / Vaso Corporation (“Vaso”) (OTCQB:VASO) today announced that its application to trade on the OTCQX Best Market has been approved by OTC Markets Group, with the beginning of trading on OTCQX expected to be on September 26, 2023.

The OTCQX Market provides investors with a premium U.S. public market to research and trade the shares of investor-focused companies. Graduating from OTCQB Venture Market, which the Company has been trading on for over 11 months, to the OTCQX Best Market marks an important milestone for our Company, enabling the Company to demonstrate its qualifications and build visibility among U.S. investors. To qualify for OTCQX, companies must meet high financial standards, follow best practice corporate governance, and demonstrate compliance with applicable securities laws.

“The OTCQX Best Market, the highest tier, is for established, investor-focused companies that are distinguished by the integrity of their operations and diligence with which they convey their qualifications. Vaso Corporation is pleased to be qualified to upgrade to this premium capital market. Trading on OTCQX should provide our shareholders and investors with better market visibility and potentially increase trading liquidity,” commented Dr. Jun Ma, President and CEO of Vaso Corporation. “Combined with our strong financial position, such a development could enhance shareholder value of our Company.”

More information regarding OTCQX eligibility requirements, etc. can be found on https://www.otcmarkets.com.

About Vaso

Vaso Corporation is a diversified medical technology company with several distinctive but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for diagnostic imaging products; and design, manufacture and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

- VasoTechnology, Inc. provides network and IT services through two business units: VasoHealthcare IT Corp., a national value added reseller of Radiology Information System (“RIS”), Picture Archiving and Communication System (“PACS”), and other software solutions from various vendors as well as related services, including implementation, management and support; and NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers.

- Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE Healthcare diagnostic imaging products in certain market segments in the USA.

- VasoMedical, Inc. manages and coordinates the design, manufacture and sales of proprietary medical equipment and software, as well as operates the Company’s overseas assets including China-based subsidiaries.

Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “optimistic”, “plans”, “potential” and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions, including the impact of the current COVID-19 pandemic; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreement; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; unexpected manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.

Investor Contact:

Michael J. Beecher

Investor Relations

Phone: 516-997-4600

Email: mbeecher@vasocorporation.com

Vaso Corporation Announces Financial Results for Second Quarter 2023

Company reports continued growth in revenue and record profitability

PLAINVIEW, NY / August 14, 2023 / Vaso Corporation (“Vaso”) (OTCQB:VASO) today reported its operating results for the three months ended June 30, 2023.

“For the quarter ended June 30, 2023, the Company recorded a total revenue of $20.4 million, representing a 5% growth from the same period last year, thanks to the great performance from all three of our business units,” commented Dr. Jun Ma, President and Chief Executive Officer of Vaso Corporation. “Gross profit for the quarter increased by 13% year-over-year, to $12.8 million, as a result of increased revenue and higher gross margin. Quarterly net income was also up significantly, to $2.1 million from prior year’s $1.5 million, making the quarter the most profitable second quarter in the history of the Company.”

“The Company continued to generate positive cashflow from operating activities, in the amount of $8.0 million during the second quarter of 2023. Furthermore, our balance sheet remains strong, with $26.1 million in cash, cash equivalents and short-term investments as of June 30, 2023, up from $15.9 million a year before, and total deferred revenue reached another historical high of $33.6 million at the end of second quarter,” Dr. Ma continued.

“We are very pleased with the operating results for the second quarter of the year, especially when the growth was from areas where we have spent resources to develop: our healthcare IT business in VasoTechnology, our new ultrasound sales program for GEHC in VasoHealthcare, and our ARCS® cloud-based software-as-a-service (SaaS) subscription program in VasoMedical. We continue to concentrate our efforts to maintain continued growth and profitability,” concluded Dr. Ma.

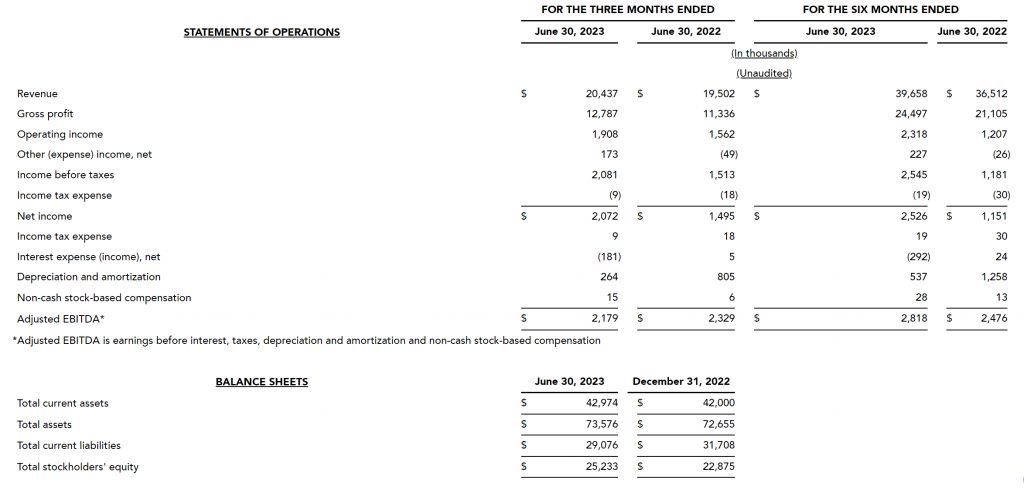

Financial Results for Three Months Ended June 30, 2023

For the three months ended June 30, 2023, total revenue increased 5% to $20.4 million from $19.5 million for the same period of 2022. Revenue in our IT segment increased by $416 thousand or 4% when compared to the second quarter of 2022, mostly because of growth in the healthcare IT business. Revenue in the professional sales service segment increased by $400 thousand or 5% when compared to the second quarter of 2022, due primarily to the new GEHC ultrasound sales program beginning in the second quarter of 2023. Revenue in the equipment segment increased by $119 thousand or 19% when compared to the same quarter of last year, due to higher sales of ARCS® cloud software subscription in the US and higher equipment deliveries in our China operations.

Gross profit for the second quarter of 2023 was $12.8 million, compared to $11.3 million for the same quarter of 2022, representing an increase of 13% year over year. This increase was primarily the result of the increase in revenue and higher gross margin for the period.

Selling, general and administrative (SG&A) expenses for the second quarter of 2023 increased 11% to $10.6 million, when compared to the second quarter of 2022. The increase is primarily attributable to additional headcount for the new GEHC ultrasound sales program and higher travel and personnel costs in the professional sales service segment and higher personnel costs in the China operations, partially offset by a decrease in expenses in the IT segment.

Net income for the three months ended June 30, 2023 was $2.1 million, compared to net income of $1.5 million in the second quarter 2022, representing an increase of $577 thousand, or 39%.

Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization and non-cash stock-based compensation) was $2.2 million for the three months ended June 30, 2023, compared to $2.3 million for the same period a year ago.

Net cash provided by operating activities in the first six months of 2023 was $6.0 million, compared to cash provided by operations of $9.7 million for the same period in 2022. As of June 30, 2023 and December 31, 2022, the Company had cash, cash equivalents and short-term investments of approximately $26.1 million and $20.3 million, respectively.

About Vaso

Vaso Corporation is a diversified medical technology company with several distinctive but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for diagnostic imaging products; and design, manufacture and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

- VasoTechnology, Inc. provides network and IT services through two business units: VasoHealthcare IT Corp., a national value added reseller of Radiology Information System (“RIS”), Picture Archiving and Communication System (“PACS”), and other software solutions from various vendors as well as related services, including implementation, management and support; and NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers.

- Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE Healthcare diagnostic imaging products in certain market segments in the USA.

- VasoMedical, Inc. manages and coordinates the design, manufacture and sales of proprietary medical equipment and software, as well as operates the Company’s overseas assets including China-based subsidiaries.

Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “optimistic”, “plans”, “potential” and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions, including the impact of the current COVID-19 pandemic; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreement; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; unexpected manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.

Investor Contact:

Michael J. Beecher

Investor Relations

Phone: 516-997-4600

Email: mbeecher@vasocorporation.com

Vaso Corporation Announces Financial Results for First Quarter 2023

Revenue and Profitability Continued to Improve Year-over-year

PLAINVIEW, NY / May 15, 2023 / Vaso Corporation (“Vaso”) (OTCQB:VASO) today reported its operating results for the three months ended March 31, 2023.

“The Company recorded a total revenue of $19.2 million for the first quarter of 2023, a growth of $2.2 million or 13.0% when compared to the same quarter last year. Quarterly gross profit reached $11.7 million, up by 19.9% year-over-year, as a result of higher revenue and higher gross profit margin,” stated Dr. Jun Ma, President and Chief Executive Officer of Vaso Corporation. “We have also achieved profitability in the first quarter of the year, with quarterly net income of $0.5 million versus prior year’s quarterly net loss of $0.3 million, which is particularly noteworthy as we usually incur losses in the early quarters of the year due to the seasonality of our businesses.”

“We were able to deliver these great results thanks to the revenue growth and improved operational efficiency in all three of our business units. As the Company’s balance sheet remains strong as well, the management is looking forward to another great year in 2023,” concluded Dr. Ma.

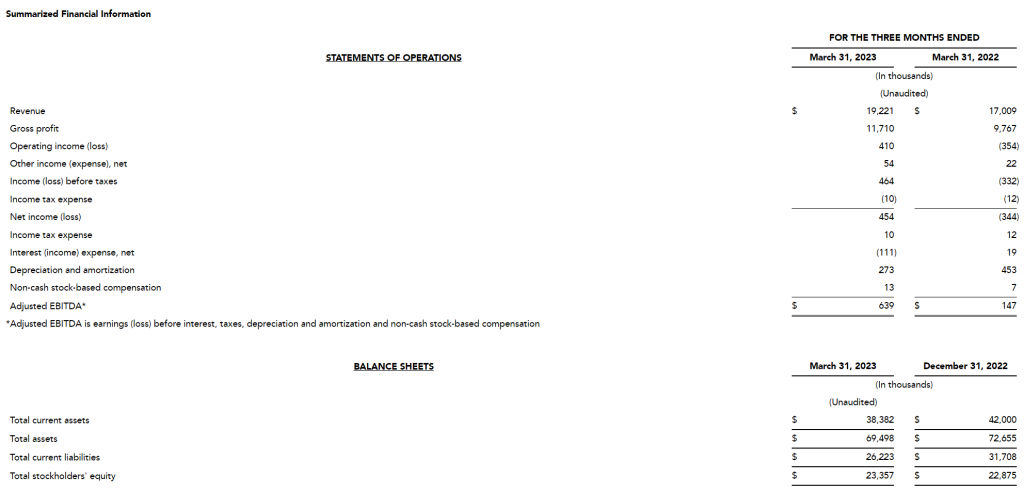

Financial Results for Three Months Ended March 31, 2023

For the three months ended March 31, 2023, revenue increased by 13.0% to $19.2 million from $17.0 million for the same period of 2022, due primarily to the increase of $1.7 million, or 25.8%, in revenue in our professional sales service segment as the result of higher equipment deliveries and a higher blended commission rate during the quarter. In addition, revenue in our IT segment increased by $271 thousand, or 2.7%, in the first quarter 2023 when compared to the same quarter of 2022, due to higher revenue in both the NetWolves and Vasohealthcare IT businesses; and our equipment segment revenue increased by $238 thousand, or 59.7%, when compared to the first quarter of 2022, principally due to higher equipment deliveries in our China operations.

Gross profit for the first quarter of 2023 increased by $1.9 million, or 19.9%, to $11.7 million, compared with a gross profit of $9.8 million for the same quarter of 2022, as a result of both higher revenues and higher gross profit margin, primarily in our professional sales service segment.

Selling, general and administrative (SG&A) expenses for the first quarter of 2023 increased by $1.1 million, or 11.4%, to $11.1 million, compared to the first quarter of 2022. The increase is primarily attributable to higher personnel costs across all three business segments as well as higher annual national sales meeting costs in our professional sales service segment.

Operating income for the three months ended March 31, 2023 was $410 thousand, compared to an operating loss of $354 thousand in the first quarter 2022, representing an improvement of $764 thousand, resulting from the increase in gross profit, partially offset by the increase in SG&A costs.

Net income for the three months ended March 31, 2023 was $454 thousand, a significant improvement over the loss of $344 thousand for the first quarter of 2022.

Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization, and stock-based compensation) improved to $639 thousand for the quarter, compared to $147 thousand in the first quarter of 2022.

Net cash used in operating activities was $1.9 million for the first quarter 2023, compared to net cash used in operating activities of $625 thousand for the first quarter of 2022. As of May 5, 2023, the Company’s net cash, cash equivalents and short-term investments totaled approximately $24.5 million.

About Vaso

Vaso Corporation is a diversified medical technology company with several distinctive but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for diagnostic imaging products; and design, manufacture and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

- VasoTechnology, Inc. provides network and IT services through two business units: VasoHealthcare IT Corp., a national value added reseller of Radiology Information System (“RIS”), Picture Archiving and Communication System (“PACS”), and other software solutions from various vendors as well as related services, including implementation, management and support; and NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers.

- Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE Healthcare diagnostic imaging products in certain market segments in the USA.

- VasoMedical, Inc. manages and coordinates the design, manufacture and sales of proprietary medical equipment and software, as well as operates the Company’s overseas assets including China-based subsidiaries.

Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “optimistic”, “plans”, “potential” and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions, including the impact of the current COVID-19 pandemic; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreement; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; unexpected manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.

Investor Contact:

Michael J. Beecher

Investor Relations

Phone: 516-997-4600

Email: mbeecher@vasocorporation.com

Vaso Corporation Announces Financial Results for Fourth Quarter and Full Year of 2022

The Company Announces Record Annual Revenue and Profit

PLAINVIEW, NY / ACCESSWIRE / March 29, 2023 / Vaso Corporation (“Vaso”) (OTCQB:VASO) today announced its operating results for the three months and year ended December 31, 2022.

“The Company recorded annual revenue of $80.0 million in fiscal year 2022, a growth of 5.9% over the prior year, and achieved an annual operating income of $7.0 million, an increase of 149.5% year-over-year. Net income for the year also increased significantly, to $11.9 million from $6.1 million for 2021,” stated Dr. Jun Ma, President and Chief Executive Officer of Vaso Corporation. “We were able to deliver such continued improvements in the top- and bottom-line results thanks to the extraordinary performance of our professional sales service segment and improved operating results in our IT segment, despite the negative effect of last year’s COVID lockdowns in China that our equipment segment endured.”

“Our balance sheet remains strong, with $20.3 million of cash and short-term investments at the end of 2022 as a result of $14.4 million in operating cashflow generated during the year,” Dr. Ma continued. “Deferred revenue increased by $5.8 million in fiscal year 2022 to reach a historical high of $30.8 million as of December 31, 2022, which will turn into recognized revenue once the underlying products or services are delivered in future periods.”

“With a healthy financial position and a diversified business portfolio, management is optimistic about the Company’s performance going forward. Our IT segment has improved operating efficiency as it’s recovering from the impact of the COVID-19 pandemic; our professional sales service segment continues to outperform expectations and has expanded the scope of its partnership with GE HealthCare; and our equipment segment is starting to evolve from a pure product play to a more product-based service business. We would not be able to accomplish all these without our employees’ dedication and professionalism. On behalf of the board of directors, I want to thank them as well as our shareholders for their continued support,” concluded Dr. Ma.

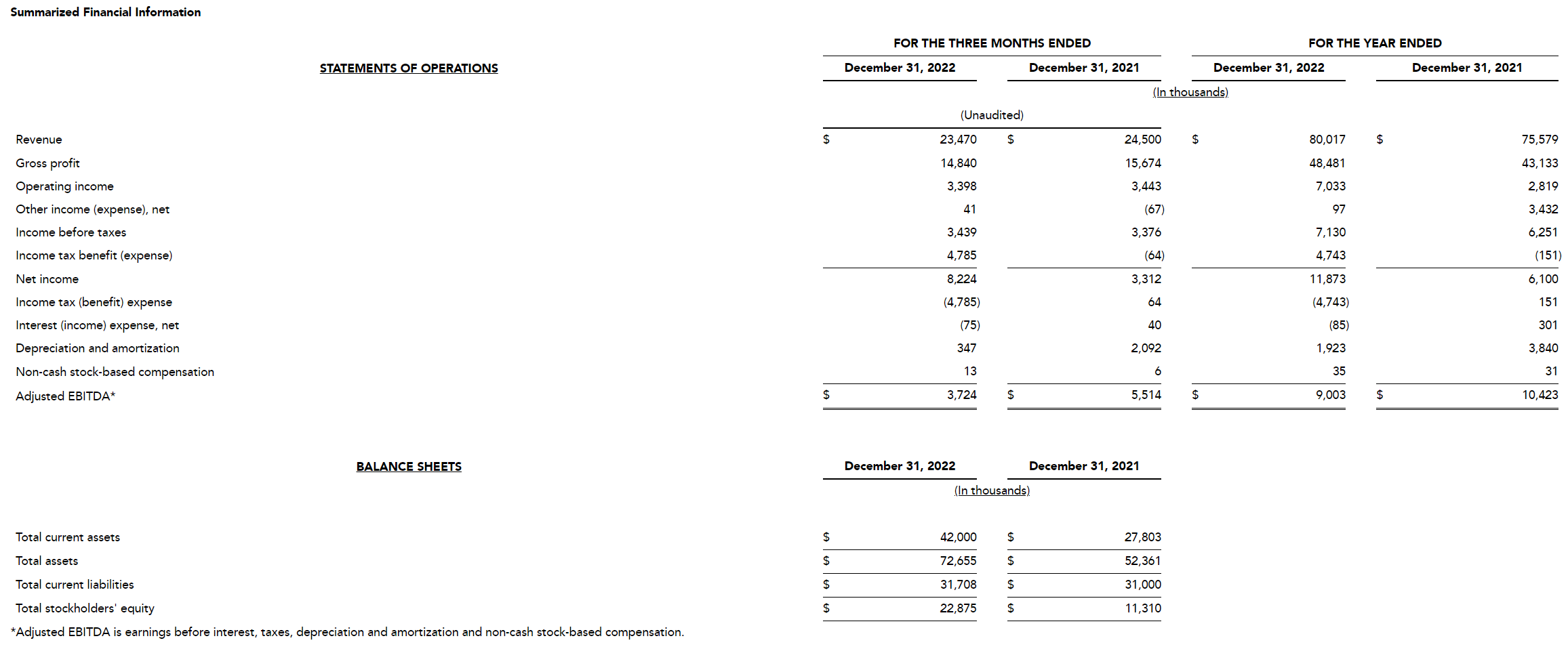

Financial Results for Three Months Ended December 31, 2022

For the three months ended December 31, 2022, revenue decreased by 4.2% to $23.5 million from $24.5 million for the same period of 2021, due to lower revenues in all our business segments. Revenue in our IT segment decreased by $0.4 million, or 3.7%, to $10.2 million as the result of lower recurring services during the quarter; revenue in our equipment segment decreased by $0.5 million, or 39.1%, to $0.8 million due to lower equipment sales in China in the quarter; and revenue in our professional sales service segment decreased by $0.1 million, or 1.0%, to $12.4 million due to lower incentive revenue when compared to the prior year, partially offset by higher equipment deliveries. We anticipate that revenue will improve in all three business segments, as we expect growth from new business in the IT segment, growth in our professional sales service segment resulting from strong order bookings in 2022, and a recovery of our China operations from last year’s COVID lockdowns.

Gross profit for the fourth quarter of 2022 decreased by 5.3% to $14.8 million, compared with a gross profit of $15.7 million for the same quarter of 2021. This decrease was primarily the result of a decrease in revenue and the increase in commission expense in the professional sales service segment.

Selling, general and administrative (SG&A) expenses for the fourth quarter of 2022 increased by 2.9% to $11.3 million, compared to $10.9 million for the fourth quarter of 2021. The increase was primarily attributable to an increase in personnel and travel costs in the professional sales service segment, offset by a decrease in travel and other costs in the IT segment. SG&A expenses were 48.0% and 44.7% of revenue in the fourth quarter of 2022 and 2021, respectively.

Net income for the three months ended December 31, 2022 was $8.2 million, compared with a net income of $3.3 million for the three months ended December 31, 2021. The increase was primarily due to the recognition of a $4.8 million tax benefit resulting from a reduction in the reserve for deferred tax assets.

Financial Results for Year Ended December 31, 2022

For the year ended December 31, 2022, revenue increased by $4.4 million, or 5.9%, to $80.0 million when compared with $75.6 million of revenue for the year 2021. Revenue in our IT segment decreased by 6.6% to $40.1 million for the year 2022, from 2021 revenue of $42.9 million, primarily due to a decrease of revenue in the network services business. Commission revenues in our professional sales service segment increased by $7.9 million, or 26.8%, to $37.3 million in the year 2022, compared to $29.4 million in 2021, primarily as the result of higher equipment deliveries by our partner and higher blended commission rates for the equipment delivered during the year. Equipment segment revenue for the year 2022 decreased by 20.1% to $2.6 million, from $3.2 million in 2021, due to a decrease in product sales in our China operations and the effect of foreign exchange rates, partially offset by a small increase in U.S. sales.

Gross profit for the year ended December 31, 2022 increased by 12.4% to $48.5 million, from $43.1 million in 2021, as a result of the higher revenue as well as higher gross profit margin in 2022.

SG&A expenses for the year ended December 31, 2022 increased by $2.3 million, or 5.8%, to $40.8 million, or 51.0% of revenue, compared with $38.6 million, or 51.1% of revenue, for the same period in 2021. The increase resulted primarily from an increase of $2.2 million in personnel and travel costs in the professional sales service segment.

For the year ended December 31, 2022, the Company had net income of $11.9 million, $5.8 million greater than the net income of $6.1 million for the year ended December 31, 2021.

Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization, and share-based compensation) was $9.0 million for the year ended December 31, 2022, compared to Adjusted EBITDA of $10.4 million for the year ended December 31, 2021 which included $3.6 million of PPP loan and interest forgiveness the Company recognized as income in 2021.

Net cash provided from operating activities in 2022 was $14.4 million, compared to net cash provided from operating activities of $7.8 million in 2021. The increase is principally due to the increase in profitability. Net cash and short-term investments increased to $20.3 million at December 31, 2022, compared to $6.6 million at December 31, 2021. The increase is the net effect of the increase in cash from operating activities and lower debt service payments in 2022 compared to 2021.

Deferred revenue increased to $30.8 million at December 31, 2022, compared to $25.0 million at December 31, 2021. The increase is primarily the result of higher order bookings in the professional sales service segment. Deferred revenue will be recognized in the future when the underlying equipment or services are delivered and accepted at the customer site.

About Vaso

Vaso Corporation is a diversified medical technology company with several distinctive but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for diagnostic imaging products; and design, manufacture and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

- VasoTechnology, Inc. provides network and IT services through two business units: VasoHealthcare IT Corp., a national value added reseller of Radiology Information System (“RIS”), Picture Archiving and Communication System (“PACS”), and other software solutions from various vendors as well as related services, including implementation, management and support; and NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers.

- Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE Healthcare diagnostic imaging products in certain market segments in the USA.

- VasoMedical, Inc. manages and coordinates the design, manufacture and sales of proprietary medical equipment and software, as well as operates the Company’s overseas assets including China-based subsidiaries.

Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “optimistic”, “plans”, “potential” and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions, including the impact of the current COVID-19 pandemic; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreement; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; unexpected manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.

Investor Contact:

Michael J. Beecher

Investor Relations

Phone: 516-508-5840

Email: mbeecher@vasocorporation.com