Vaso Corporation Expects to Report 2020 Financial Results by April 30, 2021

PLAINVIEW, NY April 15, 2021 – Vaso Corporation (“Vaso”) (OTC PINK:VASO) today announces the delayed reporting of its operating results for the three months and year ended December 31, 2020.

The Company announces that it will be temporarily delayed in filing its annual report on Form 10-K which is due on April 15, 2021. The process is not yet completed on certain accounting issues. The company currently expects to file this annual report no later than April 30, 2021.

About Vaso

Vaso Corporation is a diversified medical technology company with several distinctive but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for diagnostic imaging products; and design, manufacture and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

- VasoTechnology, Inc. provides network and IT services through two business units: VasoHealthcare IT Corp., a national value added reseller of Radiology Information System (“RIS”), Picture Archiving and Communication System (“PACS”), and other software solutions from various vendors as well as related services, including implementation, management and support; and NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers.

- Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE Healthcare diagnostic imaging products in certain market segments in the USA

- VasoMedical, Inc. manages and coordinates the design, manufacture and sales of proprietary medical equipment and software, as well as operates the Company’s overseas assets including China-based subsidiaries.

Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “optimistic”, “plans”, “potential” and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions, including the impact of the current COVID-19 pandemic; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreement; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; unexpected manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments

Vaso Corporation Announces Financial Results for Third Quarter 2020

Net Profit for the Quarter Increased by 104% Year-over-Year

PLAINVIEW, N.Y. November 13, 2020 – Vaso Corporation (“Vaso”) (OTCMKTS: VASO) today reported its operating results for the three months ended September 30, 2020.

“Despite continued impediment to business by the COVID pandemic, which led to a 6% drop in quarterly revenue from a year ago, the Company recorded an operating income of $1.3 million for the third quarter of 2020, an increase of 56% when compared to the $0.8 million operating income for the same quarter last year. This is mainly a result of much lower selling, general and administrative (“SG&A”) costs, which during the quarter decreased by 14% year-over-year,” commented Dr. Jun Ma, President and CEO of the Company. “Net profit for the quarter was $1.1 million, representing an increase of 104% year-over-year. Year-to-date, we saw a $2.2 million improvement to the bottom line from the prior year even when the top line was slightly down. The Company has also generated $4.7 million cash from operating activities for the nine months ended September 30, 2020, and maintains a healthy cash position as of today.”

“We remain cautiously optimistic about the current state of our businesses and are confident about the future of the Company. We are particularly encouraged by the performance of our professional sales service and equipment segments, which have shown significant improvements in the quarterly and year-to-date operating results even during this difficult year. We continue to be vigilant and stay ready for the recovery of the economy from the pandemic,” concluded Dr. Ma.

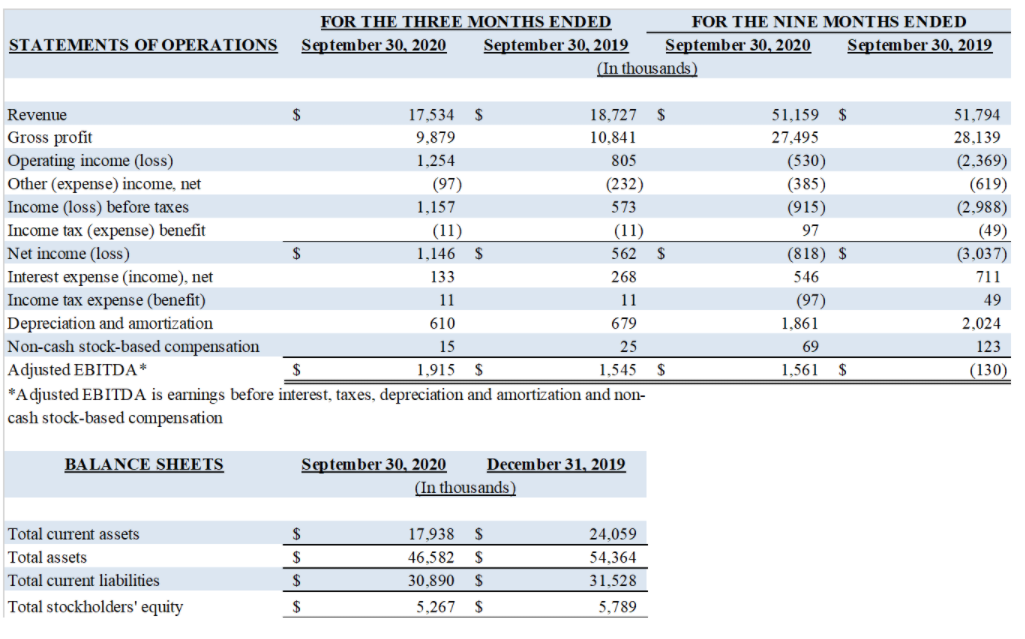

Financial Results for Three Months Ended September 30, 2020

For the three months ended September 30, 2020, revenue decreased $1.2 million, or 6%, to $17.5 million from $18.7 million for the same period of 2019, primarily due to the impact of the COVID-19 pandemic. Quarterly revenue in our IT segment decreased by $652 thousand or 6% year-over-year as both the healthcare IT business and network services business were affected by the pandemic. Revenue in the professional sales service segment decreased by $535 thousand, or 8% year-over-year, mainly due to lower equipment deliveries by our partner. Revenue in the equipment segment decreased by $6 thousand, or 0.7% year-over-year, mainly due to exclusion of EECP sales in the reporting, offset by an increase in the Biox equipment sales

Gross profit for the third quarter of 2020 decreased by 9% to $9.9 million, compared with a gross profit of $10.8 million for the third quarter of 2019. This decrease is primarily the result of a decrease in revenue in the IT and professional sales service segments due to the impact of the COVID-19 pandemic. In the IT segment gross profit decreased by $588 thousand or 12% year-over-year. Gross profit in the professional sales service segment decreased by $487 thousand or 9% year-over-year. Gross profit in the equipment segment increased $113 thousand, or 20% in the third quarter 2020 compared to the same period in 2019.

SG&A expenses for the third quarter of 2020 decreased by 14% to $8.5 million compared to $9.8 million for the same quarter of 2019. The decrease is primarily attributable to decreases in personnel and other costs in the IT segment and decreases in travel and related costs in the professional sales service and equipment segments.

Research and development costs decreased by 11% to $174 thousand in the third quarter of 2020 compared to the same period in 2019, primarily due to lower software development costs in the equipment segment

Net income for the three months ended September 30, 2020 was $1.1 million, compared to net income of $562 thousand for the third quarter of 2019. The increase of $584 thousand, or 104%, is primarily the result of the decrease in SG&A costs offset by the lower gross profit.

Net cash provided by operating activities was $4.7 million in the nine months ended September 30, 2020, compared to net cash used in operating activities of $2.1 million for the same period in 2019. Cash and cash equivalents at September 30, 2020 was $6.9 million, compared to $2.1 million at December 31, 201

Total deferred revenue remains substantial, at approximately $16.7 million as of September 30, 2020, which will be recognized in the future when the underlying equipment or services are delivered and accepted at the customer site. Our shareholders’ equity decreased to $5.3 million as of September 30, 2020 from $5.8 million as of December 31, 2019.

About Vaso

Vaso Corporation is a diversified medical technology company with several distinctive but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for diagnostic imaging products; and design, manufacture and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

- VasoTechnology, Inc. provides network and IT services through two business units: VasoHealthcare IT Corp., a national value added reseller of Radiology Information System (“RIS”), Picture Archiving and Communication System (“PACS”), and other software solutions from various vendors as well as related services, including implementation, management and support; and NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers.

- Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE Healthcare diagnostic imaging products in certain market segments in the USA

- VasoMedical, Inc. manages and coordinates the design, manufacture and sales of proprietary medical equipment and software, as well as operates the Company’s overseas assets including China-based subsidiaries.

Summarized Financial Information

Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “optimistic”, “plans”, “potential” and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions, including the impact of the current COVID-19 pandemic; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreement; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; unexpected manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments

Vaso Corporation Announces Financial Results for Second Quarter 2020

PLAINVIEW, N.Y. August 14, 2020 – Vaso Corporation (“Vaso”) (OTCMKTS: VASO) today reported its operating results for the three months ended June 30, 2020.

“The COVID-19 pandemic continues its unprecedented impact on the nation’s economy and people’s lives, and all of our businesses have been adversely affected as well. During the second quarter of 2020, the Company experienced a drop in its total revenue, by 7% year-over-year, although we still recorded a higher revenue year-to-date,” commented Dr. Jun Ma, President and Chief Executive Officer of Vaso Corporation. “At the same time, however, quarterly operating expenses were reduced by 10% from a year ago; as a result, operating loss for the quarter only increased slightly when compared to the same quarter last year. For the first half of the year, we maintained a significant improvement in the operating results over the same period of the prior year.”

“Since the beginning of the COVID-19 pandemic and the shutdown in most parts of the country, we have taken steps to protect the safety of our employees and have reached out to many of our customers and suppliers to jointly assess and mitigate risks. As uncertainties in our markets are expected to continue for an extended period of time, we are exercising extra caution in managing business expenses to stay financially stable and be ready for the reopening of the economy,” concluded Dr. Ma.

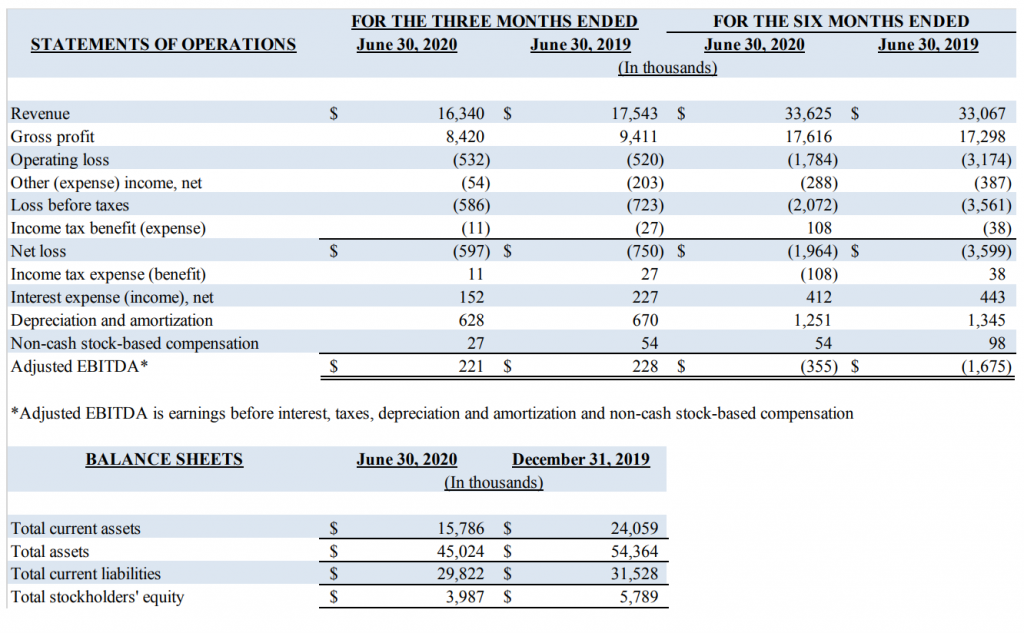

Financial Results for Three Months Ended June 30, 2020

For the three months ended June 30, 2020, revenue decreased 7% to $16.3 million from $17.5 million for the same period of 2019, as all three business segments were impacted by the COVID-19 pandemic. When compared to the second quarter of 2019, revenue in the IT segment decreased $0.6 million or 5%; revenue in our professional sales service segment decreased $0.4 million or 8%; and revenue in the equipment segment decreased $0.2 million or 21%. The decreases were due to lower deliveries of equipment and lower service revenues, all primarily caused by the pandemic and the economic shutdown.

Gross profit for the second quarter of 2020 decreased 11% to $8.4 million, compared with a gross profit of $9.4 million for the same quarter of 2019. This decrease was primarily the result of the decrease in revenue as discussed above.

Selling, general and administrative (SG&A) expenses for the second quarter of 2020 decreased 10% to $9.0 million, compared to the first quarter of 2020. The decrease is primarily attributable to personnel cost reductions in the IT segment and decreases in travel and other operating costs as a result of the

shutdown, as well as a decrease in operating costs of the EECP operation.

Other income and expense, net, improved by $149 thousand in the second quarter 2020 compared to the second quarter 2019, due primarily to a gain on the sale of 51% of the EECP business and to a decrease in interest costs resulting from the reduction of debt.

Net loss for the three months ended June 30, 2020 was $0.6 million, an improvement of $153 thousand or 20% over the loss of $0.7 million for the second quarter of 2019.

Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization and non-cash stockbased compensation) was $221 thousand for the three months ended June 30, 2020, compared to $228

thousand for the same period a year ago.

Net cash provided by operating activities in the first six months of 2020 was $4.0 million, a significant improvement when compared to net cash used in operations of $2.4 million for the same period in 2019. As of June 30, 2020 and December 31, 2019, the Company had cash and cash equivalents of approximately $6.9 million and $2.1 million, respectively.

About Vaso

Vaso Corporation is a diversified medical technology company with several distinctive but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for diagnostic imaging products; and design, manufacture and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

- VasoTechnology, Inc. provides network and IT services through two business units: VasoHealthcare IT Corp., a national value added reseller of Radiology Information System (“RIS”), Picture Archiving and Communication System (“PACS”), and other software solutions from GEHC Digital and other vendors as well as related services, including implementation, management and support; and NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers.

- Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE Healthcare diagnostic imaging products in certain market segments in the USA.

- VasoMedical, Inc. manages and coordinates the design, manufacture and sales of EECP® Therapy Systems and other medical equipment operations, as well as operates the Company’s overseas assets including China-based subsidiaries.

Summarized Financial Information

Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “optimistic”, “plans”, “potential” and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions, including the current COVID-19 pandemic; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreements; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; unexpected manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.

Vaso Corporation Announces Financial Results for First Quarter 2020

PLAINVIEW, NY / June 4, 2020 / Vaso Corporation (“Vaso”) (OTC PINK:VASO) today reported its operating results for the three months ended March 31, 2020.

“The Company’s total revenue for the first quarter 2020 was $17.3 million, an increase of 11% when compared to the same quarter in the prior year, primarily as a result of a $1.8 million increase in revenue in our professional sales service segment,” commented Dr. Jun Ma, President and Chief Executive Officer of Vaso Corporation. “Combined with a significant increase in the gross profit margin, Vaso Corporation achieved an impressive improvement of $1.4 million in operating income, reducing its quarterly operating loss by 53% year-over-year, to $1.3 million.”

“On the other hand, like many others, we started to experience the negative impact of the COVID-19 pandemic toward the end of the first quarter as the shutdown became widespread. All of our businesses have been adversely affected and much uncertainty continues to remain for the rest of the year. While we regard the safety and well-being of our employees and customers a top priority, we have also been actively engaging with our customers to maintain ongoing business relationships and help each other weather the storm. With the assistance of the $3.6 million PPP loan the Company received in the second quarter under the CARES Act, we believe Vaso will continue to be financially stable despite the anticipated volatility in orders, revenue and cash receipts,” concluded Dr. Ma.

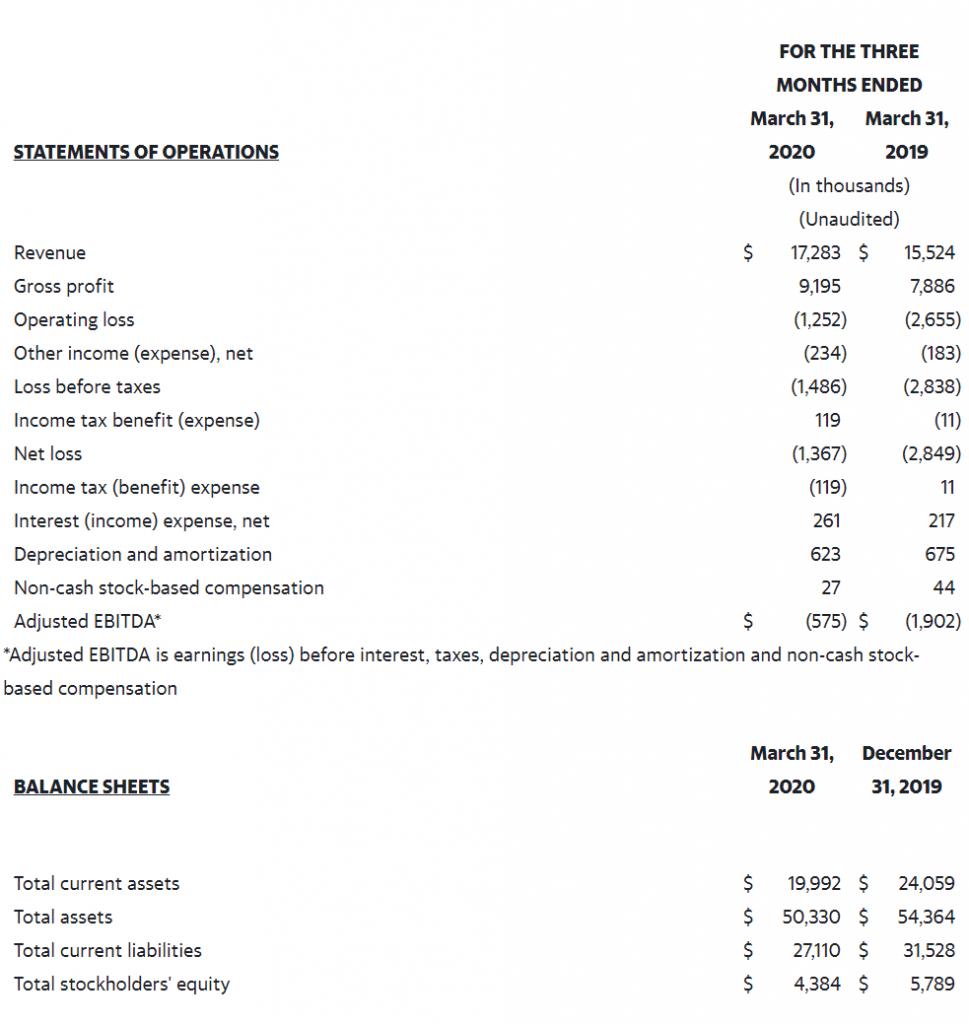

Financial Results for Three Months Ended March 31, 2020

For the three months ended March 31, 2020, revenue increased 11% to $17.3 million from $15.5 million for the same period of 2019, due primarily to the increase of $1.8 million, or 51%, in revenue in our professional sales service segment as the result of higher equipment deliveries by GEHC during the quarter. Revenue in our IT segment increased less than 1%, to $11.3 million in the first quarter 2020, compared to the same quarter of 2019, while our equipment segment revenue decreased slightly to $778 thousand compared to the first quarter of 2019, principally due to lower service revenues in that segment.

Gross profit for the first quarter of 2020 increased 17% to $9.2 million, compared with a gross profit of $7.9 million for the same quarter of 2019. This increase was primarily the result of the increase in revenue in the professional sales service and an increase in profit margin in the equipment segment due to the higher margin product mix, partially offset by a decrease in gross profit in the IT segment.

Selling, general and administrative (SG&A) expenses for the first quarter of 2020 decreased 1% to $10.3 million, compared to the first quarter of 2019. The decrease is primarily attributable to a decrease in personnel costs in the IT and equipment segments, offset by an increase in SG&A costs in the professional sales service segment resulting from costs for the national sales meeting held during the quarter. (No national sales meeting was held in 2019.) SG&A expenses were 59% and 67% of revenue in the first quarter of 2020 and 2019, respectively.

Net loss for the three months ended March 31, 2020 was $1.4 million, a significant improvement over the loss of $2.8 million for the first quarter of 2019.

About Vaso

Vaso Corporation is a diversified medical technology company with several distinctive but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for diagnostic imaging products; and design, manufacture and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

- VasoTechnology, Inc. provides network and IT services through two business units: VasoHealthcare IT Corp., a national value added reseller of Radiology Information System (“RIS”), Picture Archiving and Communication System (“PACS”), and other software solutions from GEHC Digital and other vendors as well as related services, including implementation, management and support; and NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers.

- Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE Healthcare diagnostic imaging products in certain market segments in the USA.

- VasoMedical, Inc. manages and coordinates the design, manufacture and sales of EECP® Therapy Systems and other medical equipment operations, as well as operates the Company’s overseas assets including China-based subsidiaries.

Additional information is available on the Company’s website at www.vasocorporation.com.

Summarized Financial Information

Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “optimistic”, “plans”, “potential” and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions, including the current COVID-19 pandemic; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreements; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; unexpected manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.

Vaso Corporation Announces Financial Results for Fourth Quarter and Full Year for 2019

Plainview, NY, April 14, 2020 – Vaso Corporation (“Vaso”) (OTCMKTS: VASO) today reported its operating results for the three months and year ended December 31, 2019.

“The Company’s total revenue for fiscal 2019 reached $75.7 million, a record in its history, as sales in its IT and professional sales service segments grew 3.4% and 2.7%, respectively, from the prior year,”

commented Dr. Jun Ma, President and Chief Executive Officer of Vaso Corporation. “In addition, as a result of revenue growth and significant cost reduction, Vaso Corporation has returned to profitability

after two years of losses, with an operating income of $1.0 million for 2019, an improvement of $4.7 million when compared to an operating loss of $3.7 million in 2018.”

“Selling, general and administrative, or SG&A, costs went down by $3.1 million, or 7.1%, in 2019 when compared to 2018. We continue to watch business expenses while carefully executing our business strategy, especially in this time of uncertainty when the COVID-19 pandemic is impacting all aspects of life and business adversely,” concluded Dr. Ma.

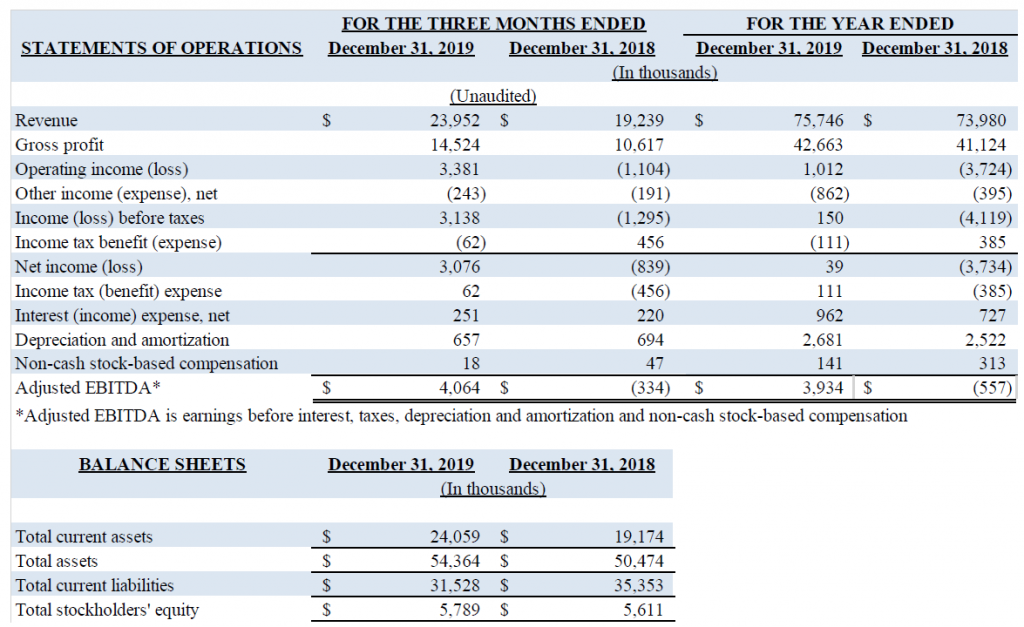

Financial Results for Three Months Ended December 31, 2019

For the three months ended December 31, 2019, revenue increased 24.5% to $24.0 million from $19.2 million for the same period of 2018, due primarily to the increase of $4.7 million, or 70.5%, in revenue in

our professional sales service segment as the result of achieving certain performance goals and higher blended commission rates for the equipment delivered during the quarter. Revenue in our IT segment

increased 3.7%, to $11.5 million in the fourth quarter 2019, compared to the same quarter of 2018, while our equipment segment revenue decreased 25.5% to $1.1 million from $1.5 million for the fourth quarter

of 2018, due to lower sales of EECP products.

Gross profit for the fourth quarter of 2019 increased 36.8% to $14.5 million, compared with a gross profit of $10.6 million for the same quarter of 2018. This increase was primarily the result of the increase in revenue in the professional sales service and IT segments, partially offset by a decrease in gross profit in the equipment segment

Selling, general and administrative (SG&A) expenses for the fourth quarter of 2019 decreased 4.8% to $11.0 million, compared to $11.5 million for the fourth quarter of 2018. The decrease is primarily

Page 2 of 4 attributable to a decrease in personnel costs in the professional sales service and IT segments. SG&A expenses were 45.7% and 59.8% of revenue in the fourth quarter of 2019 and 2018, respectively.

Net income for the three months ended December 31, 2019 was $3.1 million, compared with a net loss of $0.8 million for the three months ended December 31, 2018.

Financial Results for Year Ended December 31, 2019

For the year ended December 31, 2019, revenue increased $1.8 million or 2.4% to $75.7 million when compared with $74.0 million for the year 2018. Revenue in our IT segment increased 3.4% to $45.7 million for the year 2019, from 2018 revenue of $44.2 million, primarily due to an increase of $1.6 million in the healthcare IT business, offset by a slight decrease in network service revenue. Commission revenues in our professional sales service segment increased by 2.7% to $26.2 million in the year 2019, compared to revenue of $25.5 million in 2018. The increase was the result of achieving certain performance goals

and higher blended commission rates for the equipment delivered during the year. Equipment segment revenue for the year 2019 decreased by 10.4% to $3.8 million, from $4.2 million in 2018, principally due to the decrease in EECP equipment sales and related service revenues.

Gross profit for the year ended December 31, 2019 increased 3.7% to $42.7 million, from $41.1 million in 2018, as a result of $1.1 million increase in the professional sales service segment gross profit and $642

thousand increase in the IT segment gross profit, both resulting from revenue growth in the segments, offset by a $225 thousand decrease in the equipment segment gross profit as a result of the lower revenues

in that segment.

SG&A expenses for the year ended December 31, 2019 decreased $3.1 million or 7.1% to $40.8 million, or 53.9% of revenue, compared with $44.0 million, or 59.4% of revenue, for the same period in 2018.

The decrease resulted primarily from a decrease in personnel and other costs in the professional sales service and IT segments, as well as a decrease in corporate expenses.

For the year ended December 31, 2019, the Company had net income of $39 thousand, compared with a net loss of $3.7 million for the year ended December 31, 2018.

Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization, and share-based compensation) was $3.9 million for the year ended December 31, 2019 compared to negative Adjusted

EBITDA of $0.6 million for the year ended December 31, 2018, an improvement of $4.5 million. The improvement was primarily the result of the net income in 2019 compared to the net loss in 2018.

Net cash used in operating activities was $1.3 million, compared to net cash used in operating activities of $1.5 million in 2018. The decrease is principally due to the increase in profitability and an increase in

deferred revenue, offset by an increase in accounts receivable. Net cash decreased to $2.1 million at December 31, 2019, compared to $2.7 million at December 31, 2018. The decrease in cash is the net effect of negative cash from operating and investing activities, offset by an increase in net borrowings. As of March 31, 2020, the Company’s net cash was approximately $7.2 million.

Deferred revenue increased to $19.3 million at December 31, 2019, compared to $18.1 million at December 31, 2018. The increase is primarily the result of higher order bookings in the professional sales

service segment. The deferred revenue will be recognized in the future when the underlying equipment or services are delivered and accepted at the customer site. Our shareholders’ equity increased to $5.8 million

as of December 31, 2019 from $5.6 million as of December 31, 2018.

About Vaso

Vaso Corporation is a diversified medical technology company with several distinctive but related specialties: managed IT systems and services, including healthcare software solutions and network connectivity services; professional sales services for diagnostic imaging products; and design, manufacture and sale of proprietary medical devices.

The Company operates through three wholly owned subsidiaries:

• VasoTechnology, Inc. provides network and IT services through two business units: VasoHealthcare IT Corp., a national value added reseller of Radiology Information System (“RIS”), Picture Archiving and Communication System (“PACS”), and other software solutions from GEHC Digital and other vendors as well as related services, including implementation, management and support; and NetWolves Network Services LLC, a managed network services provider with an extensive, proprietary service platform to a broad base of customers.

• Vaso Diagnostics, Inc. d.b.a. VasoHealthcare, provides professional sales services and is the operating subsidiary for the exclusive sales representation of GE Healthcare diagnostic imaging products in certain market segments in the USA.

• VasoMedical, Inc. manages and coordinates the design, manufacture and sales of EECP® Therapy Systems and other medical equipment operations, as well as operates the Company’s overseas assets including China-based subsidiaries Biox Instruments Co. Ltd. and Life Enhancement Technology Limited.

Additional information is available on the Company’s website at www.vasocorporation.com.

Summarized Financial Information

Except for historical information contained in this release, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “optimistic”, “plans”, “potential” and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions; the effect of the dramatic changes taking place in IT and healthcare; continuation of the GEHC agreements; the impact of competitive technology and products and their pricing; medical insurance reimbursement policies; unexpected manufacturing or supplier problems; unforeseen difficulties and delays in the conduct of clinical trials and other product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; and the risk factors reported from time to time in the Company’s SEC reports. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.